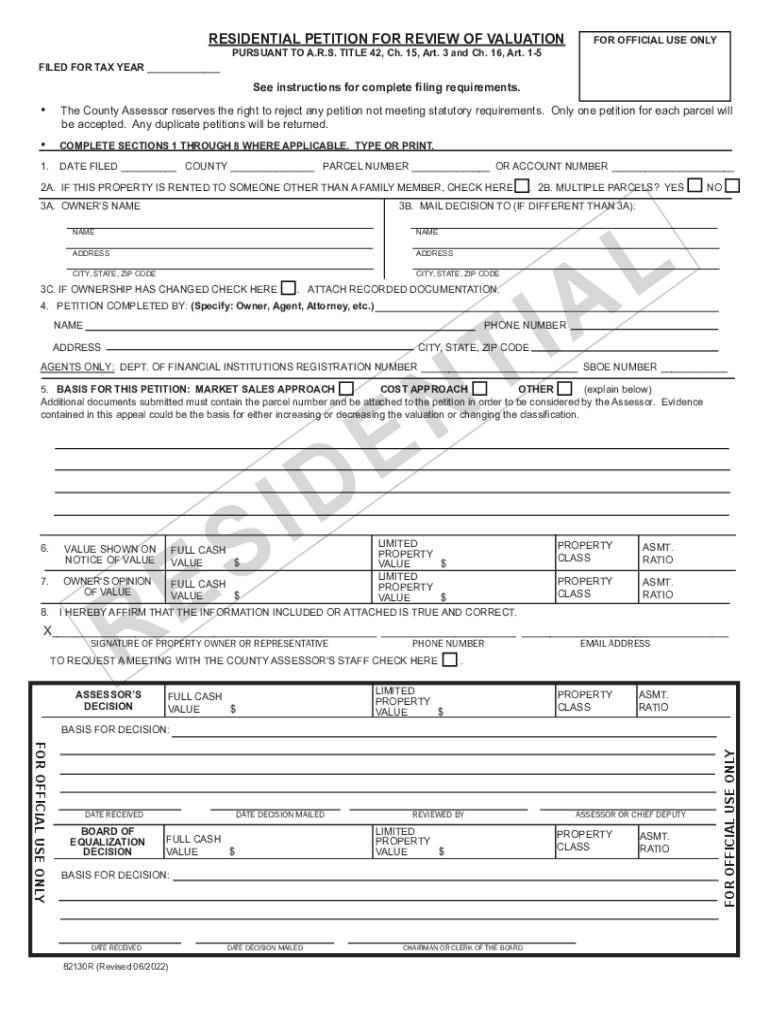

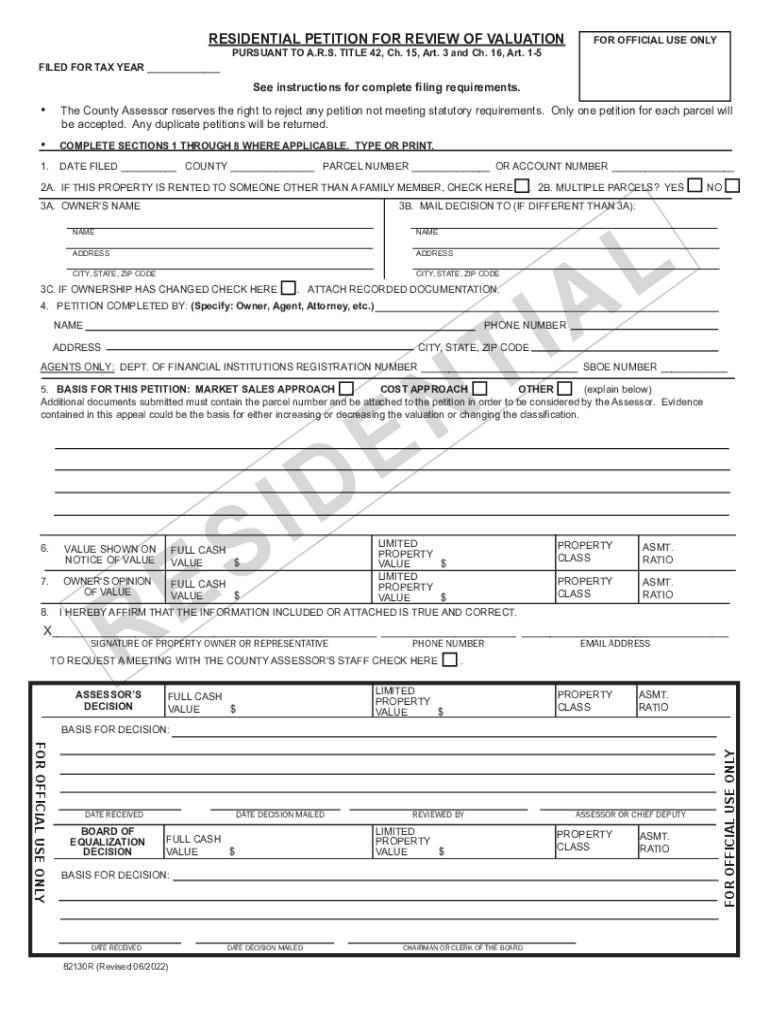

AZ 82130R - Yavapai County 2022 free printable template

Show details

INSTRUCTIONS RESIDENTIAL PETITION FOR REVIEW OF VALUATION Read these instructions before completing the petition. Remember to keep a copy of the form for your records. Use the Petition for Review

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ 82130R - Yavapai County

Edit your AZ 82130R - Yavapai County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ 82130R - Yavapai County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ 82130R - Yavapai County online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ 82130R - Yavapai County. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ 82130R - Yavapai County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ 82130R - Yavapai County

How to fill out AZ 82130R - Yavapai County

01

Obtain the AZ 82130R form from the Yavapai County website or office.

02

Fill in the applicant's name at the top of the form.

03

Provide the mailing address where correspondence should be sent.

04

Complete any required questions regarding the property's location and description.

05

Indicate the reason for submitting the form as per the instructions.

06

Sign and date the application at the bottom of the form.

07

Submit the completed form to the appropriate Yavapai County office either in person or via mail.

Who needs AZ 82130R - Yavapai County?

01

Individuals or entities looking to initiate a property tax exemption or review in Yavapai County.

02

Property owners who believe they are eligible for specific exemptions under Yavapai County guidelines.

03

Residents seeking information or adjustments to their property tax status.

Fill

form

: Try Risk Free

People Also Ask about

How is assessed value determined in Arizona?

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

What is the notice of value in Yavapai County?

The Notice of Value is the County's official declaration of Full Cash Value and Limited Property Value Assessments. Please note that only the Limited Property Value is used to calculate your property tax bill. By state statute, the Notice of Value must be mailed before March 1 of the year prior to the tax year.

How do I appeal a property tax assessment in Arizona?

Owner may file an appeal with the Court on changed assessment. Within 60 days of the date of mailing of the County Board decision, or within 60 days of the date of the State Board's written decision. A new Owner may file an appeal with the Court if the former Owner did not appeal.

