PA DoR Wage Tax Refund Petition Salary/Hourly Employees (Formerly 83-A272A) 2018 free printable template

Show details

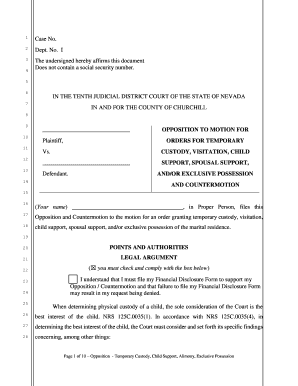

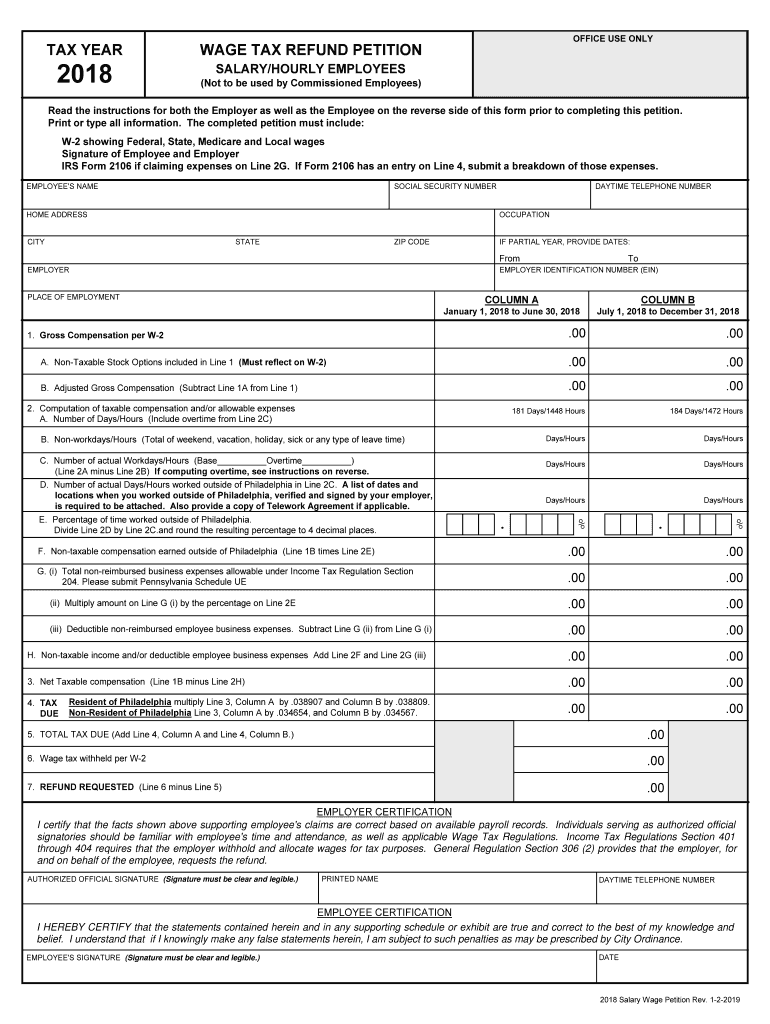

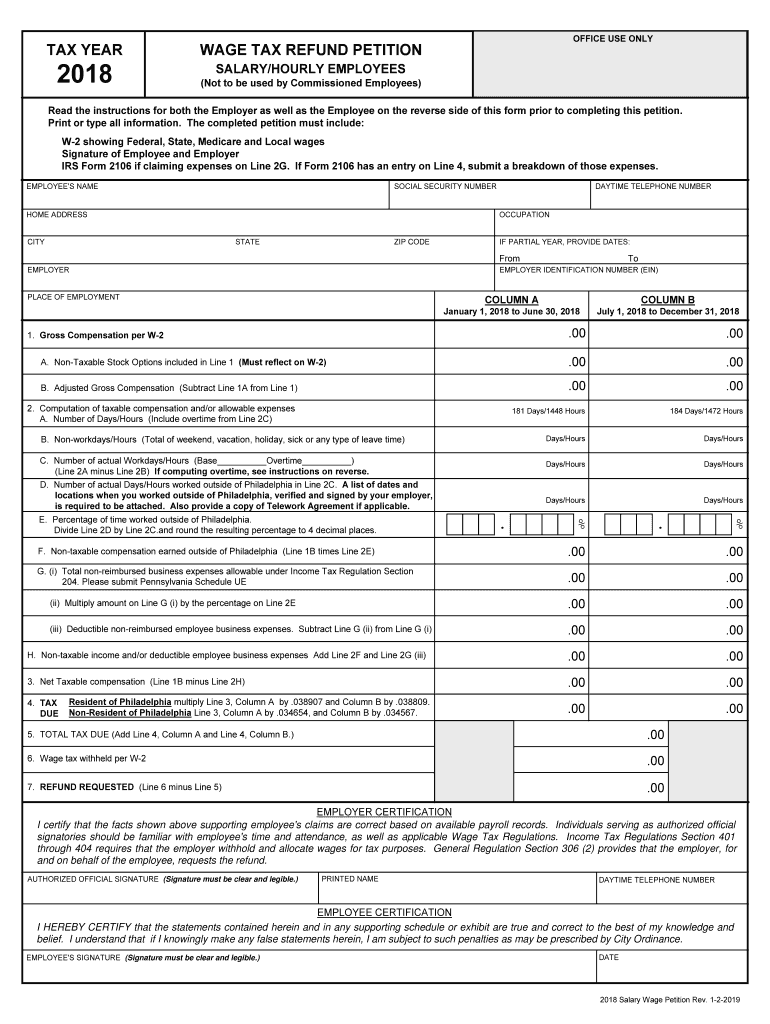

EMPLOYEE S SIGNATURE Signature must be clear and legible. DATE 83-A272A Rev. 12-18-2017 INSTRUCTIONS FOR FILING WAGE TAX REFUND PETITION Salary and Hourly Employees Only You must attach the applicable W-2 indicating Federal Medicare State and Local wages to the petition. A separate petition must be filed for each W-2 issued by employers that may have overwithheld Wage Tax. TAX YEAR OFFICE USE ONLY WAGE TAX REFUND PETITION SALARY/HOURLY EMPLOYEES Not to be used by Commissioned Employees Read...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign city of philadelphia city

Edit your city of philadelphia city form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of philadelphia city form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit city of philadelphia city online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit city of philadelphia city. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR Wage Tax Refund Petition Salary/Hourly Employees (Formerly 83-A272A) Form Versions

Version

Form Popularity

Fillable & printabley

4.7 Satisfied (33 Votes)

4.5 Satisfied (45 Votes)

4.9 Satisfied (50 Votes)

4.8 Satisfied (146 Votes)

4.3 Satisfied (177 Votes)

4.3 Satisfied (269 Votes)

4.2 Satisfied (31 Votes)

4.4 Satisfied (91 Votes)

4.4 Satisfied (380 Votes)

4.4 Satisfied (534 Votes)

4.0 Satisfied (57 Votes)

4.2 Satisfied (39 Votes)

How to fill out city of philadelphia city

How to fill out PA DoR Wage Tax Refund Petition Salary/Hourly

01

Gather all necessary documents such as W-2 forms, pay stubs, and proof of residency.

02

Download the PA DoR Wage Tax Refund Petition form from the Pennsylvania Department of Revenue website.

03

Fill out the form by providing your personal information including name, address, and Social Security number.

04

Indicate your employment details, including salary or hourly wage, and the amount of wage tax that was withheld.

05

Explain the reason for your refund request in the designated section.

06

Double-check all information for accuracy.

07

Sign and date the form.

08

Mail the completed form along with any required supporting documents to the appropriate Pennsylvania Department of Revenue address.

Who needs PA DoR Wage Tax Refund Petition Salary/Hourly?

01

Individuals who have overpaid wage taxes in Pennsylvania.

02

Employees who have worked in multiple jurisdictions and need to claim a refund for excess wage tax withholdings.

03

Residents who have moved out of Pennsylvania and wish to reclaim wage taxes withheld post-residency.

04

Individuals who have had incorrect wage tax amounts withheld due to administrative errors by their employer.

Fill

form

: Try Risk Free

People Also Ask about

Is Philadelphia wage tax refund taxable?

Refunds for salaried or commissioned employees Resident employees are taxable whether working in or out of Philadelphia. However, resident employees may apply for a refund for deductible, non-reimbursed business expenses.

