CO DR 0442 2021-2025 free printable template

Show details

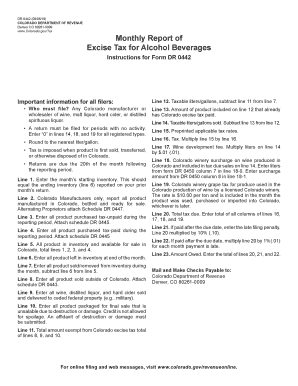

DR 0442 (05/12/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO 802610009

Tax.Colorado.gov

DOR_ExciseTax@state.co.usMonthly Report of

Excise Tax for Alcohol Beverages

Instructions for Form DR 0442Important

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado excise tax form

Edit your colorado excise tax online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr0442 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 0442 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit co monthly alcohol beverages. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0442 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out co monthly alcohol beverages

How to fill out CO DR 0442

01

Obtain the CO DR 0442 form from the Colorado Department of Revenue website or your local office.

02

Fill out your personal information at the top of the form, including your name, address, and contact information.

03

Indicate the reason for the request in the designated section.

04

Provide any relevant details or additional information that supports your request.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form via mail or in person to the appropriate address as specified on the form.

Who needs CO DR 0442?

01

Any individual or business seeking to request a specific type of record or information from the Colorado Department of Revenue may need to fill out CO DR 0442.

02

This form is typically required for those who need to access their tax information, vehicle registration details, or other related documents.

Fill

form

: Try Risk Free

People Also Ask about

Why would I get a letter from the Colorado Department of Revenue?

While the Department is required by law to send the Notice of Deficiency or Rejection of Refund Claim letter, the main purpose of this letter is to provide you with the following information: Any adjustment made to the return you filed and the detail of that adjustment. The outstanding balance for a specified tax year.

What is the excise tax on beer in Colorado?

Colorado Beer Tax The Colorado excise tax on beer is $0.08 per gallon, one of the lowest beer taxes in the country. Colorado's beer excise tax is ranked #45 out of the 50 states. The Colorado beer tax is already added to the purchase price of all beer bought in Colorado, whether in kegs, bottles, or cans.

What is the excise tax on alcohol in Colorado?

✔ Colorado's general sales tax of 2.9% also applies to the purchase of liquor. In Colorado, liquor vendors are responsible for paying a state excise tax of $2.28 per gallon, plus Federal excise taxes, for all liquor sold.

What is the excise tax rate in Colorado?

Colorado has a 4.40 percent corporate income tax rate. There are jurisdictions that collect local income taxes. Colorado also has a 2.90 percent state sales tax rate, a max local sales tax rate of 8.30 percent, and an average combined state and local sales tax rate of 7.78 percent.

What is Colorado excise tax?

A 15% state excise tax is imposed on the first sale or transfer from a retail marijuana cultivation facility to a retail marijuana store or retail marijuana product manufacturing facility. The industry may refer to retail marijuana as recreational or adult use marijuana.

What is an example of an excise tax?

The IRS says excise taxes are “imposed on a wide variety of goods, services and activities.” Here are a few examples: Gasoline. Coal. Alcohol. Cigarettes and tobacco. Airline tickets. Telephone service. Sports wagering.

What is dr 4709 Colorado department of revenue?

The department collects most types of taxes and issues state identification cards and driver licenses and also enforces Colorado laws regarding gaming, liquor, tobacco, racing, auto dealers, and marijuana.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my co monthly alcohol beverages in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your co monthly alcohol beverages and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out the co monthly alcohol beverages form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign co monthly alcohol beverages. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit co monthly alcohol beverages on an Android device?

The pdfFiller app for Android allows you to edit PDF files like co monthly alcohol beverages. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CO DR 0442?

CO DR 0442 is a form used by taxpayers in Colorado to report specific tax-related information to the state's Department of Revenue.

Who is required to file CO DR 0442?

Individuals or organizations that are required to report certain tax details or activities to the Colorado Department of Revenue must file CO DR 0442.

How to fill out CO DR 0442?

To fill out CO DR 0442, taxpayers should provide the requested details accurately, including personal or business information, tax calculations, and any other information specified on the form.

What is the purpose of CO DR 0442?

The purpose of CO DR 0442 is to ensure that the Colorado Department of Revenue receives accurate tax information for compliance and assessment purposes.

What information must be reported on CO DR 0442?

The information that must be reported on CO DR 0442 includes taxpayer identification details, income or revenue figures, tax credits or deductions claimed, and any other relevant financial data as specified by the form's instructions.

Fill out your co monthly alcohol beverages online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co Monthly Alcohol Beverages is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.