PA DoR Wage Tax Refund Petition Salary/Hourly Employees (Formerly 83-A272A) 2019 free printable template

Show details

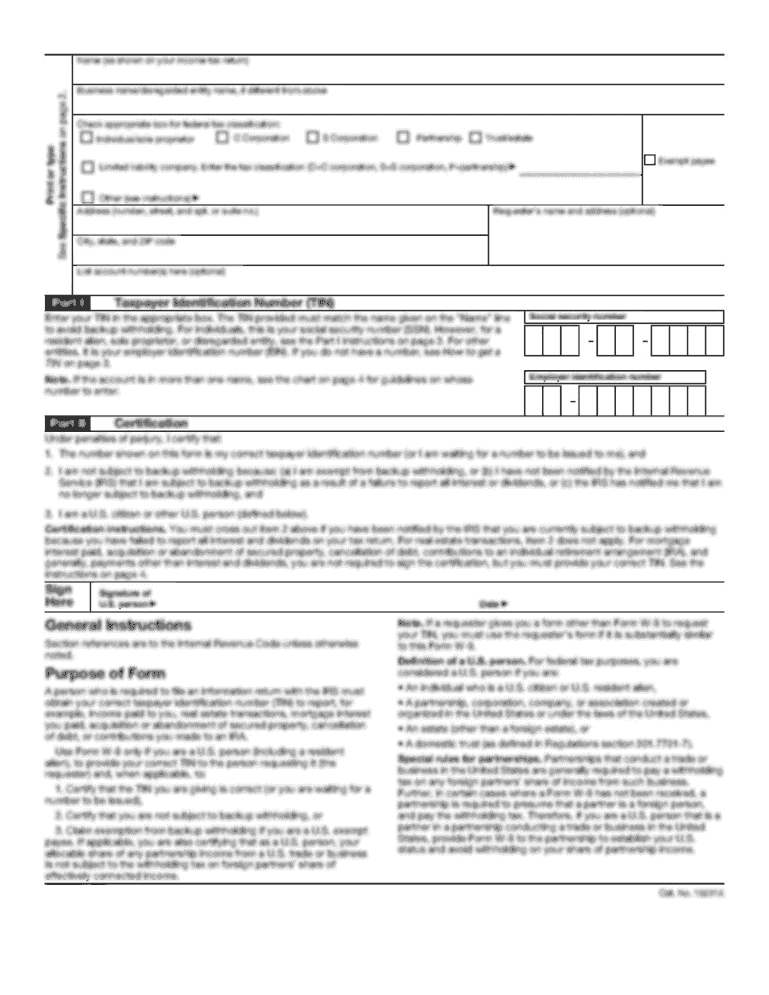

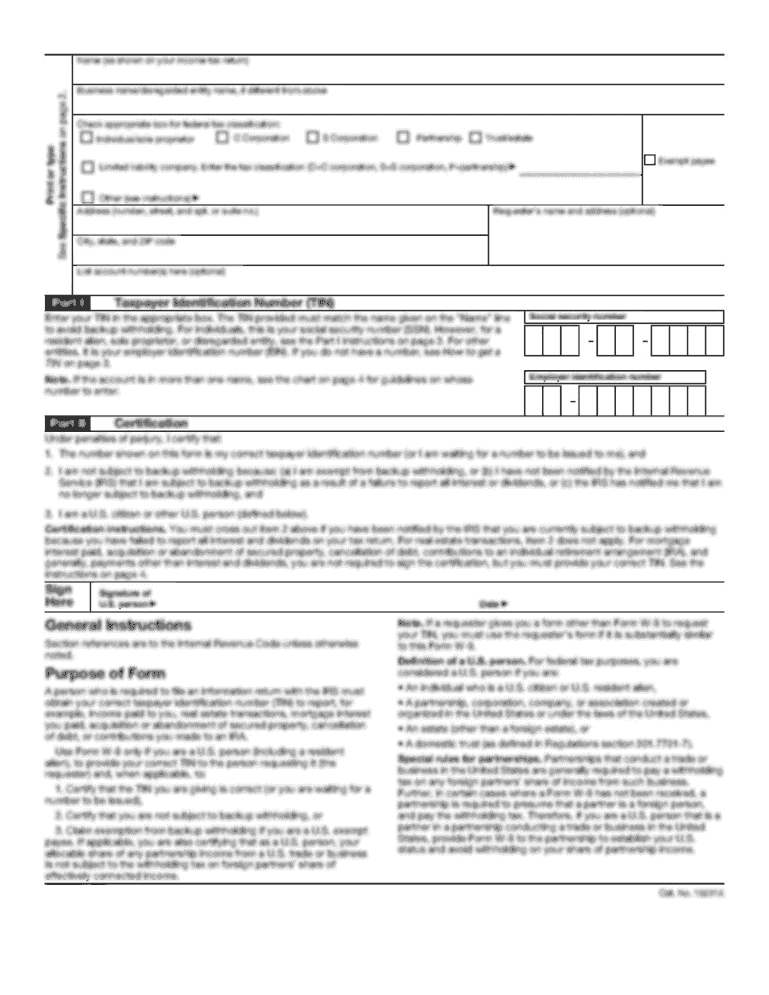

EMPLOYEE S SIGNATURE Signature must be clear and legible. DATE 83-A272A Rev. 12-18-2017 INSTRUCTIONS FOR FILING WAGE TAX REFUND PETITION Salary and Hourly Employees Only You must attach the applicable W-2 indicating Federal Medicare State and Local wages to the petition. A separate petition must be filed for each W-2 issued by employers that may have overwithheld Wage Tax. TAX YEAR OFFICE USE ONLY WAGE TAX REFUND PETITION SALARY/HOURLY EMPLOYEES Not to be used by Commissioned Employees Read...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax wage petition

Edit your tax wage petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax wage petition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax wage petition online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax wage petition. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR Wage Tax Refund Petition Salary/Hourly Employees (Formerly 83-A272A) Form Versions

Version

Form Popularity

Fillable & printabley

4.7 Satisfied (33 Votes)

4.5 Satisfied (45 Votes)

4.9 Satisfied (50 Votes)

4.8 Satisfied (146 Votes)

4.3 Satisfied (177 Votes)

4.3 Satisfied (269 Votes)

4.2 Satisfied (31 Votes)

4.4 Satisfied (91 Votes)

4.4 Satisfied (380 Votes)

4.4 Satisfied (534 Votes)

4.0 Satisfied (57 Votes)

4.2 Satisfied (39 Votes)

How to fill out tax wage petition

How to fill out PA DoR Wage Tax Refund Petition Salary/Hourly

01

Gather all necessary documents, including your W-2 forms and any other proof of income.

02

Access the PA DoR Wage Tax Refund Petition Salary/Hourly form on the Pennsylvania Department of Revenue website.

03

Fill out your personal information, including your name, address, and Social Security number.

04

Indicate your employment status and the period for which you are requesting a refund.

05

Detail your total wages and the amount of wage tax withheld.

06

Complete the sections related to additional deductions or credits, if applicable.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form.

09

Submit the form to the appropriate PA Department of Revenue office or through their online portal.

Who needs PA DoR Wage Tax Refund Petition Salary/Hourly?

01

Employees who have overpaid their wage tax in Pennsylvania.

02

Individuals who have worked in multiple jurisdictions with different wage tax rates.

03

Residents of Pennsylvania who have worked in other states and had wage taxes withheld.

04

Those who changed jobs within a tax year and need to reconcile their wage tax payments.

Fill

form

: Try Risk Free

People Also Ask about

Is Philadelphia wage tax refund taxable?

Refunds for salaried or commissioned employees Resident employees are taxable whether working in or out of Philadelphia. However, resident employees may apply for a refund for deductible, non-reimbursed business expenses.

