IRS 656-B 2022 free printable template

Instructions and Help about IRS 656-B

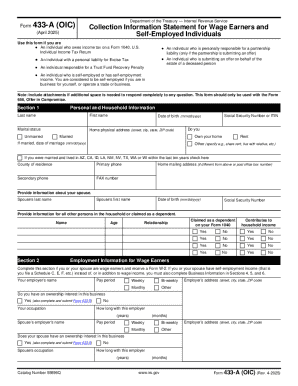

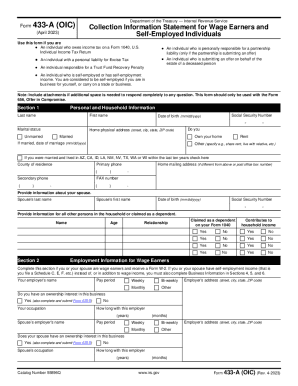

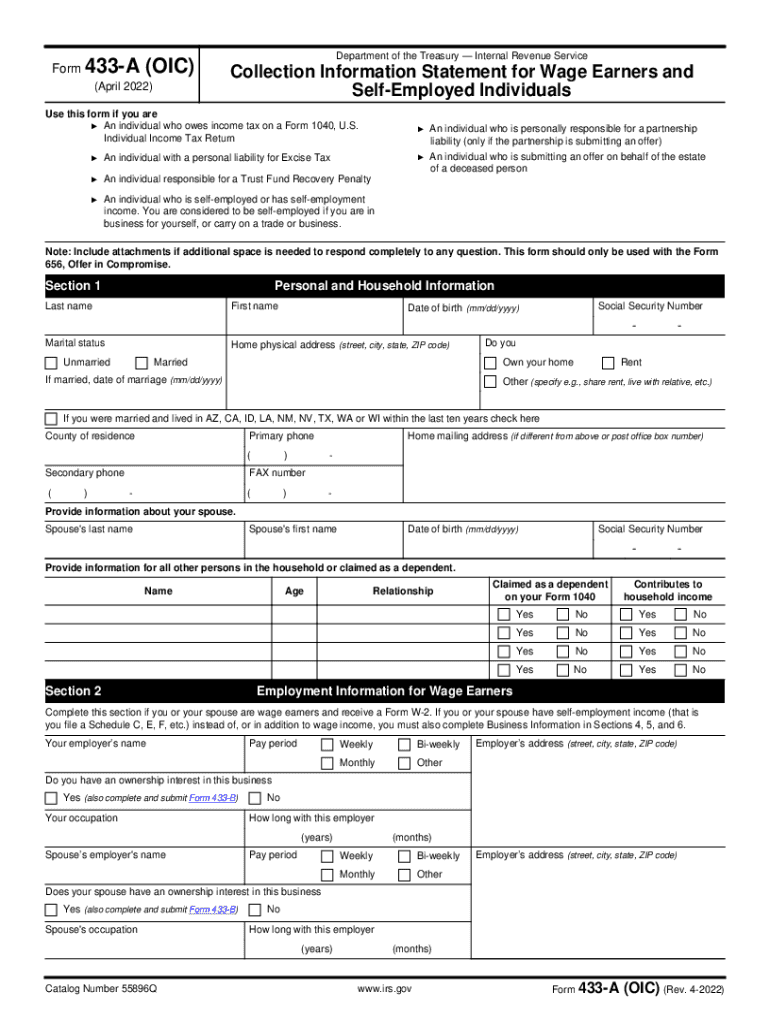

How to edit IRS 656-B

How to fill out IRS 656-B

About IRS 656-B 2022 previous version

What is IRS 656-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 656-B

What should I do if I realize I made an error after filing my compromise?

If you discover an error after submitting your compromise, you can typically submit an amended or corrected form. Ensure you clearly indicate the revisions and provide any necessary supporting documentation. It’s crucial to keep copies of all submissions for your records.

How can I verify the status of my compromise submission?

To verify your compromise submission status, you may check online through the designated portal or contact the relevant agency directly. Be prepared to provide identifying information to facilitate the tracking process.

Are there any special considerations for filing a compromise on behalf of someone else?

When filing a compromise on behalf of another individual, ensure you have proper authorization, such as a Power of Attorney (POA). Additionally, you must include any required documentation proving your authority to act on their behalf.

What common errors should I avoid when filing a compromise?

Common errors in filing a compromise include incorrect taxpayer identification numbers, miscalculating amounts, and failing to sign the form. Double-check all fields for accuracy before submission to minimize the risk of rejection or delays.

See what our users say