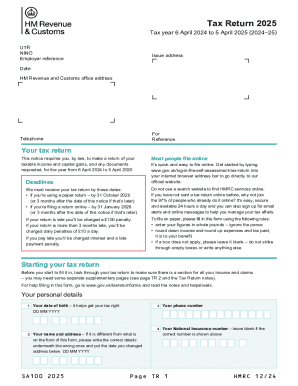

UK Form SA100 2019 free printable template

Show details

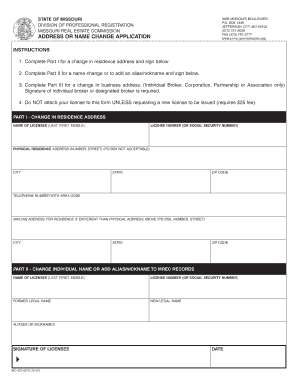

Important information to include on your tax return before sending it to us. Please make sure you include your: 10digit Unique Taxpayer Reference (UTC) National Insurance number (NIÑO) employer reference

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK Form SA100

Edit your UK Form SA100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Form SA100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Form SA100 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK Form SA100. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form SA100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Form SA100

How to fill out UK Form SA100

01

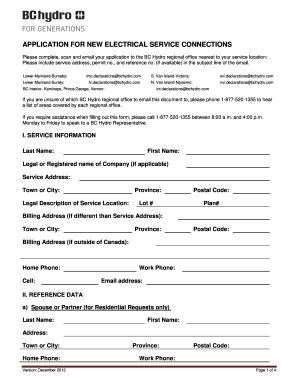

Begin by downloading the UK Form SA100 from the HMRC website or accessing it through your online account.

02

Fill in your personal details at the top of the form, including your name, address, and Unique Taxpayer Reference (UTR).

03

Indicate your employment status, including any self-employment income.

04

Report your income sources in Section 4, including PAYE income, rental income, dividends, etc.

05

Deduct any allowable expenses related to your self-employment or other income sources in Section 5.

06

Move on to Section 6 and declare any tax reliefs and allowances you are entitled to.

07

In Section 8, calculate your total income and taxable income.

08

Review the declarations and sign the form, confirming that the information provided is accurate.

09

Submit the completed form online or by post to HMRC before the deadline.

Who needs UK Form SA100?

01

Individuals who are self-employed and need to report their income.

02

People who have additional income outside of their regular employment.

03

Landlords who receive rental income from properties.

04

Individuals earning over a certain threshold who need to file a tax return.

05

Those who received income from savings, investments, or dividends.

Fill

form

: Try Risk Free

People Also Ask about

Can I look up my 1040 online?

You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

How do I get a copy of my 1040 form?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return.

How do I see previous tax returns?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How can I get my tax transcript online immediately online?

How to access IRS transcripts online You must register or log in to your IRS Online Account. After signing in, click "Get Transcript Online" here. Pick a reason from the drop-down menu. Select your IRS transcript by year and download the pdf.

How do I download my tax return?

To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2022, the IRS charges $43 for each return you request.

How do I find my tax return documents?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

Can I download a 1040 tax form?

You can e-file directly to the IRS and download or print a copy of your tax return.

What is self assessment tax?

Self-assessment tax means balance tax payable that an assessee pays after deducting Advance Tax, TDS/TCS, MAT/AMT and other eligible deductible credits. Advance tax is a payment of an individual's tax liability which is required to be paid in advance at specified intervals during the same financial year.

Can I download a short tax return form?

Only fill in the short tax return (SA200) if HMRC sends it to you. You can not download it, but you can read the guidance notes (external link) .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in UK Form SA100?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your UK Form SA100 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the UK Form SA100 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your UK Form SA100 and you'll be done in minutes.

How do I fill out UK Form SA100 using my mobile device?

Use the pdfFiller mobile app to complete and sign UK Form SA100 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is UK Form SA100?

UK Form SA100 is the Self Assessment tax return form used by individuals in the UK to report their income and capital gains, and to claim tax allowances and reliefs.

Who is required to file UK Form SA100?

Individuals who are self-employed, have other sources of income, or whose income exceeds certain thresholds are required to file UK Form SA100.

How to fill out UK Form SA100?

To fill out UK Form SA100, individuals must provide personal information, details of income, any capital gains, and claim any tax reliefs and allowances applicable, ensuring all sections of the form are completed accurately.

What is the purpose of UK Form SA100?

The purpose of UK Form SA100 is to calculate and report an individual's tax liability to HM Revenue and Customs (HMRC) so that the correct amount of tax can be paid.

What information must be reported on UK Form SA100?

Information that must be reported on UK Form SA100 includes personal details, total income, business income (if applicable), capital gains, tax relief claims, and other deductions.

Fill out your UK Form SA100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form sa100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.