Get the free CapAlt's RAQ for Business w editable fields v 26 (2).docx

Show details

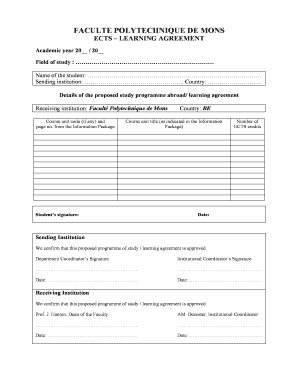

RISK ASSESSMENT Questionnaire For Insurable Business Risks Bundled Coverages1155 Mt. Vernon Hwy NE, Suite 800, Atlanta, GA 30338 P: 4048236200 F: 4048457866CAPTIVEALTERNATIVES. Comprise Assessment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capalts raq for business

Edit your capalts raq for business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capalts raq for business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capalts raq for business online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit capalts raq for business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capalts raq for business

How to fill out capalts raq for business

01

To fill out a capalts raq for business, follow these steps:

02

Start by gathering all the necessary information about your business, including its name, address, contact details, and legal structure.

03

Identify the type of business you have, such as sole proprietorship, partnership, corporation, or LLC.

04

Determine the fiscal year for which you are preparing the capalts raq.

05

Calculate your business's gross income for the fiscal year by adding up all the revenue it generated.

06

Deduct any allowable expenses from the gross income to calculate the net income.

07

Provide details about any capital assets your business owns, including their description, date of acquisition, cost, and accumulated depreciation.

08

Fill out the financial statement section, which includes information about your business's assets, liabilities, and equity.

09

Complete the tax computation section, where you calculate the tax payable based on the net income.

10

Make sure to include all necessary attachments, such as supporting documents, statements, and schedules.

11

Review the completed capalts raq form for accuracy and completeness before submitting it.

12

Submit the capalts raq form to the appropriate tax authority or follow the specified submission process.

13

Note: It is recommended to consult with a tax professional or accountant familiar with the local tax laws to ensure accurate completion of the capalts raq for business.

Who needs capalts raq for business?

01

Capalts raq for business is needed by any individual or entity running a business in a jurisdiction where it is required to file a capalts raq.

02

This includes sole proprietors, partnerships, corporations, limited liability companies (LLCs), and any other business structure recognized by the local tax authority.

03

Filing a capalts raq is mandatory for businesses to report their financial information and fulfill their tax obligations.

04

It allows the tax authority to assess the business's taxable income, determine the tax liability, and ensure compliance with the applicable tax regulations.

05

Businesses of all sizes, from small startups to large enterprises, may need to fill out a capalts raq depending on the local tax laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit capalts raq for business in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your capalts raq for business, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the capalts raq for business electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your capalts raq for business.

How do I fill out capalts raq for business using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign capalts raq for business and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is capalts raq for business?

Capalts raq is a form that businesses use to report their capital assets.

Who is required to file capalts raq for business?

Businesses that have capital assets are required to file capalts raq.

How to fill out capalts raq for business?

Capalts raq can be filled out by providing information about the business's capital assets, such as their value and depreciation.

What is the purpose of capalts raq for business?

The purpose of capalts raq is to help businesses keep track of their capital assets and report them accurately for tax purposes.

What information must be reported on capalts raq for business?

Businesses must report information such as the description, cost, date acquired, and depreciation of their capital assets on capalts raq.

Fill out your capalts raq for business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capalts Raq For Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.