Why am I being charged an underpayment penalty?

If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax.

What is NJ underpayment penalty?

If your estimated payments are made late, interest charges will be assessed from the due date of the payment(s) to the actual payment date(s). Interest is assessed at the annual rate of 3% above the prime rate.

Does NJ 1041 accept federal extension?

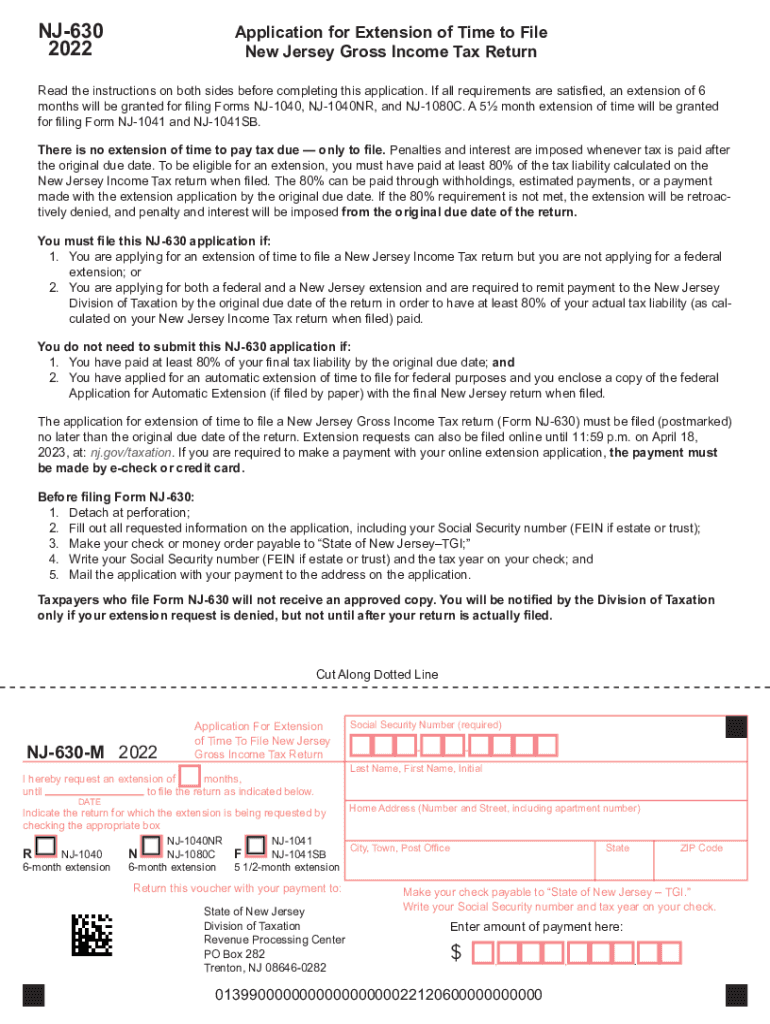

New Jersey Gross Income Tax Return Read the instructions on both sides before completing this application. If all requirements are satisfied, an extension of 6 months will be granted for filing Forms NJ-1040, NJ-1040NR, and NJ-1080C. A 5½ month extension of time will be granted for filing Form NJ-1041 and NJ-1041SB.

Does NJ Partnership accept federal extension?

Extension of Time to File If a five-month extension is obtained for filing Federal Form 1065, then an automatic five-month extension is granted for submitting your Form NJ-1065. A copy of your application for Federal extension, Federal Form 7004, must be filed with your New Jersey return.

Is NJ tax extension automatic with federal?

A New Jersey tax extension can be obtained by first filing a Federal tax extension (IRS Form 4868). If you have a valid Federal extension, you will automatically be granted a New Jersey extension. You must attach a copy of your Federal extension to your New Jersey tax return when it's filed.

Do you have to file NJ state taxes if you don't owe?

For Tax Year 2022, if you expect a refund or you don't owe taxes, you do not have to file a tax extension.

Does federal extension cover states?

Most states don't require you to file separate state extension forms if you don't owe any additional taxes. When you file your state return, you only need to attach a copy of your federal extension form. If you owe state tax, you typically must file state tax extension to avoid penalties.

How much is a typical underpayment penalty?

Typically, underpayment penalties are 5% of the underpaid amount, and they're capped at 25%. Underpaid taxes also accrue interest at a rate that the IRS sets annually.

Who is required to file a New Jersey tax return?

NJ Income Tax – Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return head of household, Qualifying widow(er)/surviving CU partner$20,000 May 12, 2021

Who files a NJ-1040NR?

E-file NJ Taxes and Get Your Tax Refund Fast. Form NJ-1040 must be filed by residents who are filing NJ taxes and nonresidents or partial-year residents must file Form NJ-1040NR. New Jersey tax returns can be filed electronically or mailed to the address indicated on the form.

Why do I owe an underpayment?

Underpayment of estimated tax occurs when you don't pay enough tax during those quarterly estimated tax payments. Failure to pay proper estimated tax throughout the year might result in a penalty for underpayment of estimated tax.

What is NJ 630?

The application for extension of time to file a New Jersey Gross Income Tax return (Form NJ-630) must be filed (postmarked) no later than the original due date of the return.

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

What is underpayment penalty worksheet 2210?

Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. You may need this form if: You're self-employed or have other income that isn't subject to withholding, such as investment income.

Who has to file a NJ tax return?

NJ Income Tax – Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return head of household, Qualifying widow(er)/surviving CU partner$20,000 12 May 2021

Does NJ accept federal extension?

XII EXTENSIONS An extension will only be accepted if it has been properly requested. Extensions require either the filing of form NJ-630, Application for Extension of Time to File New Jersey Gross Income Tax Returns or filing a request for a Federal Extension.

Do I need to file a NJ state return?

If you were a resident of New Jersey for only part of the year and your income from all sources for the entire year was more than $20,000 ($10,000 if filing status is single or married/CU partner, filing separate return), you must file a New Jersey resident Income Tax return and report any income you received while you

Who is subject to NJ income tax?

Who has to file New Jersey state taxes? Any resident with a New Jersey income source above the taxable amount minimum is subject to income tax. The same applies to part-year residents (those who spend less than 180 days in the state during the year) and non-residents earning an income in New Jersey.

Are non residents required to file taxes?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Who must file a NJ non resident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.