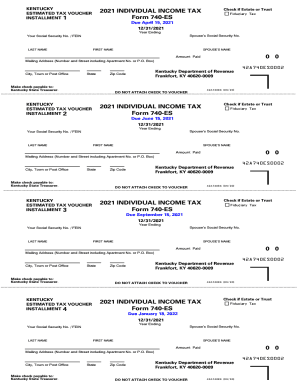

KY DoR 740-ES 2020 free printable template

Get, Create, Make and Sign KY DoR 740-ES

Editing KY DoR 740-ES online

Uncompromising security for your PDF editing and eSignature needs

KY DoR 740-ES Form Versions

How to fill out KY DoR 740-ES

How to fill out KY DoR 740-ES

Who needs KY DoR 740-ES?

Instructions and Help about KY DoR 740-ES

Law.com legal forms guide form 740 Kentucky individual income tax return resident full year residents of Kentucky should file their state income taxes using a form 740 this document can be obtained from the website of the Kentucky Department of Revenue step 1 if not filing on a calendar year basis enter the beginning and ending dates of your fiscal year step 2 if filing jointly enter your spouse's social security number in box a and yours in box be otherwise just enter yours in box be enter both names or just yours as applicable in the box below as well as your complete mailing address step 3 indicate your filing status with a check mark step 4 indicate with a check mark whether you or your spouse wish to donate two dollars to a political party fund you may donate to a Republican or Democratic fund or donate with no designation step 5 throughout the form two columns are provided column an is only for those who are filing jointly to document their spouses income while column B is for the person filing the form whether filing jointly or singly lines 5 through 11 provide instructions for computing your taxable income step 6 lines 12 through 26 compute your income tax liability note that in order to complete line 17 which concerns personal tax credits you must first complete section b on the third page and transfer the results from lines 4a and 4b there additionally if you are claiming business incentive and related tax credits you must complete schedule a and transfer the results to line 15 step 7 lines 27 through 29 adjust your state tax liability by adding use tax on any items purchased online step 8 complete lines 30 through 43 as directed in order to calculate your adjusted tax liability balance due or the refund you are owed by the state step 9 attach a copy of your federal 1040 return if you received farm business or rental income or loss sign and date the form to watch more videos please make sure to visit laws calm

People Also Ask about

What does Form 1040-ES estimated tax mean?

What is a Kentucky 740 form?

How do I pay my estimated taxes in Kentucky?

What is the easiest way to pay estimated taxes?

Does Kentucky require estimated tax payments?

Do I have to pay estimated taxes in Kentucky?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KY DoR 740-ES for eSignature?

How can I edit KY DoR 740-ES on a smartphone?

How do I fill out KY DoR 740-ES on an Android device?

What is KY DoR 740-ES?

Who is required to file KY DoR 740-ES?

How to fill out KY DoR 740-ES?

What is the purpose of KY DoR 740-ES?

What information must be reported on KY DoR 740-ES?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.