KY DoR 740-ES 2015 free printable template

Show details

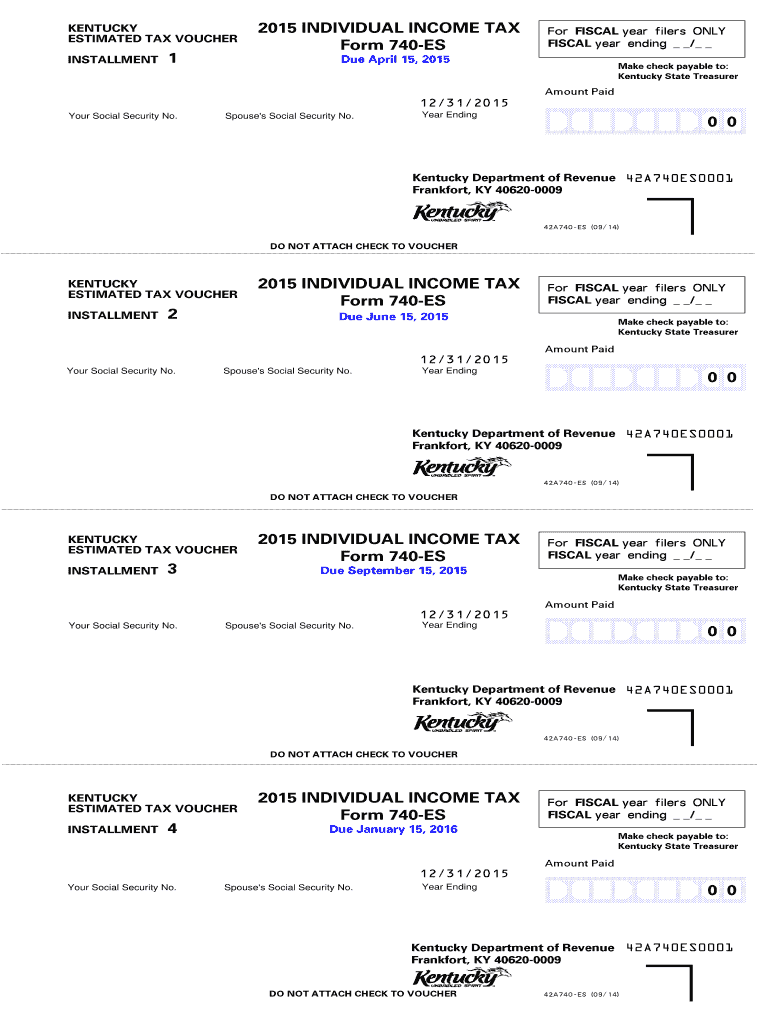

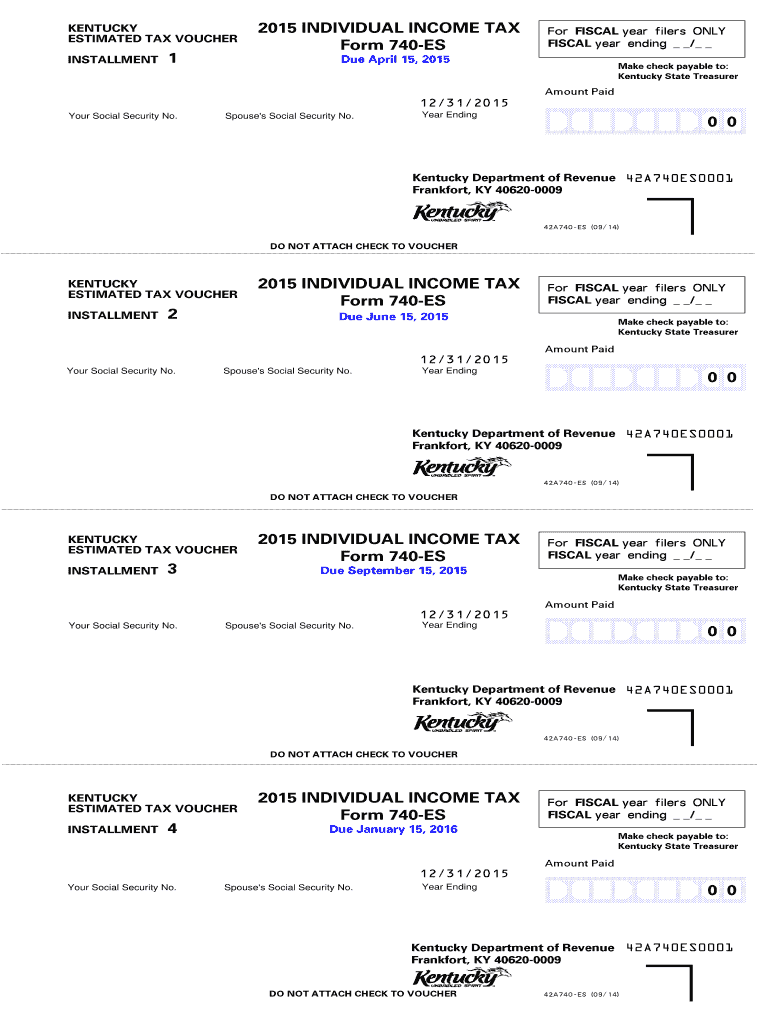

KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 2015 INDIVIDUAL INCOME TAX Form 740-ES Due April 15 2015 12/31/2015 Your Social Security No. Spouse s Social Security No. Year Ending FISCAL year filers ONLY FISCAL year ending / For Make check payable to Kentucky State Treasurer AAAAAAAAAB EFCEFCEFCD Amount Paid Kentucky Department of Revenue 42A740ES0001 Frankfort KY 40620-0009 42A740-ES 09/14 DO NOT ATTACH CHECK TO VOUCHER Due June 15 2015 Due Septe...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 740-ES

Edit your KY DoR 740-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 740-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 740-ES online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KY DoR 740-ES. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 740-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 740-ES

How to fill out KY DoR 740-ES

01

Obtain the KY DoR 740-ES form from the Kentucky Department of Revenue website or your local tax office.

02

Enter your personal information, including your name, address, and Social Security number.

03

Indicate the tax year for which you are making estimated payments.

04

Calculate your estimated tax liability based on your expected income, deductions, and credits.

05

Divide your estimated tax liability by the number of payments you wish to make (typically four) to determine the amount due for each installment.

06

Complete the payment information section, indicating your preferred payment method.

07

Review all information for accuracy and completeness before submitting.

08

Submit the form by the due date, either online or via mail, along with your payment if applicable.

Who needs KY DoR 740-ES?

01

Individuals and businesses in Kentucky who expect to owe $500 or more in state income tax for the year.

02

Taxpayers who have income that is not subject to withholding, such as self-employed individuals or those with investment income.

03

People who want to avoid penalties for underpayment of estimated taxes.

Fill

form

: Try Risk Free

People Also Ask about

Can I choose not to pay estimated taxes?

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

Does Kentucky have a state income tax withholding form?

