IRS 656-B 2019 free printable template

Instructions and Help about IRS 656-B

How to edit IRS 656-B

How to fill out IRS 656-B

About IRS 656-B 2019 previous version

What is IRS 656-B?

Who needs the form?

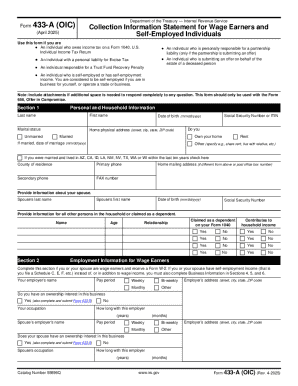

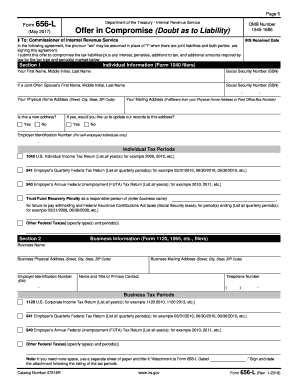

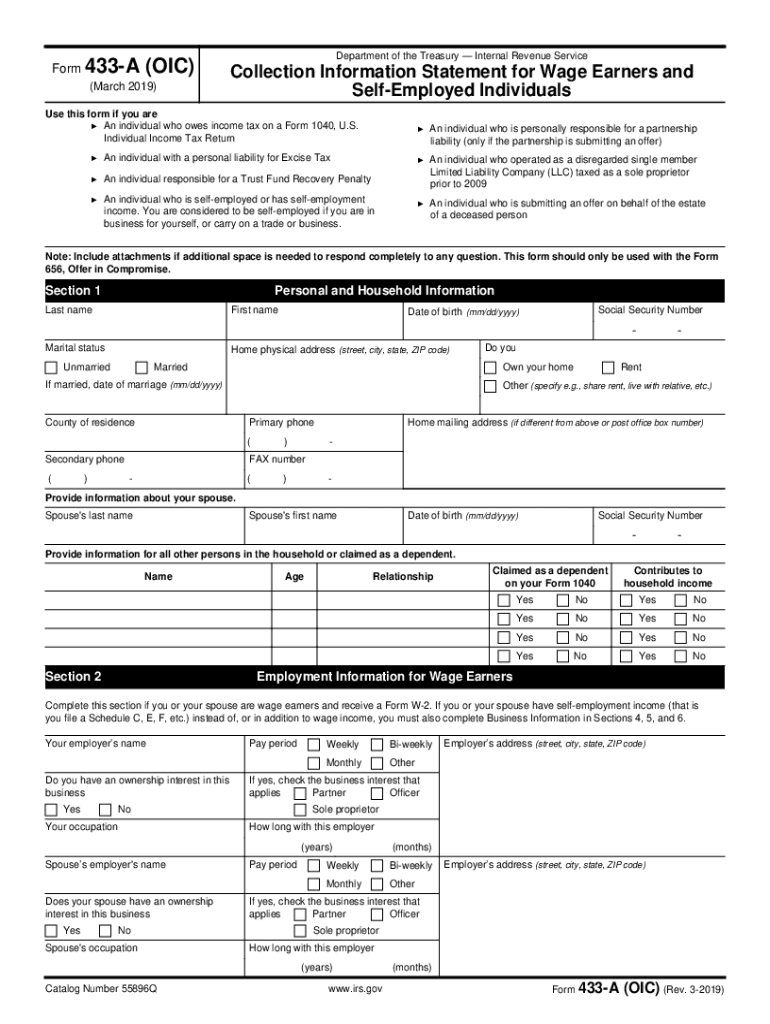

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 656-B

What should I do if I realize I've made a mistake on my form 656 irs after submitting it?

If you notice an error on your form 656 irs after submission, you should file an amended return. Inform the IRS of the mistake by submitting a corrected version of the form. This will help ensure that the IRS has accurate information on your file and can process your request correctly.

How can I verify if my form 656 irs has been received and is being processed?

To check the status of your form 656 irs, you can call the IRS toll-free number or visit their website. Provide the necessary details regarding your submission, such as your taxpayer identification number and the date you filed to expedite the process.

Are there any common errors that I should avoid when submitting form 656 irs?

Yes, one common error is failing to sign the form before submission. Ensure you review all entries for accuracy, including ensuring you provide all required information. Keeping copies of your documents can also help mitigate issues that may arise post-filing.

What if I receive a notice from the IRS after submitting form 656 irs?

If you receive a notice or letter from the IRS regarding your form 656 irs, carefully review the communication for specific instructions. In most cases, you may need to respond, provide additional documentation, or clarify certain information to resolve any pending issues.

What are the technical requirements for e-filing form 656 irs?

When e-filing form 656 irs, ensure that you are using compatible software or an IRS-approved e-filing program. Additionally, it’s advisable to use a secure internet connection and current web browsers to maintain data privacy and security during the submission process.

See what our users say