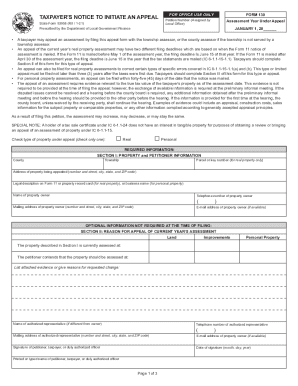

IN State Form 53958 2018 free printable template

Get, Create, Make and Sign indiana local government finance

How to edit indiana local government finance online

Uncompromising security for your PDF editing and eSignature needs

IN State Form 53958 Form Versions

How to fill out indiana local government finance

How to fill out IN State Form 53958

Who needs IN State Form 53958?

Instructions and Help about indiana local government finance

The dot Motor Vehicle Division is getting Arizona out of line and safely on the road by creating more digital service options one of those options is e title which allows you to do secure title transfers on a desktop or mobile device you don't have to come to an MV D office a title also reduces the risk of title fraud by utilizing a secure online process instead of paper in this initial phase there are limitations on the electronic transfers for example the vehicle must have an Arizona title and current Arizona registration it must be a passenger vehicle and a one owner — one owner transfer a complete list of requirements can be found on our website a ZO t gov e title assuming the transfer requirements are met to get started the buyer and seller should each establish an AZ MVD now account if they don't already have one acts as a Z M V D now through service Arizona com a title takes just a few minutes but for security reasons the process must be completed within 24 hours if you go past that the e title process will be discontinued, and you'll need to start over or go to an M VD or authorize third party office now here's how it works the seller will select and confirm the vehicle title being transferred utilizing AZ MVD now the buyer will generate a random code and give it to the seller this ensures that personal information isn't exchanged the buyer than waits for the seller to proceed the seller will fill out legally required odometer information and using the buyer code transmit the vehicle information to the buyer once the buyer reviews the information and decides to move forward the buyer hits continue and the seller will be prompted to finalize the title transfer the seller will either decide to release their ownership or choose to cancel but if a title transfer proceeds the seller will be asked twice to confirm once confirmed the buyer is notified that ownership has been released to him or her and the seller has finished the buyer finalizes the transfer by paying title and registration fees online to MVD it's important to do this immediately in order to avoid potential penalties with a transfer complete the buyer will receive and should print a temporary registration and the temporary paper license plate to be displayed on the vehicle until the permanent plate is sent to the buyers home and finally the seller should destroy the old paper title a few other notes MVD does not have any role in the actual sale of the vehicle that's up to the parties involved this transaction is for a title transfer only if for some reason you need a paper title such as moving to another state you can get one at an MVD or authorized third-party office eat idle simple convenient and ahead of the curve with innovation it's another way MID gets you out of line and safely on the road

People Also Ask about

What property tax exemptions are available in Indiana?

What is fair market value?

What is fair value or appraised value?

How do I find the assessed value of my property in Indiana?

How long does a homeowner have to file an objective appeal in Indiana?

What type of value is generally greater than the assessed value?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit indiana local government finance from Google Drive?

How do I execute indiana local government finance online?

How do I make changes in indiana local government finance?

What is IN State Form 53958?

Who is required to file IN State Form 53958?

How to fill out IN State Form 53958?

What is the purpose of IN State Form 53958?

What information must be reported on IN State Form 53958?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.