Hartford Funds CHET Advisor Account Application 2019 free printable template

Show details

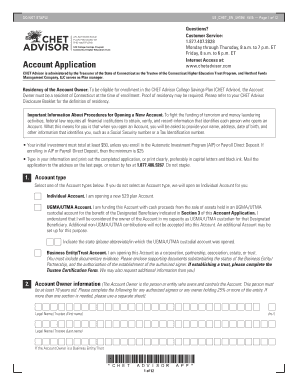

Chetadvisor. com AN ADVISOR-SOLD PLAN MANAGED BY THE HARTFORD 529 College Savings Program Connecticut Higher Education Trust Account Application CHET Advisor is administered by the Treasurer of the State of Connecticut as the Trustee of the Connecticut Higher Education Trust Program and Hartford Funds Management Company LLC serves as Plan manager. DO NOT STAPLE 107453AESCHET 0119 Page 1 of 12 CHET ADVISOR Questions Customer Service 1. 877. 407. 2828 Monday through Thursday 8 a*m* to 7 p*m*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Hartford Funds CHET Advisor Account Application

Edit your Hartford Funds CHET Advisor Account Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Hartford Funds CHET Advisor Account Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Hartford Funds CHET Advisor Account Application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Hartford Funds CHET Advisor Account Application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Hartford Funds CHET Advisor Account Application Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Hartford Funds CHET Advisor Account Application

How to fill out Hartford Funds CHET Advisor Account Application

01

Download the Hartford Funds CHET Advisor Account Application form from the official website.

02

Begin filling out the personal information section, including your name, address, and contact details.

03

Provide details of the financial advisor who will manage the account.

04

Specify the type of account you are opening (individual, joint, or custodian).

05

Fill in your investment objectives and risk tolerance levels.

06

Include any required identification, such as Social Security number or Tax ID.

07

Review the terms and conditions of the account.

08

Sign and date the application to confirm your agreement.

09

Submit the completed application along with any additional required documents to Hartford Funds.

Who needs Hartford Funds CHET Advisor Account Application?

01

Individuals or guardians looking to invest in a tax-advantaged Education Savings Account.

02

Financial advisors managing funds for clients aiming to save for education expenses.

03

Parents wanting to explore education funding options for their children.

Fill

form

: Try Risk Free

People Also Ask about

Are 529 plans deductible in CT?

State tax deduction or credit for contributions: Contributions to a Connecticut 529 plan of up to $5,000 per year by an individual, and up to $10,000 per year by a married couple filing jointly, are deductible in computing Connecticut taxable income, with a five-year carryforward of excess contributions.

How much can I contribute to a 529 plan in 2023?

Individuals may contribute as much as $85,000 to a 529 plan in 2023 ($80,000 in 2022) if they treat the contribution as if it were spread over a 5-year period.

Should I choose my state 529 plan?

Pick your home state plan if it offers fees under 0.50% or a state income tax break, and your child is in high school. Otherwise, choose the 529 plan with the best combination of high return on investment and low fees.

How to open a 529 college savings plan?

Here are the five steps to opening a 529 plan: Choose a 529 Plan. 529 plans are offered by administrators that are financial institutions through a state program. Determine the Type of 529 Plan Account. Complete the 529 Plan Application. Fund the 529 Plan. Choose Investments for the 529 Plan.

What expenses are allowed for Chet?

Connecticut taxpayers are eligible to receive a Connecticut income tax deduction of up to $10,000 on contributions made to CHET. Use the funds for a wide range of college expenses at accredited schools nationwide—plus tuition expenses for K–12th grade, certain apprenticeship costs, and student loan repayments.

What is the best 529 plan for Connecticut residents?

We recommend that Connecticut residents use the Connecticut Higher Education Trust (CHET) 529 plan due to the tax benefits, low fees, and plan investment options. We recommend that out-of-state residents utilize other plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Hartford Funds CHET Advisor Account Application electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Hartford Funds CHET Advisor Account Application in minutes.

Can I create an eSignature for the Hartford Funds CHET Advisor Account Application in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your Hartford Funds CHET Advisor Account Application right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit Hartford Funds CHET Advisor Account Application on an iOS device?

Create, edit, and share Hartford Funds CHET Advisor Account Application from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is Hartford Funds CHET Advisor Account Application?

The Hartford Funds CHET Advisor Account Application is a form used to open and manage an advisor-managed account within the Connecticut Higher Educational Trust (CHET) program, designed to help families save for college.

Who is required to file Hartford Funds CHET Advisor Account Application?

Individuals or entities seeking to establish an advisor-managed account under the CHET program must file the Hartford Funds CHET Advisor Account Application.

How to fill out Hartford Funds CHET Advisor Account Application?

To fill out the application, individuals must provide personal information including the account owner's details, beneficiary information, financial information, and any required signatures. It is advisable to follow the instructions included with the application form closely.

What is the purpose of Hartford Funds CHET Advisor Account Application?

The purpose of this application is to facilitate the opening and management of college savings accounts to help families save for future education expenses through a structured and advisor-supported investment approach.

What information must be reported on Hartford Funds CHET Advisor Account Application?

The application requires reporting personal details such as the account holder's name, address, social security number, details of the beneficiary, investment preferences, and financial background.

Fill out your Hartford Funds CHET Advisor Account Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hartford Funds CHET Advisor Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.