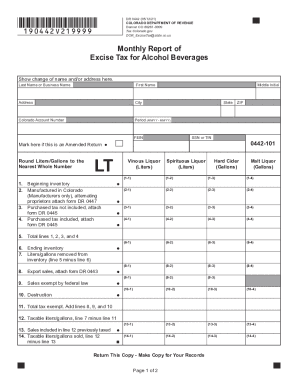

CO DR 0442 2018 free printable template

Show details

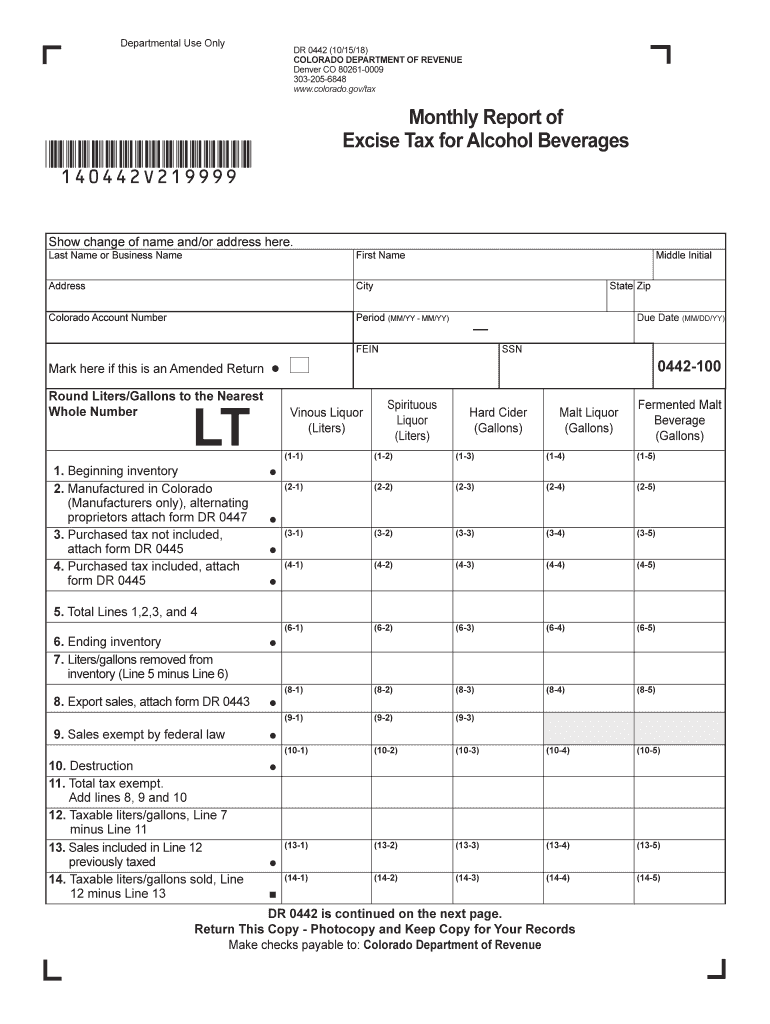

DR 0442 (10/15/18)

COLORADO DEPARTMENT OF REVENUE

Denver CO 802610009

3032056848

www.colorado.gov/taxMonthly Report of

Excise Tax for Alcohol Beverages

Instructions for Form DR 0442

(See form on page

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 0442

Edit your CO DR 0442 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 0442 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR 0442 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DR 0442. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0442 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 0442

How to fill out CO DR 0442

01

Obtain the CO DR 0442 form from the appropriate government website or office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the applicant's information in the designated sections, including full name, address, and contact details.

04

Provide any required identification numbers, such as Social Security Number or tax identification number.

05

Fill in the details of your request or application clearly and accurately.

06

If applicable, include any supporting documents as outlined in the instructions.

07

Double-check your entries for accuracy and completeness.

08

Sign and date the form in the appropriate section.

09

Submit the completed form according to the instructions provided.

Who needs CO DR 0442?

01

Individuals or organizations requiring official documents or records from the Colorado Department of Revenue.

02

Those who are seeking to amend or update information previously filed with the department.

03

Anyone who needs to request specific information or certifications from the state.

Fill

form

: Try Risk Free

People Also Ask about

Why would I get a letter from the Colorado Department of Revenue?

While the Department is required by law to send the Notice of Deficiency or Rejection of Refund Claim letter, the main purpose of this letter is to provide you with the following information: Any adjustment made to the return you filed and the detail of that adjustment. The outstanding balance for a specified tax year.

What is the excise tax on beer in Colorado?

Colorado Beer Tax The Colorado excise tax on beer is $0.08 per gallon, one of the lowest beer taxes in the country. Colorado's beer excise tax is ranked #45 out of the 50 states. The Colorado beer tax is already added to the purchase price of all beer bought in Colorado, whether in kegs, bottles, or cans.

What is the excise tax on alcohol in Colorado?

✔ Colorado's general sales tax of 2.9% also applies to the purchase of liquor. In Colorado, liquor vendors are responsible for paying a state excise tax of $2.28 per gallon, plus Federal excise taxes, for all liquor sold.

What is the excise tax rate in Colorado?

Colorado has a 4.40 percent corporate income tax rate. There are jurisdictions that collect local income taxes. Colorado also has a 2.90 percent state sales tax rate, a max local sales tax rate of 8.30 percent, and an average combined state and local sales tax rate of 7.78 percent.

What is Colorado excise tax?

A 15% state excise tax is imposed on the first sale or transfer from a retail marijuana cultivation facility to a retail marijuana store or retail marijuana product manufacturing facility. The industry may refer to retail marijuana as recreational or adult use marijuana.

What is an example of an excise tax?

The IRS says excise taxes are “imposed on a wide variety of goods, services and activities.” Here are a few examples: Gasoline. Coal. Alcohol. Cigarettes and tobacco. Airline tickets. Telephone service. Sports wagering.

What is dr 4709 Colorado department of revenue?

The department collects most types of taxes and issues state identification cards and driver licenses and also enforces Colorado laws regarding gaming, liquor, tobacco, racing, auto dealers, and marijuana.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CO DR 0442 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your CO DR 0442 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify CO DR 0442 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CO DR 0442, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in CO DR 0442 without leaving Chrome?

CO DR 0442 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is CO DR 0442?

CO DR 0442 is a form used in Colorado for reporting certain tax information. It is primarily associated with various tax-related submissions.

Who is required to file CO DR 0442?

Entities or individuals who have tax obligations that fall under the conditions specified by the Colorado Department of Revenue must file CO DR 0442.

How to fill out CO DR 0442?

To fill out CO DR 0442, you need to provide your identifying information, details about the tax obligations, and any specific financial data required as per the form’s instructions.

What is the purpose of CO DR 0442?

The purpose of CO DR 0442 is to ensure that taxpayers report their tax liabilities accurately and comply with Colorado tax regulations.

What information must be reported on CO DR 0442?

The information reported on CO DR 0442 typically includes taxpayer identification details, income information, deductions, credits, and any other data related to tax liabilities.

Fill out your CO DR 0442 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 0442 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.