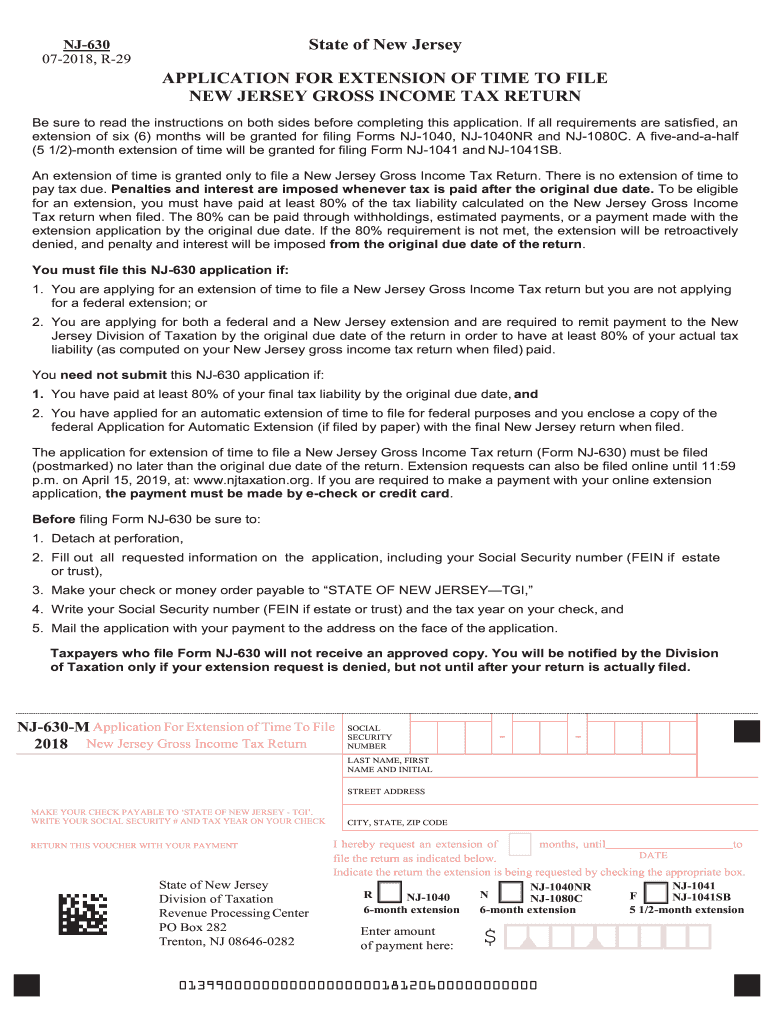

Who needs form NJ-630?

This is a form for taxpayers in New Jersey. They must have paid at least 80% of the tax liability computed on the New Jersey gross income tax return, when filed.

What is form NJ-630 for?

This is an Application for Extension of Time to File New Jersey Gross Income Tax Return. It means that if an applicant meets all requirements, he may get a six-month extension to file Forms NJ-1040, NJ-1041 and NJ-1080C5 or a five-month extension for filing Forms NJ-1041 and NJ-1041 SB. Remember that this application can result in an extension of time for filing a gross income tax return but not for paying the tax itself.

Is it accompanied by other forms?

Make your check or money order payable to “State of New Jersey — TGI”, write your SSN or VEIN and the tax year on your check, and then send the application with the check.

When is form NJ-630 due?

The due date is the same as for the original tax return. If form NJ-630 is filed later, penalties and interest will be imposed.

How do I fill out an NJ-630 form?

There are only a few fields to fill out on this application. Write your social security number, your last name, first name and initials, and your current mailing address. Determine what kind of extension you need (five or six months), specify when this period will end, and indicate the type of return you will be filing then and then add the amount of payment you’ve already made.

Where do I send it?

These applications can be filed online at www.state.nj.us/treasury/taxation. Keep in mind that you will not receive an approved copy in return. The Division of Taxation will notify you only if the extension is denied.