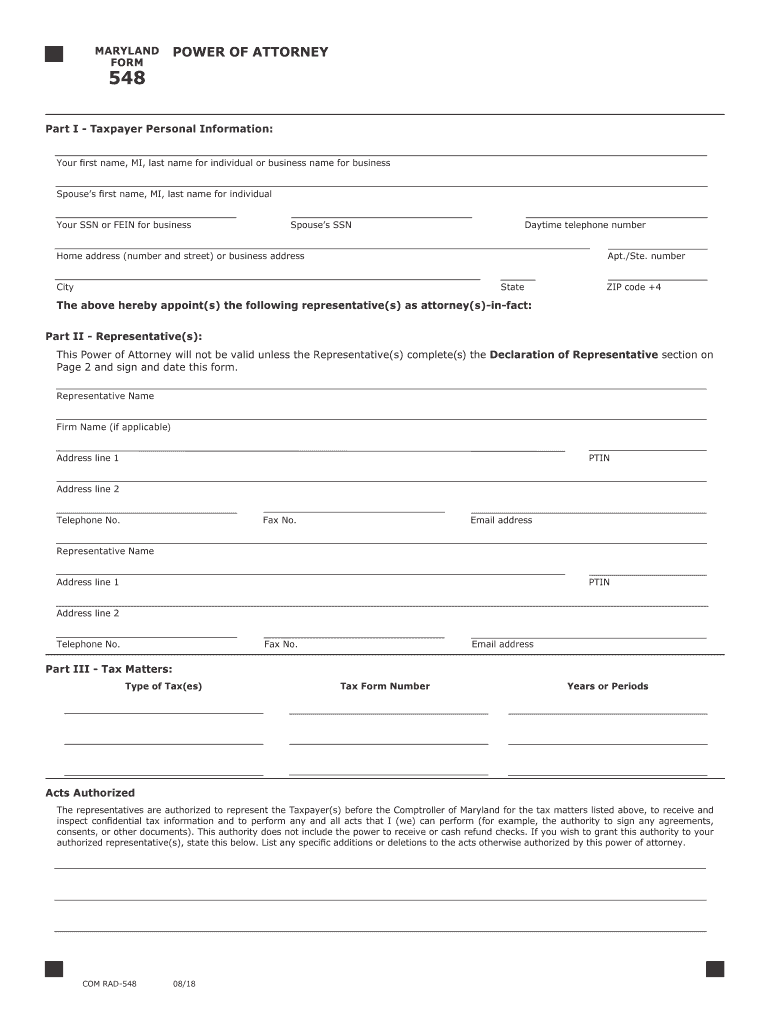

MD Form 548 2018 free printable template

Get, Create, Make and Sign 548 form

How to edit 548 form online

Uncompromising security for your PDF editing and eSignature needs

MD Form 548 Form Versions

How to fill out 548 form

How to fill out MD Form 548

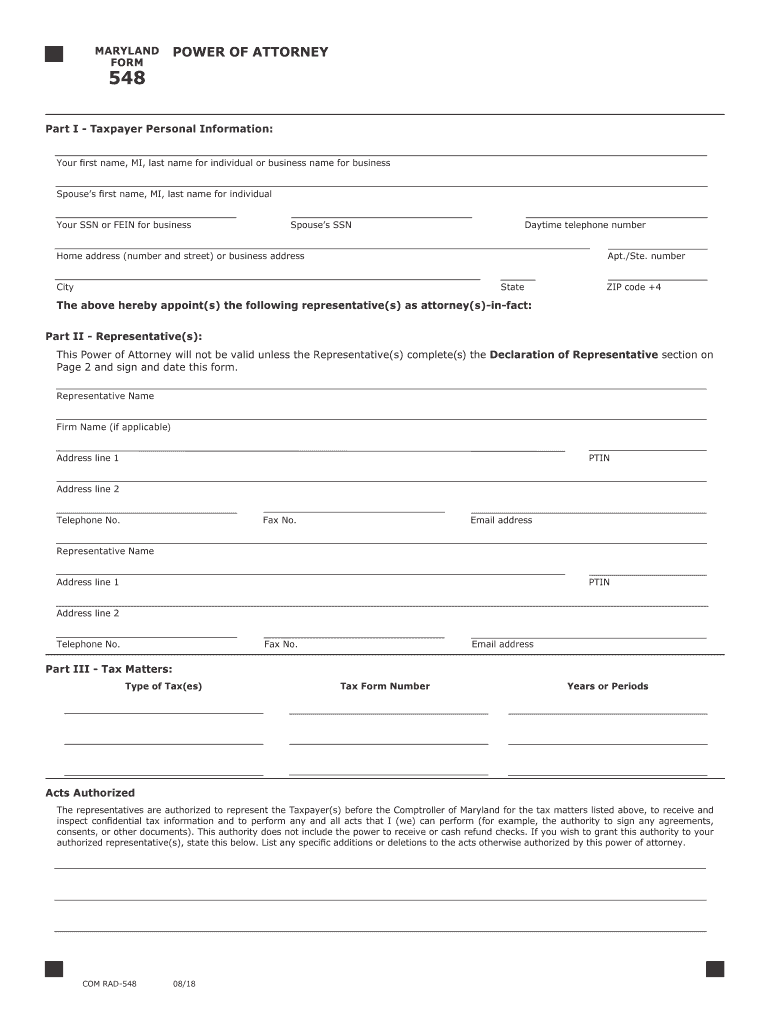

Who needs MD Form 548?

Instructions and Help about 548 form

The following information is provided for educational purposes only and in no way constitutes legal, tax, or financial advice. For legal, tax, or financial advice specific to your business needs, we encourage you to consult with a licensed attorney and/or CPA in your State. The following information is copyright protected. No part of this lesson may be redistributed, copied, modified or adapted without prior written consent of the author. As we mentioned earlier, there are ongoing requirements for your LLC with the State of Maryland. The first of these requirements is called the Annual Report, and the second requirement is filing your LLC's income taxes. These can be quit complicated and at the end of this Lesson we will recommend that you get help to file these forms. However, we want to give you an overview, so that you have a basic understanding of the requirements. In most states, the purpose of the Annual Report is to keep the State updated with your LLC's contact information. However, Maryland does things a little differently. Their Annual Report is called the Personal Property Tax Return, and it is used to tax personal property owned by the LLC. Personal property includes furniture, machinery, equipment, tools, fixtures, inventory, and anything else that is not real property. Real property refers real estate or land. Another way to think of personal property is anything that is not permanently attached to the ground. In order to file your Personal Property Tax Return, you will first list all of your LLC's personal property and its estimated value. Then you'll need to list your LLC's gross sales, as well as a balance sheet