Get the free Tax Delinquent Property and Land SalesAlabama ...

Show details

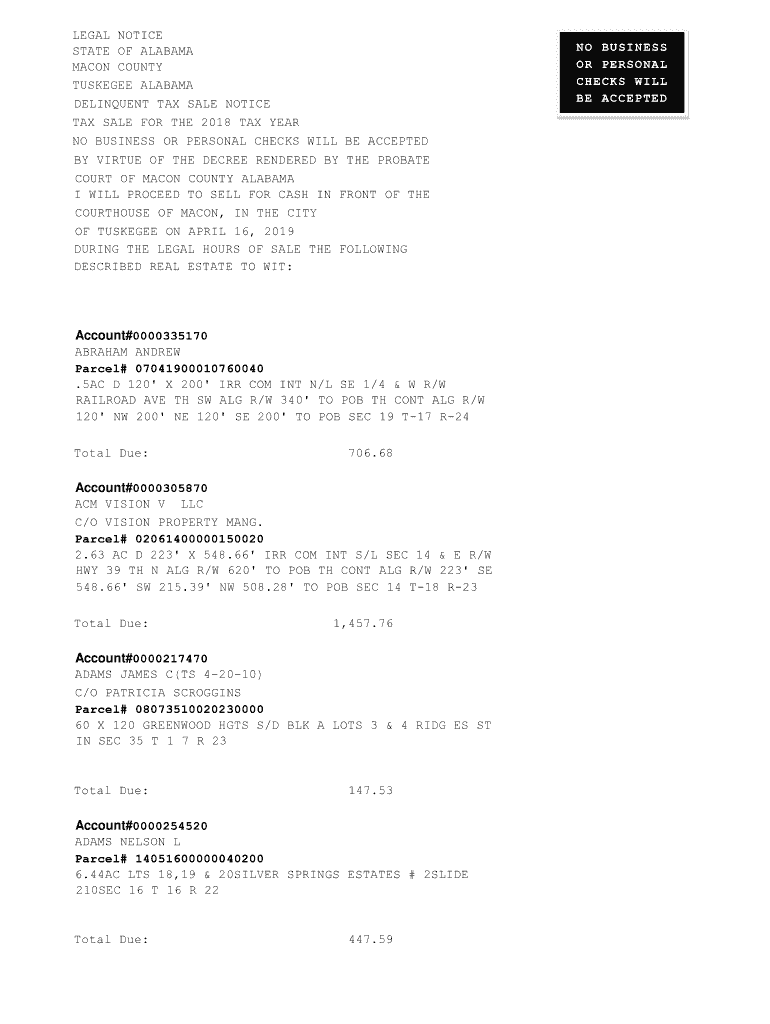

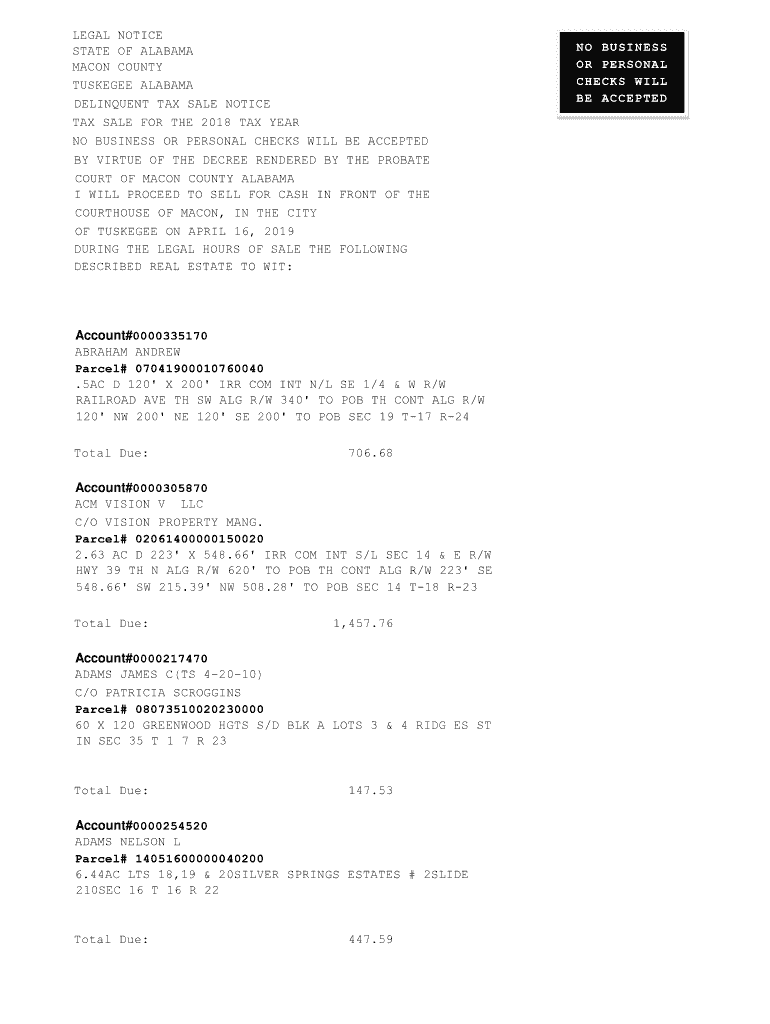

LEGAL NOTICE

STATE OF ALABAMA

MACON COUNTY

TUSKEGEE ALABAMA

DELINQUENT TAX SALE NOTICE

TAX SALE FOR THE 2018 TAX YEAR

NO BUSINESS OR PERSONAL CHECKS WILL BE ACCEPTED

BY VIRTUE OF THE DECREE RENDERED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax delinquent property and

Edit your tax delinquent property and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax delinquent property and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax delinquent property and online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax delinquent property and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax delinquent property and

How to fill out tax delinquent property and

01

Step 1: Gather all relevant documents and information related to the tax delinquent property, such as property identification number, tax assessment documents, and previous tax payment records.

02

Step 2: Determine the specific procedure and requirements for filling out tax delinquent property forms. This may vary depending on the country or state you are in.

03

Step 3: Fill out the necessary forms accurately and completely. Provide all requested information, including property details, ownership information, and any outstanding tax amounts.

04

Step 4: Attach any supporting documentation required, such as proof of previous tax payments or any relevant correspondence with tax authorities.

05

Step 5: Double-check all the filled forms and supporting documents for accuracy and completeness. Make sure all required fields have been filled correctly and all necessary attachments are included.

06

Step 6: Submit the completed forms and supporting documents to the appropriate tax authorities or relevant department designated for tax delinquent properties.

07

Step 7: Keep copies of all submitted documents for your records and follow up with the tax authorities or department within the specified timeframe to ensure the processing of your application.

Who needs tax delinquent property and?

01

Investors: Investors who are looking for potential properties to purchase at a discounted price may be interested in tax delinquent properties. These properties are often sold at auctions or through special sales to recover unpaid taxes.

