LPL Financial CM107-CDT 2023-2025 free printable template

Show details

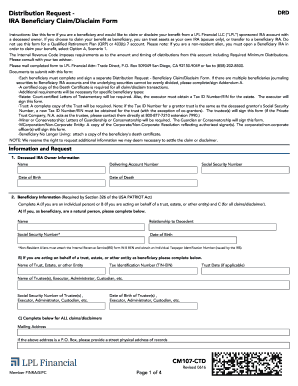

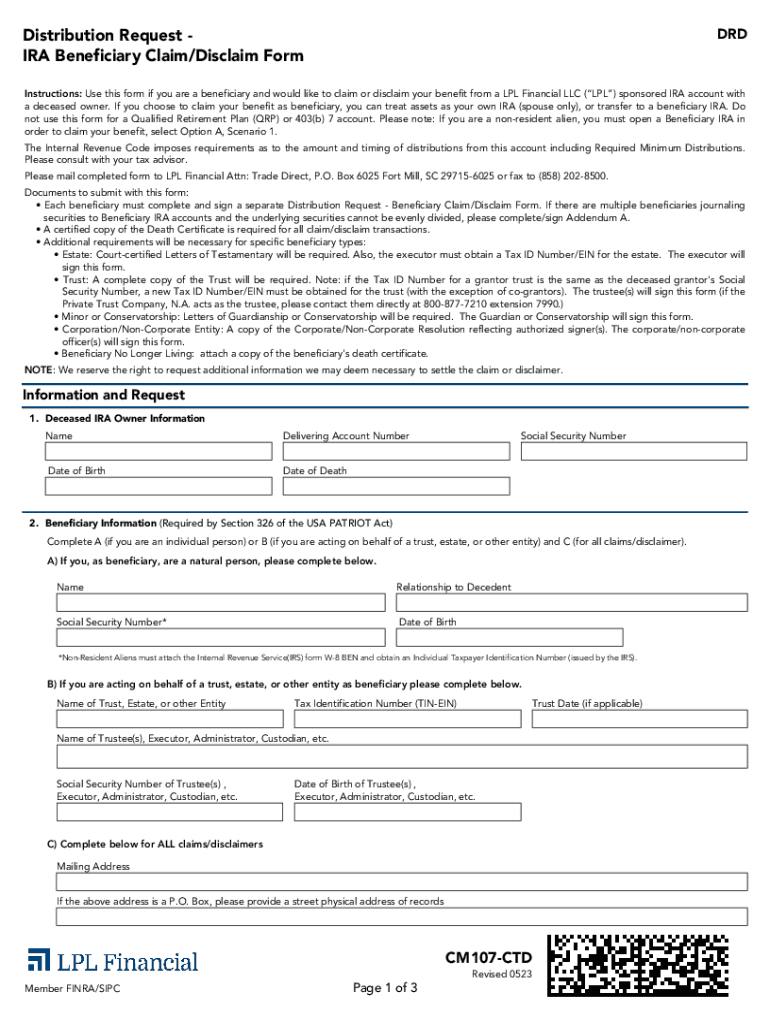

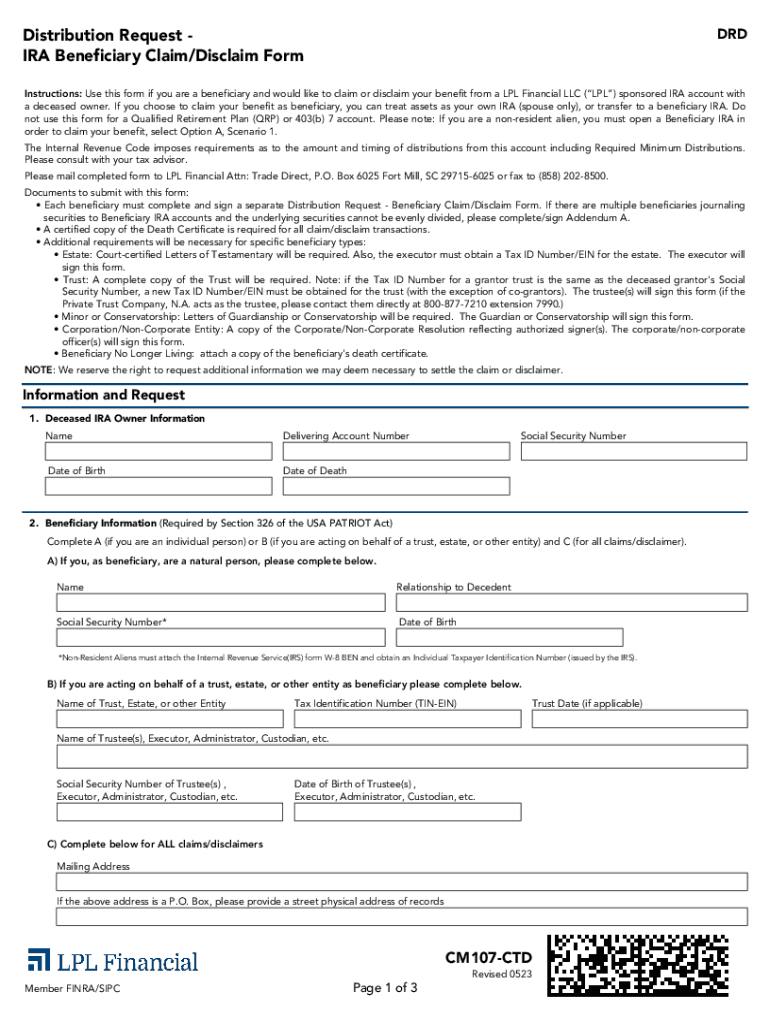

Distribution Request IRA Beneficiary Claim/Disclaim FormDRDInstructions: Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a LPL Financial LLC (LPL) sponsored

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit . Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LPL Financial CM107-CDT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out

How to fill out LPL Financial CM107-CDT

01

Obtain the LPL Financial CM107-CDT form from LPL's official website or your financial advisor.

02

Begin by filling out your personal identification details, including your name, contact information, and account number.

03

Provide information about your financial situation, including income, assets, and liabilities.

04

Specify the type of account or investment you are applying for.

05

Review LPL's terms and conditions and confirm your understanding by signing the designated section.

06

Ensure all information is accurate and complete to avoid delays.

07

Submit the completed form to LPL Financial via their specified submission method.

Who needs LPL Financial CM107-CDT?

01

Individuals seeking to open or manage an account with LPL Financial.

02

Investors looking to make changes to their investment strategy or account details.

03

Clients needing to provide updated financial information as part of compliance or regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

Why would you disclaim an IRA?

Beneficiaries who do not want to receive inherited IRA assets may disclaim their interest in the IRA, but they only have a certain amount of time to do so. A beneficiary cannot simply delay or do nothing with the IRA in hopes that it will all go away.

What happens when a beneficiary disclaims?

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Can a beneficiary disclaim a portion of an IRA?

A beneficiary may disclaim a whole or partial interest in an IRA, ing to Internal Revenue Code Section (IRC Sec.) 2518. As a result, the beneficiary is treated as though he had never been named a beneficiary in the first place or as though he predeceased the original IRA owner.

How do I disclaim an inheritance from my IRA?

Option #1: “Disclaim” the inherited retirement account By disclaiming the asset, you can potentially pass these assets on to someone in a lower tax bracket. To disclaim, you need to make this choice within nine months of the original owner's death and before taking possession of any assets.