Who determines the value of your property for the purposes of taxation in Arizona?

For additional information regarding the content herein, refer to Overview of the Arizona Property Tax System . The County Assessor is responsible for identifying, classifying, valuing, and assessing all property in the county in ance with state law.

What is Arizona notice of value?

The notification outlines the value the county assessor has established for your property for the current tax year and the future tax year.

What is Yavapai County assessment ratios?

Each class of property is assigned an assessment ratio, pursuant to state law, ranging from 1% to 18%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ 82130R - Yavapai County to be eSigned by others?

To distribute your AZ 82130R - Yavapai County, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit AZ 82130R - Yavapai County in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing AZ 82130R - Yavapai County and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit AZ 82130R - Yavapai County on an iOS device?

Use the pdfFiller mobile app to create, edit, and share AZ 82130R - Yavapai County from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is AZ 82130R - Yavapai County?

AZ 82130R - Yavapai County is a specific form used for reporting and remitting certain taxes in Yavapai County, Arizona. It may pertain to property tax assessments or related financial disclosures.

Who is required to file AZ 82130R - Yavapai County?

Individuals or entities who own property within Yavapai County and are subject to the relevant tax obligations are required to file AZ 82130R.

How to fill out AZ 82130R - Yavapai County?

To fill out AZ 82130R, taxpayers must provide required information about their property, including descriptions, assessed values, and any applicable exemptions. It's essential to follow the guidelines provided with the form carefully.

What is the purpose of AZ 82130R - Yavapai County?

The purpose of AZ 82130R - Yavapai County is to ensure accurate reporting of property values and tax liabilities to the Yavapai County authorities, facilitating the proper collection of taxes.

What information must be reported on AZ 82130R - Yavapai County?

The information that must be reported on AZ 82130R includes the property owner's name and contact information, property description, assessed value, tax exemptions, and any relevant additional details as mandated by local regulations.

Fill out your AZ 82130R - Yavapai County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ 82130r - Yavapai County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.