that shows your LLC's assets and liabilities. Once finalized, you will mail your Personal Property Tax Return to the State along with the Filing Fee. The Filing Fee and your Personal Property Tax Return must be filed every year by April 15th. You may also be charged an additional tax depending on the value of your LLC's personal property. If your LLC owes additional tax, the county will mail you a bill shortly after April 15th and tell you when this additional payment is due. Below this video, you will find the Filing Fee amount and the accepted forms of payment. If you don't file your Personal Property Tax Return before the April 15th deadline, the State will eventually dissolve (aka shut down) your LLC. The State takes this requirement seriously, so it's important that you file your Personal Property Tax Return on time every year. The State will mail you a notice each February reminding you to file by the April 15th deadline. However, we recommend that you keep a repeating reminder on your calendar in case you don't receive the State's reminder notice. We know that this information not only sounds confusing, but also sounds like a lot of work. The truth is — it is a lot of work. Determining your personal property depreciable value, commercial inventory, depreciation rates, total gross sales, and creating the balance...

People Also Ask about

Does Maryland accept form 2848?

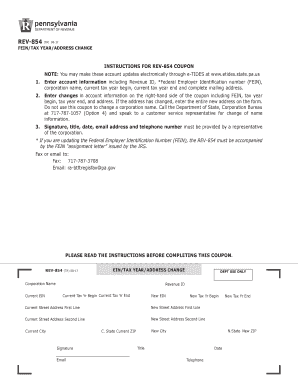

Where to fax md form 548?

How much does it cost to get a power of attorney in Maryland?

What is Maryland form 548?

What are the requirements for a power of attorney in Maryland?

How do I get power of attorney in MD?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 548 form to be eSigned by others?

Where do I find 548 form?

How do I complete 548 form on an Android device?

What is MD Form 548?

Who is required to file MD Form 548?

How to fill out MD Form 548?

What is the purpose of MD Form 548?

What information must be reported on MD Form 548?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.