AZ ADOR A1-QRT 2020 free printable template

Show details

Arizona FormA1QRTArizona Quarterly Withholding Tax Return DO NOT file more than one original A1QRT per EIN per quarter.

View Instructions

Part 1NameTaxpayer InformationEmployer Identification Number

pdfFiller is not affiliated with any government organization

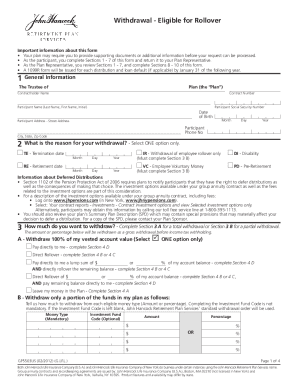

Get, Create, Make and Sign AZ ADOR A1-QRT

Edit your AZ ADOR A1-QRT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ ADOR A1-QRT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ ADOR A1-QRT online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ ADOR A1-QRT. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR A1-QRT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ ADOR A1-QRT

How to fill out AZ ADOR A1-QRT

01

Obtain the AZ ADOR A1-QRT form from the Arizona Department of Revenue website or your local tax office.

02

Begin with entering your personal information, including your name, address, and taxpayer identification number.

03

Specify the tax period for which you are filing the form.

04

Fill out the sections related to any taxable sales you made during the reporting period.

05

Calculate the total sales and the applicable tax due based on your reported sales.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form before submitting it to the Arizona Department of Revenue.

Who needs AZ ADOR A1-QRT?

01

Business owners in Arizona who collect transaction privilege tax (TPT) must file the AZ ADOR A1-QRT.

02

Companies involved in sales activities in Arizona where tax reporting is necessary.

Fill

form

: Try Risk Free

People Also Ask about

How far back can Arizona audit your taxes?

An audit generally covers the most recent four-year period. However, if tax returns have not been filed, the statute of limitations may be longer. This will result in the audit period extending beyond four years, but not to exceed seven years.

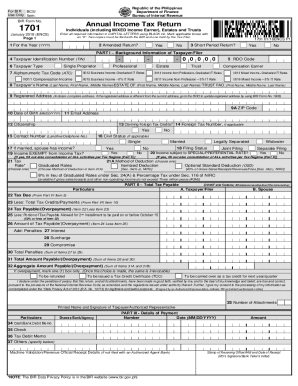

What is form A1-QRT?

Employers must reconcile the amounts withheld during the quarter to the amounts paid during the quarter. Form A1-QRT is filed for this purpose. Form A1-QRT is also used as: • The payment transmittal form for payments made on a. quarterly basis when those payments are made by check or.

How do I know if I owe state taxes in Arizona?

Arizona Individual Income Tax Refund Inquiry (602) 255-3381 (in Phoenix) or. 1-800-352-4090 (toll-free statewide, outside of Maricopa County)

What is Form a1r?

Arizona Withholding Reconciliation Tax Return Instructions (A1-R) – Department of Revenue Government Form in Arizona – Formalu.

What does Arizona Department of Revenue do?

The mission of the Arizona Department of Revenue is to Serve Taxpayers! Tax laws that fall under the Department's purview are primarily in the areas of income, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance.

Why would the Arizona Department of Revenue send me a letter?

A tax correction notice (TCN) is a correspondence letter sent by the Arizona Department of Revenue to inform taxpayers of important account matters or changes. For transaction privilege tax, the tax rate is the rate at which business activity is taxed.

What is form a1r?

Arizona Withholding Reconciliation Tax Return Instructions (A1-R) – Department of Revenue Government Form in Arizona – Formalu.

What is Arizona Department of Revenue Education and Compliance?

Tax Education and Compliance—The Department is responsible for ensuring compliance with Arizona tax laws, department regulations, and policies through education, auditing and assessing, and collections and enforcement activities.

What is Arizona Form A1-QRT?

Used by employers to reconcile the amount(s) of Arizona income tax withheld and deposited with the Department of Revenue. This form must be completed and filed 4 times a year, April 30, July 31, October 31, and January 31 of the following year. A1-QRT. Withholding Forms.

Where do I send my Arizona state taxes to?

1600 W. Monroe St. Include the payment with the TPT return, or if paying separately mail with a tax payment voucher. Make check payable to Arizona Department of Revenue and include your TPT license number and tax period on your payment.

Where do I file an amended A1-QRT?

You may use a Payroll Service Company (PSC) to file your Form A1-QRT. If you use a PSC, that company must file your A1-QRT electronically. For Arizona income tax withholding purposes, several deposit schedules may apply.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AZ ADOR A1-QRT in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing AZ ADOR A1-QRT and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out AZ ADOR A1-QRT on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your AZ ADOR A1-QRT. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit AZ ADOR A1-QRT on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as AZ ADOR A1-QRT. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is AZ ADOR A1-QRT?

AZ ADOR A1-QRT is a tax form used in Arizona for reporting withholding tax information.

Who is required to file AZ ADOR A1-QRT?

Employers who withhold Arizona state income tax from their employees' wages are required to file AZ ADOR A1-QRT.

How to fill out AZ ADOR A1-QRT?

To fill out AZ ADOR A1-QRT, employers must provide their identification information, report the amounts of state tax withheld, and follow the instructions stipulated by the Arizona Department of Revenue.

What is the purpose of AZ ADOR A1-QRT?

The purpose of AZ ADOR A1-QRT is to ensure accurate reporting and remittance of state withholding taxes to the Arizona Department of Revenue.

What information must be reported on AZ ADOR A1-QRT?

The information that must be reported on AZ ADOR A1-QRT includes the employer's details, employee wages, amounts withheld, and any applicable adjustments.

Fill out your AZ ADOR A1-QRT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ ADOR a1-QRT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.