UK Form SA100 2021 free printable template

Show details

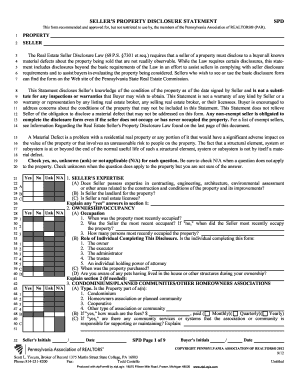

I declare that the information given 25 If you filled in boxes 23 and 24 enter your name DD MM YYYY United Kingdom official is correctinterest and complete If any pay late you llpages and a late SA100 2019 if a box does not apply Page TR We must these 12/18 blankyour thepayment best of my knowledge and belief. penalty. For example executor receiver late you ll be charged interest and a late SA100 Date DD MM YYYY personal details Postcode If you re enclosing separate supplementary pages put X...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self assessment tax return

Edit your self assessment tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self assessment tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self assessment tax return online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self assessment tax return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form SA100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out self assessment tax return

How to fill out UK Form SA100

01

Obtain the SA100 form from the HM Revenue and Customs (HMRC) website or request a paper form.

02

Fill in your personal details, including your name, address, and Unique Taxpayer Reference (UTR).

03

Provide details of your income, including employment, self-employment, and any other sources such as rental income or dividends.

04

Declare any tax reliefs or deductions you are eligible for, such as pension contributions or charity donations.

05

Complete the supplementary pages if you have specific types of income, like foreign income or capital gains.

06

Review all the information for accuracy and completeness.

07

Submit the form electronically through the HMRC online service or send it by post before the deadline.

Who needs UK Form SA100?

01

Individuals who are self-employed and need to report their income.

02

People who have additional income outside of their regular employment, such as rental income.

03

Individuals who are directors of a company and need to report their earnings.

04

Those who received income from trusts, estates, or partnerships.

Instructions and Help about self assessment tax return

USB SMS m 100 SMS SA 100 Bluetooth m 100 RCA 9 Bluetooth SA 100 USB m 100 Bluetooth me name me tan tap them Nana USB EME me ANE tan tan tan c me aux Bluetooth 1 1 treble Bluetooth USB m 100 m 100 SA 100 SMS BGM Bluetooth USB 1 hi-fi USB Bluetooth BGM SA 100 Amazon Prime music good voodoo

Fill

form

: Try Risk Free

People Also Ask about

What is self employment form called?

More In Forms and Instructions Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

How do I know which tax form to use?

Key Takeaways. Form 1040 is the standard tax return form that most individual taxpayers use every year. The IRS no longer accepts Forms 1040-EZ or Form 1040-A for tax years 2018 and beyond, which means most taxpayers must use Form 1040 to complete their tax returns.

Which tax form do I use?

Form 1040 is the standard tax return form that most individual taxpayers use every year.

How do I get a copy of my full tax return?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Should I use 1040 or 1040EZ?

You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. If your situation has changed this year, it may be to your advantage to file a Form 1040 instead.

What is the SA100?

The SA100 is the main tax return for individuals. Use it to file your tax return for: student loan repayments. interest and dividends. UK pensions and annuities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my self assessment tax return directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign self assessment tax return and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify self assessment tax return without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including self assessment tax return, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit self assessment tax return on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as self assessment tax return. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is UK Form SA100?

UK Form SA100 is the Self Assessment tax return used by individuals in the UK to report their income, capital gains, and claim tax reliefs.

Who is required to file UK Form SA100?

Individuals who are self-employed, those who have income from property, dividends, or savings over a certain threshold, and anyone who received taxable income exceeding their Personal Allowance are required to file UK Form SA100.

How to fill out UK Form SA100?

To fill out UK Form SA100, gather all relevant income and expense information, complete the sections related to your income sources, provide personal information, and submit it online or by post to HM Revenue and Customs (HMRC) by the deadline.

What is the purpose of UK Form SA100?

The purpose of UK Form SA100 is to report an individual's taxable income to HMRC for calculating the amount of tax owed or any potential tax refunds.

What information must be reported on UK Form SA100?

The information that must be reported on UK Form SA100 includes personal details, income from various sources (such as employment, self-employment, dividends, property income), capital gains, and any claimed deductions or tax reliefs.

Fill out your self assessment tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Assessment Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.