AZ 82130R - Yavapai County 2015 free printable template

Show details

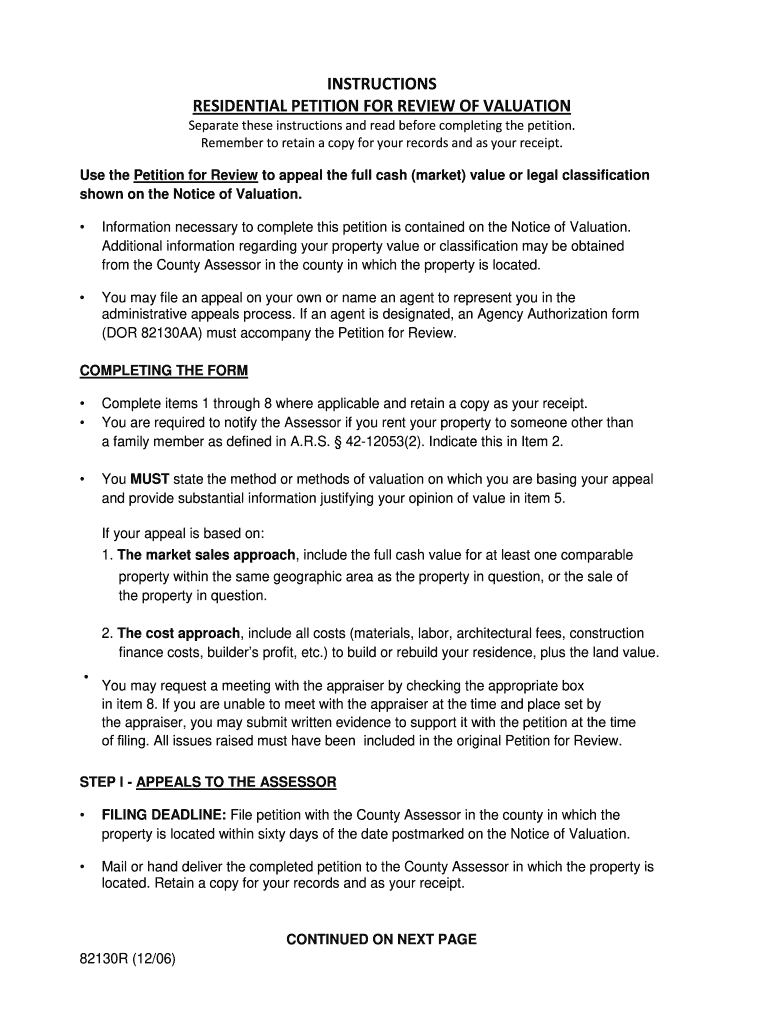

INSTRUCTIONS RESIDENTIAL PETITION FOR REVIEW OF VALUATION Separate these instructions and read before completing the petition. Remember to retain a copy for your records and as your receipt. Use the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ 82130R - Yavapai County

Edit your AZ 82130R - Yavapai County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ 82130R - Yavapai County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ 82130R - Yavapai County online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ 82130R - Yavapai County. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ 82130R - Yavapai County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ 82130R - Yavapai County

How to fill out AZ 82130R - Yavapai County

01

Obtain the AZ 82130R form from the Yavapai County official website or office.

02

Read the instructions provided with the form carefully.

03

Fill out the applicant's personal information in the designated fields.

04

Provide details regarding property information, including addresses and relevant descriptions.

05

Include any necessary supporting documentation as specified in the form requirements.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate Yavapai County office either in person or via mail.

Who needs AZ 82130R - Yavapai County?

01

Property owners in Yavapai County who need to apply for a specific permit or request related to their property.

02

Individuals seeking to amend or update property information with the county.

03

Real estate professionals assisting clients with property transactions within Yavapai County.

Fill

form

: Try Risk Free

People Also Ask about

How is assessed value determined in Arizona?

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

What is the notice of value in Yavapai County?

The Notice of Value is the County's official declaration of Full Cash Value and Limited Property Value Assessments. Please note that only the Limited Property Value is used to calculate your property tax bill. By state statute, the Notice of Value must be mailed before March 1 of the year prior to the tax year.

How do I appeal a property tax assessment in Arizona?

Owner may file an appeal with the Court on changed assessment. Within 60 days of the date of mailing of the County Board decision, or within 60 days of the date of the State Board's written decision. A new Owner may file an appeal with the Court if the former Owner did not appeal.

Who determines the value of your property for the purposes of taxation in Arizona?

For additional information regarding the content herein, refer to Overview of the Arizona Property Tax System . The County Assessor is responsible for identifying, classifying, valuing, and assessing all property in the county in ance with state law.

What is Arizona notice of value?

The notification outlines the value the county assessor has established for your property for the current tax year and the future tax year.

What is Yavapai County assessment ratios?

Each class of property is assigned an assessment ratio, pursuant to state law, ranging from 1% to 18%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AZ 82130R - Yavapai County in Chrome?

AZ 82130R - Yavapai County can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the AZ 82130R - Yavapai County form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign AZ 82130R - Yavapai County and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit AZ 82130R - Yavapai County on an iOS device?

Use the pdfFiller mobile app to create, edit, and share AZ 82130R - Yavapai County from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is AZ 82130R - Yavapai County?

AZ 82130R is a specific form used in Yavapai County, Arizona, primarily for reporting certain tax-related information or business activities.

Who is required to file AZ 82130R - Yavapai County?

Individuals or businesses operating in Yavapai County that meet specific criteria related to income, property, or business operations are required to file AZ 82130R.

How to fill out AZ 82130R - Yavapai County?

To fill out AZ 82130R, individuals or businesses should provide the required personal or business information, financial details, and any related attachments as specified in the filing instructions.

What is the purpose of AZ 82130R - Yavapai County?

The purpose of AZ 82130R is to collect necessary data for tax assessment and compliance purposes, ensuring that local taxes and regulations are properly enforced.

What information must be reported on AZ 82130R - Yavapai County?

The information required on AZ 82130R typically includes details about income, expenses, property valuation, and any other financial information relevant to the tax obligations.

Fill out your AZ 82130R - Yavapai County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ 82130r - Yavapai County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.