How long does it take to get Philly wage tax refund?

All wage tax refund requests can be submitted online. You don't need a username and password to request a refund on the Philadelphia Tax Center site, but it may help to set up an account if you also need to pay other city taxes. Then you wait! It typically takes six to eight weeks for your refund to be sent.

How do I claim my Philadelphia City Wage Tax refund?

Wage Tax refund requests must be submitted through the Philadelphia Tax Center. This includes all income-based and Covid-EZ (non-residents only) refunds. You don't need a username and password to request a refund on the Philadelphia Tax Center.

Do I have to file a Philadelphia wage tax return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Are tax refunds taxable as income?

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include the refund in income in the year you receive it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit city of philadelphia city online?

The editing procedure is simple with pdfFiller. Open your city of philadelphia city in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the city of philadelphia city in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your city of philadelphia city in minutes.

How do I edit city of philadelphia city on an Android device?

With the pdfFiller Android app, you can edit, sign, and share city of philadelphia city on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is PA DoR Wage Tax Refund Petition Salary/Hourly?

The PA DoR Wage Tax Refund Petition is a form that allows individuals to request a refund on wage taxes withheld in Pennsylvania, specifically for those who were overtaxed based on their salary or hourly earnings.

Who is required to file PA DoR Wage Tax Refund Petition Salary/Hourly?

Individuals who have had wage taxes withheld from their paychecks in Pennsylvania and believe they are owed a refund due to overpayment or incorrect withholding are required to file this petition.

How to fill out PA DoR Wage Tax Refund Petition Salary/Hourly?

To fill out the PA DoR Wage Tax Refund Petition, individuals need to provide personal information, details regarding their employment, the amount of wage tax withheld, and the reason for requesting a refund. It is important to follow the guidelines provided by the Pennsylvania Department of Revenue.

What is the purpose of PA DoR Wage Tax Refund Petition Salary/Hourly?

The purpose of the PA DoR Wage Tax Refund Petition is to allow eligible taxpayers to recover overpaid wage taxes, ensuring they are only paying taxes on their actual earnings.

What information must be reported on PA DoR Wage Tax Refund Petition Salary/Hourly?

The information that must be reported includes the individual's name, address, Social Security number, employer information, total wages earned, amount of tax withheld, and reason for the refund request.

Fill out your city of philadelphia city online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Philadelphia City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.