CA BOE-502-D 2018 free printable template

Show details

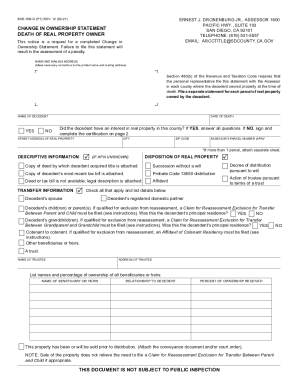

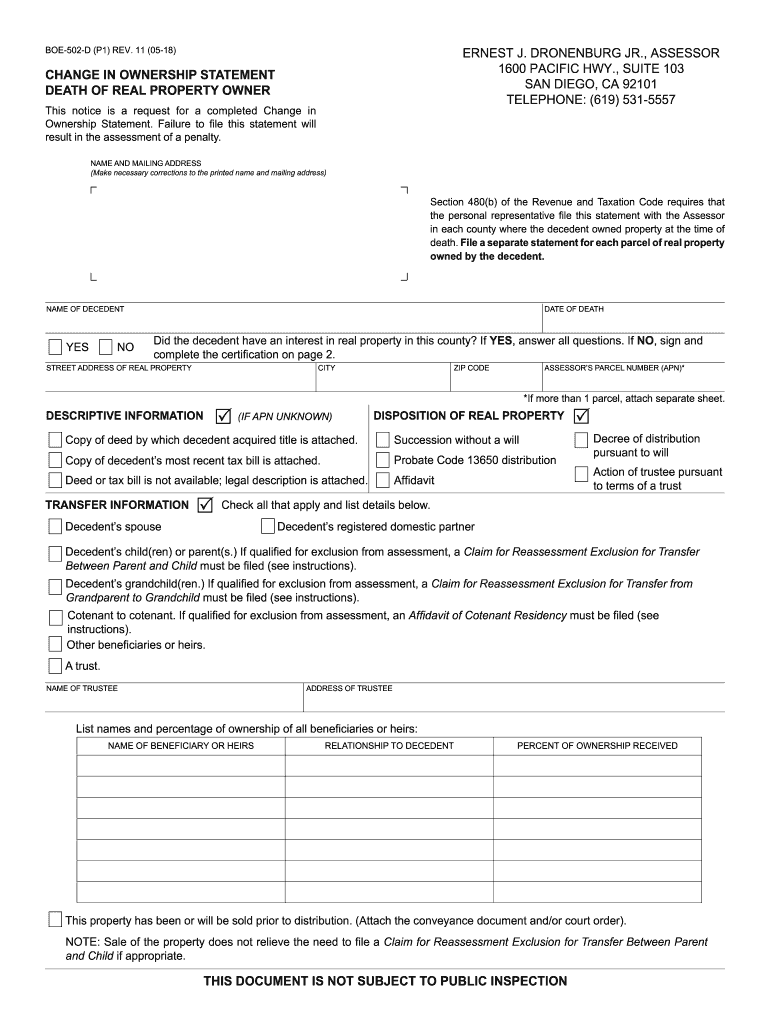

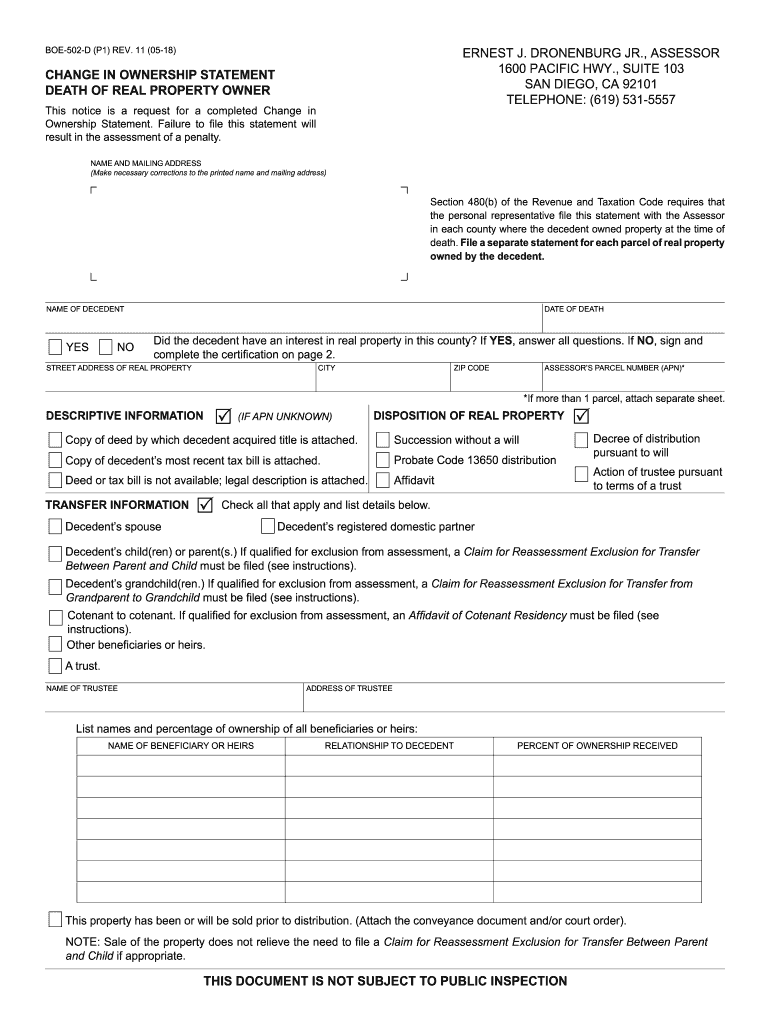

BOE502D (P1) REV. 11 (0518)ERNEST J. BRANDENBURG JR., ASSESSOR

1600 PACIFIC HWY., SUITE 103

SAN DIEGO, CA 92101

TELEPHONE: (619) 5315557CHANGE IN OWNERSHIP STATEMENT

DEATH OF REAL PROPERTY OWNER

This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA BOE-502-D

Edit your CA BOE-502-D form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA BOE-502-D form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA BOE-502-D online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA BOE-502-D. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-502-D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA BOE-502-D

How to fill out CA BOE-502-D

01

Gather necessary documentation and information, including your business details and tax information.