If you meet any of the four exemptions you are exempted from Kentucky withholding. However, you must complete this form and file it with your employer before withholding can be stopped. You will need to maintain a copy of the K-4 for your permanent records.

How do I pay estimated taxes in Kentucky?

HOW TO PAY—You may pay your estimated tax installments using the following options: Pay by check using Form 740-ES. Make check payable to Kentucky State Treasurer, and write your Social Security Number on the face of the check.

Do I have to file a Kentucky nonresident tax return?

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources. Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021.

Does Kentucky require estimated tax payments?

Taxpayers who may have a total tax obligation above $5,000.00 in any tax year are required to submit quarterly estimated payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in KY DoR 740-ES?

With pdfFiller, the editing process is straightforward. Open your KY DoR 740-ES in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit KY DoR 740-ES in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your KY DoR 740-ES, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my KY DoR 740-ES in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your KY DoR 740-ES and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is KY DoR 740-ES?

KY DoR 740-ES is a form used for making estimated tax payments to the state of Kentucky.

Who is required to file KY DoR 740-ES?

Individuals and entities that expect to owe $500 or more in state income tax for the tax year are required to file KY DoR 740-ES.

How to fill out KY DoR 740-ES?

To fill out KY DoR 740-ES, provide your personal information, estimated income, and calculate the corresponding estimated tax due based on your projections.

What is the purpose of KY DoR 740-ES?

The purpose of KY DoR 740-ES is to allow taxpayers to make timely estimated tax payments to avoid penalties and interest charges.

What information must be reported on KY DoR 740-ES?

The KY DoR 740-ES requires reporting of taxpayer information, estimated income amounts, deductions, and the total estimated tax liability.

Fill out your KY DoR 740-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 740-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.