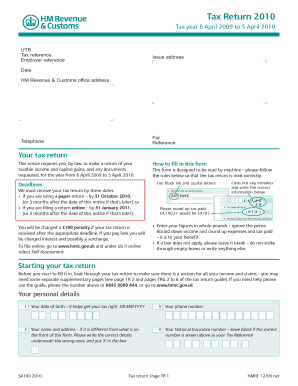

UK Form SA100 2023 free printable template

Show details

If you pay late you ll be charged interest and a late SA100 signed on behalf of someone else enter 23 If you ve DD MM YYYY Your Date Postcode Your date of birth it helps get your tax right the capacity. For example executor receiver put X in the box Starting your tax return theit you have signed for you the tooffill in look Your National Insurance number leave blank if the above personal details and any supplementary pages isnumber correct and complete is shown Date DD MM YYYY if TR a box...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self assessment tax return

Edit your self assessment tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self assessment tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self assessment tax return online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self assessment tax return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form SA100 Form Versions

Version

Form Popularity

Fillable & printabley

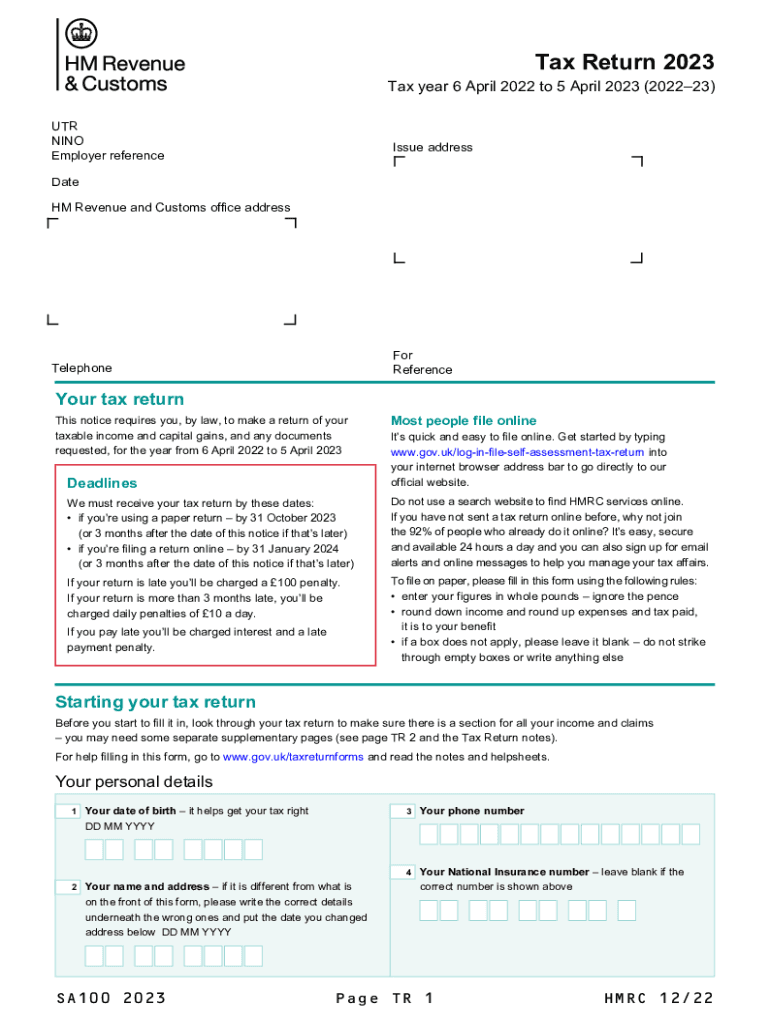

How to fill out self assessment tax return

How to fill out UK Form SA100

01

Obtain a copy of the UK Form SA100 from the HMRC website or your tax office.

02

Enter your personal details including your name, address, and National Insurance number at the beginning of the form.

03

Fill in the 'Income' section with details about your earnings, including employment income, self-employment income, and any other sources of income.

04

Complete the 'Deductions' section if applicable, which may include expenses related to your self-employment or pension contributions.

05

If you are claiming any allowances or reliefs, provide the necessary information in the respective sections.

06

Review the 'Tax Calculation' section to determine how much tax you owe or your potential refund.

07

Sign and date the form before submitting it to HMRC by the deadline.

Who needs UK Form SA100?

01

Individuals who are self-employed in the UK.

02

People who receive income that is not taxed at source, such as rental income.

03

Anyone who has income from sources that require them to file a self-assessment tax return.

04

Individuals who have capital gains that exceed the annual exempt amount.

Instructions and Help about self assessment tax return

USB SMS m 100 SMS SA 100 Bluetooth m 100 RCA 9 Bluetooth SA 100 USB m 100 Bluetooth me name me tan tap them Nana USB EME me ANE tan tan tan c me aux Bluetooth 1 1 treble Bluetooth USB m 100 m 100 SA 100 SMS BGM Bluetooth USB 1 hi-fi USB Bluetooth BGM SA 100 Amazon Prime music good voodoo

Fill

form

: Try Risk Free

People Also Ask about

What is self employment form called?

More In Forms and Instructions Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

How do I know which tax form to use?

Key Takeaways. Form 1040 is the standard tax return form that most individual taxpayers use every year. The IRS no longer accepts Forms 1040-EZ or Form 1040-A for tax years 2018 and beyond, which means most taxpayers must use Form 1040 to complete their tax returns.

Which tax form do I use?

Form 1040 is the standard tax return form that most individual taxpayers use every year.

How do I get a copy of my full tax return?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Should I use 1040 or 1040EZ?

You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. If your situation has changed this year, it may be to your advantage to file a Form 1040 instead.

What is the SA100?

The SA100 is the main tax return for individuals. Use it to file your tax return for: student loan repayments. interest and dividends. UK pensions and annuities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self assessment tax return for eSignature?

Once your self assessment tax return is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I fill out self assessment tax return on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your self assessment tax return, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit self assessment tax return on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share self assessment tax return on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is UK Form SA100?

UK Form SA100 is the official tax return form used by individuals in the UK to report their income and calculate their tax liability for a given tax year.

Who is required to file UK Form SA100?

Individuals who earn income above the personal allowance threshold, are self-employed, receive rental income, or have other taxable income sources are required to file UK Form SA100.

How to fill out UK Form SA100?

To fill out UK Form SA100, gather all necessary income information, complete each section of the form with accurate details regarding income, deductions, and personal information, and finally submit the form by the deadline to HM Revenue and Customs (HMRC).

What is the purpose of UK Form SA100?

The purpose of UK Form SA100 is to declare income for tax purposes, calculate the amount of tax owed, and ensure compliance with tax regulations in the UK.

What information must be reported on UK Form SA100?

Information that must be reported on UK Form SA100 includes personal details, income from employment, self-employment, property income, savings interest, dividends, and any tax relief claims or allowances.

Fill out your self assessment tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Assessment Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.