02

Download the CA BOE-502-D form from the California Department of Tax and Fee Administration (CDTFA) website.

03

Fill in your business name, address, and contact information in the appropriate sections.

04

Indicate your account number if you have one.

05

Provide details regarding the transactions or taxation that the form pertains to.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form either online or via mail as instructed on the form.

Who needs CA BOE-502-D?

01

Businesses and individuals in California who are claiming a refund or requesting a reconsideration of taxes paid.

02

Entities involved in sales and use tax transactions who need to document and clarify their tax obligations.

03

Taxpayers seeking to provide additional information regarding their tax status to the California Department of Tax and Fee Administration.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a preliminary change of ownership report in California?

0:13 8:38 California Preliminary Change of Ownership Report Instructions YouTube Start of suggested clip End of suggested clip Address. Then to the right which are going to be doing is you're going to be typing. The property'sMoreAddress. Then to the right which are going to be doing is you're going to be typing. The property's APN number that is located on the deed. So take a look at your deed.

What is a preliminary change of ownership report California?

What Is A PCOR? A PCOR is specific to California real estate transactions. It is issued by the State Board of Equalization per Section 480.3 of California's Revenue and Taxation Code. It is a form used to notify the county assessor's office of real property transactions (buys and sells).

How much tax do you pay when you sell an inherited house in California?

If you held the property for 365 days or less, you will be taxed on the gain at the same rate as the tax on your ordinary income. If you held the property 366 days or more, the tax on your gain will either be 5 percent, if you are in the lowest two tax brackets, or 15%, if you are in higher tax brackets.

What happens to property taxes when owner dies California?

In the event the deceased property owner had no heirs, the estate and all assets would be assumed by the state. To take care of a tax lien, the property will be sold by the county holding the lien to satisfy taxes due. Any remaining funds would then be transferred to the State of California.

How do I transfer a house title after death in California?

How Do I Prepare the Transfer on Death Deed? Fill out all general required information about your identity and address. Name your beneficiary or beneficiaries. Sign and date the transfer on death deed before a notary public. Have the notarized deed recorded with your county clerk's office.

When must a PCOR be filed in California?

The law requires the owners of any property that has changed ownership (except those caused by the death of an owner) to file a change in ownership statement (PCOR) when the transfer is recorded, or, if not recorded, within 45 days of the date of transfer.

What does preliminary change of ownership mean?

The Preliminary Change of Ownership Report is a document that is created and filed with municipal authorities at the time of sale. It contains key information about the buyers (name, phone number, etc), the property (address, occupancy, condition of the property, etc), and additional information as needed.

How many times can you transfer your property taxes in California?

You can do so up to three times during your lifetime, whereas before, you could do so only once. For transfers occurring before April 1, 2021, use your county-specific version of Form 60-AH. In addition, Prop.

How do I transfer property in San Bernardino County?

State law requires the buyer of real property to file a Preliminary Change of Ownership Report with the County Recorder's Office at the time a document is recorded which transfers ownership of the property. If this form is not filed, the recorder will charge an additional fee of $20.

What happens to property taxes when you inherit a house in California?

You will have to pay capital gains taxes based on the property's value at your parents' time of death. When you inherit a home, even if the house is now worth 20 times the value it was when your parents originally purchased it, you will not be required to pay a tax on the total difference in value.

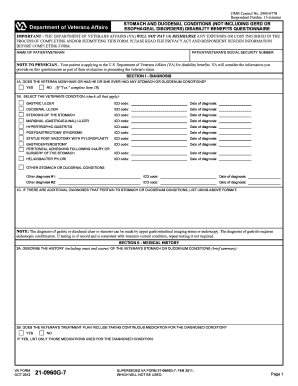

What is form BOE 502 D?

The Change in Ownership Statement Death of Real Property Owner Form (BOE-502-D/ ASSR-176) is required to be completed and submitted to the Assessor's Office, even if the decedent held the property in a trust.

Where to file the preliminary change of ownership report Los Angeles county?

To be completed by the transferee (buyer) prior to a transfer of subject property, in ance with section 480.3 of the Revenue and Taxation Code. A Preliminary Change of Ownership Report must be filed with each conveyance in the County Recorder's office for the county where the property is located.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA BOE-502-D directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CA BOE-502-D as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit CA BOE-502-D in Chrome?

CA BOE-502-D can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit CA BOE-502-D on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CA BOE-502-D right away.

What is CA BOE-502-D?

CA BOE-502-D is a California Board of Equalization form used for reporting personal property owned by a business.

Who is required to file CA BOE-502-D?

All businesses that own taxable personal property in California are required to file CA BOE-502-D annually.

How to fill out CA BOE-502-D?

To fill out CA BOE-502-D, provide detailed information about your business including the type of personal property owned, its acquisition date, and its cost. Follow the instructions provided with the form carefully.

What is the purpose of CA BOE-502-D?

The purpose of CA BOE-502-D is to report personal property to the California tax authorities for proper assessment and taxation.

What information must be reported on CA BOE-502-D?

The information that must be reported includes a description of the personal property, its location, acquisition date, cost, and any additions or disposals made during the year.

Fill out your CA BOE-502-D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA BOE-502-D is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.