What happens when an IRA beneficiary disclaims?

Disclaim (decline to inherit) all or part of the assets If no other beneficiaries exist, the assets will pass in ance with the IRA provider's custodial agreement. For example, with a Fidelity IRA, the assets will pass to the original IRA owner's surviving spouse and, if none, to the owner's estate.

Why would you disclaim assets?

Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary—for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

How do you write a disclaimer of inheritance?

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate—usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Why would a beneficiary disclaim an IRA?

Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets. A disclaimer that does not meet basic requirements under federal and state law could cause adverse consequences for the person disclaiming the assets as well as any subsequent beneficiaries.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ?

The editing procedure is simple with pdfFiller. Open your in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your in seconds.

How can I fill out on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your . You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is LPL Financial CM107-CDT?

LPL Financial CM107-CDT is a compliance reporting document used by LPL Financial to ensure adherence to regulatory requirements in the financial services industry.

Who is required to file LPL Financial CM107-CDT?

Individuals and entities associated with LPL Financial, such as registered representatives and advisors, may be required to file LPL Financial CM107-CDT to maintain compliance with financial regulations.

How to fill out LPL Financial CM107-CDT?

To fill out LPL Financial CM107-CDT, users must accurately provide their personal information, details of any transactions, and any other required disclosures according to the guidelines provided by LPL Financial.

What is the purpose of LPL Financial CM107-CDT?

The purpose of LPL Financial CM107-CDT is to maintain regulatory compliance, facilitate transparency in financial practices, and ensure that all required information is reported to the relevant authorities.

What information must be reported on LPL Financial CM107-CDT?

The information that must be reported on LPL Financial CM107-CDT includes personal identification details, transaction specifics, compliance-related disclosures, and any conflicts of interest that may arise.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.