KY DoR 740-ES 2019 free printable template

Show details

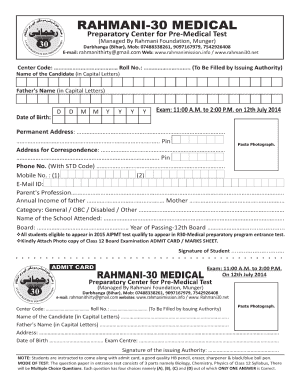

KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 2018 INDIVIDUAL INCOME TAX Form 740-ES For FISCAL year filers ONLY FISCAL year ending / Due April 17 2018 12/31/2018 Year Ending Spouse s Social Security No. Your Social Security No. LAST NAME FIRST NAME SPOUSE S NAME Amount Paid Mailing Address Number and Street including Apartment No. or P. O. Box City Town or Post Office State Kentucky Department of Revenue Frankfort KY 40620-0009 Zip Code Make check payable to Kentucky State Treasurer....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 740-ES

Edit your KY DoR 740-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 740-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 740-ES online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY DoR 740-ES. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 740-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 740-ES

How to fill out KY DoR 740-ES

01

Obtain the KY DoR 740-ES form from the Kentucky Department of Revenue website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Determine your expected income for the year to calculate your estimated tax liability.

04

Use the tax tables provided in the form to calculate your estimated tax due.

05

Fill in the estimated tax amount on the form.

06

Review your entries for accuracy.

07

Submit the completed form to the Kentucky Department of Revenue, along with any payment if applicable.

Who needs KY DoR 740-ES?

01

Individuals and businesses in Kentucky who expect to owe state income tax of $500 or more for the tax year.

02

Taxpayers who want to make quarterly estimated tax payments to avoid penalties.

Fill

form

: Try Risk Free

People Also Ask about

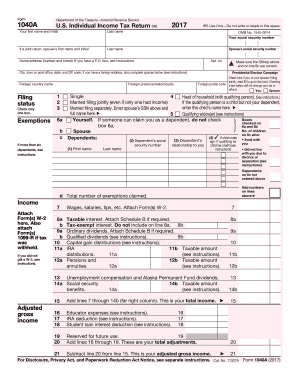

What does Form 1040-ES estimated tax mean?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is a Kentucky 740 form?

Form 740 is the Kentucky income tax return for use by all taxpayers.

How do I pay my estimated taxes in Kentucky?

HOW TO PAY—You may pay your estimated tax installments using the following options: Pay by check using Form 740-ES. Make check payable to Kentucky State Treasurer, and write your Social Security Number on the face of the check.

What is the easiest way to pay estimated taxes?

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS.

Does Kentucky require estimated tax payments?

Taxpayers who may have a total tax obligation above $5,000.00 in any tax year are required to submit quarterly estimated payments.

Do I have to pay estimated taxes in Kentucky?

Taxpayers who may have a total tax obligation above $5,000.00 in any tax year are required to submit quarterly estimated payments. This obligation includes taxes for Louisville Metro, Kentucky, TARC, and the School Boards.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the KY DoR 740-ES in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your KY DoR 740-ES and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out KY DoR 740-ES using my mobile device?

Use the pdfFiller mobile app to fill out and sign KY DoR 740-ES on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit KY DoR 740-ES on an Android device?

With the pdfFiller Android app, you can edit, sign, and share KY DoR 740-ES on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is KY DoR 740-ES?

KY DoR 740-ES is a form used by taxpayers in Kentucky to make estimated income tax payments to the state government.

Who is required to file KY DoR 740-ES?

Individuals who expect to owe at least $500 in state income tax after subtracting their withholding and credits, as well as certain businesses, are required to file the KY DoR 740-ES.

How to fill out KY DoR 740-ES?

To fill out KY DoR 740-ES, taxpayers must provide their name, address, Social Security number or Federal Employer Identification Number (FEIN), and the estimated tax amount for the year. They need to follow the instructions included with the form for accurate completion.

What is the purpose of KY DoR 740-ES?

The purpose of KY DoR 740-ES is to allow taxpayers to estimate and pay their anticipated state income tax liability in installments throughout the year to avoid a large tax bill at the end of the fiscal year.

What information must be reported on KY DoR 740-ES?

KY DoR 740-ES requires taxpayers to report their name, address, Social Security number or FEIN, estimated annual income, expected tax liability, and the amount of estimated payments for the year.

Fill out your KY DoR 740-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 740-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.