AZ ADOR A1-QRT 2018 free printable template

Show details

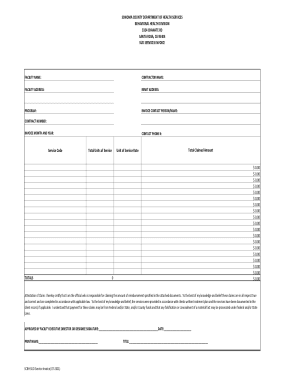

Arizona FormA1QRTArizona Quarterly Withholding Tax Return DO NOT file more than one original A1QRT per EIN per quarter.

View Instructions

Part 1NameTaxpayer InformationEmployer Identification Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ ADOR A1-QRT

Edit your AZ ADOR A1-QRT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ ADOR A1-QRT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ ADOR A1-QRT online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AZ ADOR A1-QRT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR A1-QRT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ ADOR A1-QRT

How to fill out AZ ADOR A1-QRT

01

Obtain the AZ ADOR A1-QRT form from the Arizona Department of Revenue website or your local office.

02

Fill out the top section with your business name, address, and identification number.

03

Indicate the reporting period for which you are filing.

04

Complete the income section by providing total sales and any exempt sales.

05

Calculate the sales tax due based on the rates applicable to your sales.

06

Include any prepayments made and other credits that apply.

07

Determine the total amount due and enter it in the appropriate field.

08

Sign and date the form at the bottom to certify that the information provided is accurate.

09

Submit the completed form by the due date via mail or online, if available.

Who needs AZ ADOR A1-QRT?

01

Businesses that are registered for sales tax in Arizona and need to report their quarterly sales and remit taxes collected to the Arizona Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What form is Arizona tax withholding 2023?

Arizona employees must submit Form A-4, Employee's Arizona Withholding Election, to their employers for 2023. The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828.

What Arizona state tax form should I use?

Common Arizona Income Tax Forms & Instructions The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Does Arizona have a state withholding form?

The employee should complete Form A-4 electing their withholding percentage and return it to the employer. Arizona law requires every employer to withhold Arizona income tax from those employees for services provided within Arizona.

What is an A1 QRT form?

Employers that remit Arizona income tax on any of the following schedules must file Form A1-QRT to reconcile their withholding deposits for the calendar quarter: • Quarterly • Monthly • Semi-weekly • Next day Form A1-QRT is also used as: • The payment transmittal form for payments made on a quarterly basis when those

What is the Arizona withholding form for 2023?

Arizona employees must submit Form A-4, Employee's Arizona Withholding Election, to their employers for 2023. The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828.

What is an A1 QRT?

Arizona Quarterly Withholding Tax Return A1-QRT.

What should I withhold for Arizona state taxes?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

How do I file an extension for Arizona state taxes?

You have the follow two options to file a AZ tax extension: Pay all or some of your Arizona income taxes online via: AZTaxes and select "204" as your payment type. Complete Form 204, include a Check or Money Order, and mail both to the address on Form 204.

What percentage should I withhold for Arizona taxes?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

How do I choose my Arizona tax withholding?

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ ADOR A1-QRT to be eSigned by others?

To distribute your AZ ADOR A1-QRT, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute AZ ADOR A1-QRT online?

pdfFiller has made it easy to fill out and sign AZ ADOR A1-QRT. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit AZ ADOR A1-QRT online?

With pdfFiller, the editing process is straightforward. Open your AZ ADOR A1-QRT in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is AZ ADOR A1-QRT?

AZ ADOR A1-QRT is a form used by the Arizona Department of Revenue for reporting transactions, specifically for those related to sales tax and various business activities.

Who is required to file AZ ADOR A1-QRT?

Businesses in Arizona that are engaged in sales, lease, or rental of tangible personal property, or who provide taxable services are required to file the AZ ADOR A1-QRT.

How to fill out AZ ADOR A1-QRT?

To fill out the AZ ADOR A1-QRT, you should gather all relevant sales data, including gross sales and applicable exemptions, then accurately complete the form with the appropriate financial figures as instructed in the form's guidelines.

What is the purpose of AZ ADOR A1-QRT?

The purpose of AZ ADOR A1-QRT is to collect detailed sales information that helps the state assess sales tax owed and ensure compliance with tax reporting regulations.

What information must be reported on AZ ADOR A1-QRT?

The AZ ADOR A1-QRT must report information such as gross sales, taxable sales, exemptions claimed, and sales tax collected during the reporting period.

Fill out your AZ ADOR A1-QRT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ ADOR a1-QRT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.