Get the free Regular InvestmentRegular Draw-down Plan Form

Show details

Please do not staple Regular Investment/Regular Draw-down Plan Form Answer Investment Portfolio 1 July 2014 Customer Services Phone 133 665 Email customer onepath.com.AU Website onepath.com.AU Neath

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regular investmentregular draw-down plan

Edit your regular investmentregular draw-down plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regular investmentregular draw-down plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

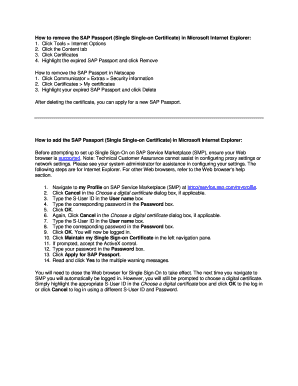

How to edit regular investmentregular draw-down plan online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regular investmentregular draw-down plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regular investmentregular draw-down plan

How to fill out a regular investment draw-down plan:

01

Start by determining your financial goals and objectives. Are you saving for retirement, education, or a major purchase? Understanding your goals will help you decide how much you need to save and for how long.

02

Assess your risk tolerance. Determine how comfortable you are with market fluctuations and the potential for loss. This will help you choose the right investment products and strategies for your draw-down plan.

03

Set a target timeline for your investments. Determine when you will need to start withdrawing money and how long you expect the funds to last. This will help you plan your investments accordingly.

04

Research and select suitable investment options. Consider factors such as your risk tolerance, time horizon, and investment objectives. Look for investment vehicles that align with your goals, such as mutual funds, stocks, bonds, or real estate.

05

Determine the amount you can afford to invest regularly. Evaluate your income, expenses, and savings to determine how much you can allocate towards your draw-down plan. Consistency is key, so try to invest the same amount at regular intervals.

06

Monitor and review your investments regularly. Keep track of how your investments are performing and make any necessary adjustments to stay on track with your goals. Consult with a financial advisor if needed.

07

Be mindful of taxes and regulations. Depending on your country and jurisdiction, there may be tax implications when withdrawing funds from your investment draw-down plan. Familiarize yourself with the rules and seek professional advice if required.

Who needs a regular investment draw-down plan?

01

Individuals saving for retirement: A regular investment draw-down plan can help individuals build a nest egg and ensure a steady stream of income during their retirement years.

02

Parents saving for their children's education: By starting a regular investment draw-down plan early, parents can accumulate funds to cover their children's educational expenses when the time comes.

03

Individuals planning for major expenses: Whether it's buying a house, starting a business, or any significant financial goal, a regular investment draw-down plan can help individuals save and generate substantial funds over time.

Remember, it's always recommended to seek professional financial advice tailored to your specific situation when filling out a regular investment draw-down plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out regular investmentregular draw-down plan using my mobile device?

Use the pdfFiller mobile app to fill out and sign regular investmentregular draw-down plan on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit regular investmentregular draw-down plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share regular investmentregular draw-down plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit regular investmentregular draw-down plan on an Android device?

You can make any changes to PDF files, such as regular investmentregular draw-down plan, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is regular investmentregular draw-down plan?

A regular investment regular draw-down plan is a financial strategy where an individual invests a fixed amount of money periodically and also withdraws a fixed amount of money periodically to meet their financial goals.

Who is required to file regular investmentregular draw-down plan?

Individuals who have opted to create a regular investment regular draw-down plan are required to file it.

How to fill out regular investmentregular draw-down plan?

To fill out a regular investment regular draw-down plan, one needs to specify the fixed amount to be invested periodically, the frequency of the investments, the fixed amount to be withdrawn periodically, and the financial goals the plan is intended to achieve.

What is the purpose of regular investmentregular draw-down plan?

The purpose of a regular investment regular draw-down plan is to systematically invest and withdraw money to achieve specific financial objectives over a period of time.

What information must be reported on regular investmentregular draw-down plan?

The regular investment regular draw-down plan must report the fixed amount to be invested periodically, the frequency of the investments, the fixed amount to be withdrawn periodically, and the financial goals.

Fill out your regular investmentregular draw-down plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regular Investmentregular Draw-Down Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.