02

Real Estate Developers: Developers who specialize in renovating or rebuilding distressed properties may see tax delinquent properties as opportunities for redevelopment.

03

Financial Institutions: Banks or other financial institutions may have an interest in tax delinquent properties if they hold mortgages or liens on these properties and want to recover their debts.

04

Governments: Local governments may be interested in tax delinquent properties to either collect unpaid taxes or to repurpose the properties for public use.

05

Individuals: Some individuals may seek tax delinquent properties as a means of finding affordable housing or investment opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax delinquent property and from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like tax delinquent property and, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the tax delinquent property and electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your tax delinquent property and in seconds.

How do I fill out tax delinquent property and on an Android device?

On an Android device, use the pdfFiller mobile app to finish your tax delinquent property and. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is tax delinquent property?

Tax delinquent property is real estate that has unpaid property taxes and is at risk of being seized and sold by the government to recover the owed taxes.

Who is required to file tax delinquent property?

Property owners who have not paid their property taxes are required to file tax delinquent property.

How to fill out tax delinquent property?

To fill out tax delinquent property, property owners must provide information about the property, the amount owed in taxes, and any attempts made to pay the taxes.

What is the purpose of tax delinquent property?

The purpose of tax delinquent property is to ensure that property owners pay their property taxes in a timely manner to fund local government services and infrastructure.

What information must be reported on tax delinquent property?

Property owners must report the property address, tax assessment information, amount owed in taxes, and any payment history.

Fill out your tax delinquent property and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Delinquent Property And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.