TN SS-4461 2017-2025 free printable template

Show details

Instructions: Form SS4461

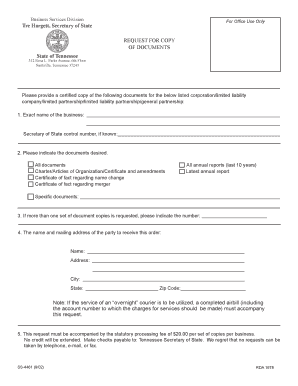

Request for Copy of DocumentsBusiness Services Division

TRE Largest, Secretary of State of TennesseeSubmission Options Request for Copy of Documents may be obtained using

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ss 4461 2017-2025 form

Edit your ss 4461 2017-2025 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ss 4461 2017-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ss 4461 2017-2025 form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ss 4461 2017-2025 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN SS-4461 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ss 4461 2017-2025 form

How to fill out TN SS-4461

01

Gather necessary personal information, including your name, address, and Social Security number.

02

Locate the form TN SS-4461 online or from your local Social Security office.

03

Review the instructions provided with the form to understand each section's requirements.

04

Fill in your personal details accurately in the designated fields.

05

If applicable, provide information about your spouse and dependents.

06

Specify the type of benefits you are applying for, as instructed on the form.

07

Check the form for errors or missing information before submission.

08

Submit the filled form to the appropriate Social Security office either in person or by mail.

Who needs TN SS-4461?

01

Individuals applying for Social Security benefits.

02

Those who need to report changes in their Social Security information.

03

Beneficiaries seeking to update or correct their personal details.

Fill

form

: Try Risk Free

People Also Ask about

What is the annual report fee for an LLC in Tennessee?

The annual report fee is $20, and an additional $20 is required if any change is made concerning the registered agent/registered office. The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000.

How do I obtain a certificate of tax clearance in Tennessee?

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

How do I get a tax clearance certificate in Tennessee?

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

How much does a tax clearance certificate cost?

within 1-week @ Only R890.

How do I get a tax clearance for my business?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

How do I prove active status in Tennessee Secretary of State?

To be active and in good standing you must have filed formation or registration documents with the Secretary of State and have filed all required annual reports and paid all fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ss 4461 2017-2025 form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ss 4461 2017-2025 form.

How do I edit ss 4461 2017-2025 form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ss 4461 2017-2025 form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out ss 4461 2017-2025 form on an Android device?

Use the pdfFiller Android app to finish your ss 4461 2017-2025 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is TN SS-4461?

TN SS-4461 is a tax form used in Tennessee for reporting and remitting state income tax for certain types of income.

Who is required to file TN SS-4461?

Individuals or entities that earn income subject to Tennessee tax, including those receiving income from self-employment, partnerships, or other business activities, are typically required to file TN SS-4461.

How to fill out TN SS-4461?

To fill out TN SS-4461, individuals must provide their personal identification information, report their income sources, calculate the tax owed, and sign the form before submitting it to the appropriate state agency.

What is the purpose of TN SS-4461?

The purpose of TN SS-4461 is to facilitate the reporting of certain income and ensure that individuals and entities comply with Tennessee tax regulations.

What information must be reported on TN SS-4461?

TN SS-4461 requires reporting of personal identification details, specific income details, deductions if applicable, and the calculated state tax owed.

Fill out your ss 4461 2017-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ss 4461 2017-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.