How long does it take to get Philly wage tax refund?

All wage tax refund requests can be submitted online. You don't need a username and password to request a refund on the Philadelphia Tax Center site, but it may help to set up an account if you also need to pay other city taxes. Then you wait! It typically takes six to eight weeks for your refund to be sent.

How do I claim my Philadelphia City Wage Tax refund?

Wage Tax refund requests must be submitted through the Philadelphia Tax Center. This includes all income-based and Covid-EZ (non-residents only) refunds. You don't need a username and password to request a refund on the Philadelphia Tax Center.

Do I have to file a Philadelphia wage tax return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Are tax refunds taxable as income?

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include the refund in income in the year you receive it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax wage petition in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your tax wage petition and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute tax wage petition online?

With pdfFiller, you may easily complete and sign tax wage petition online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit tax wage petition on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax wage petition on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is PA DoR Wage Tax Refund Petition Salary/Hourly?

The PA DoR Wage Tax Refund Petition is a form that allows workers to request a refund of wage taxes that have been withheld in error or overpaid to the state of Pennsylvania.

Who is required to file PA DoR Wage Tax Refund Petition Salary/Hourly?

Individuals who have had wage taxes withheld from their paychecks in Pennsylvania, and believe they are owed a refund due to overpayment or incorrect withholding, are required to file this petition.

How to fill out PA DoR Wage Tax Refund Petition Salary/Hourly?

To fill out the PA DoR Wage Tax Refund Petition, provide your personal information, details about your employment, indicate the amount of wage tax withheld, and explain the basis for your refund request. Then, submit the completed form to the appropriate state department.

What is the purpose of PA DoR Wage Tax Refund Petition Salary/Hourly?

The purpose of the PA DoR Wage Tax Refund Petition is to allow taxpayers to reclaim excess wage taxes that were mistakenly withheld, ensuring they are not overcharged for their wage tax liabilities.

What information must be reported on PA DoR Wage Tax Refund Petition Salary/Hourly?

The form must report the taxpayer's name, address, Social Security number, employer's information, the amount of taxes withheld, and the reasons for the refund request.

Fill out your tax wage petition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Wage Petition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.