Canada T2062 2018 free printable template

Show details

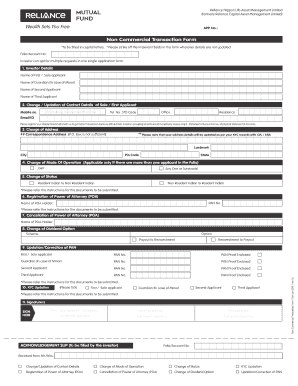

If both forms T2062 and T2062A are required for a disposition the forms must be filed together. File a separate T2062 for each disposition or proposed disposition. However if you are disposing of or proposing to dispose of several properties to the same purchaser at the same time only one T2062 is required for all the properties. Protected B when completed Supporting Document List When you send us your completed Form T2062 you must attach supporting documents so we can process your request....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2062

Edit your Canada T2062 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2062 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T2062 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada T2062. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2062 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2062

How to fill out Canada T2062

01

Obtain a copy of Form T2062 from the Canada Revenue Agency (CRA) website.

02

Fill out your name, address, and contact information in the designated sections.

03

Indicate your tax year and the type of property you are reporting.

04

Provide details about the sale or transfer of the property, including dates and amounts.

05

Include any relevant deductions or credits applied.

06

Sign and date the form at the bottom.

07

Submit the completed T2062 form to the CRA by the due date.

Who needs Canada T2062?

01

Individuals or entities that are disposing of taxable Canadian property.

02

Non-residents of Canada who need to report gains on the disposition of Canadian property.

03

Taxpayers seeking to comply with Canadian tax obligations related to property transactions.

Instructions and Help about Canada T2062

Fill

form

: Try Risk Free

People Also Ask about

Can I claim back Canadian withholding tax?

Generally, the CRA can refund excess non-resident tax withheld if you complete and send Form NR7-R no later than two years after the end of the calendar year that the payer sent the CRA the tax withheld.

What form do I need to declare non-resident Canada?

Pros and Cons of Form NR73 If you are leaving Canada, you have the option of filling out the Determination of Residency Status form (Form NR73) with the CRA. Pros: By completing this form, the CRA can provide you with a notice of determination on your residency status.

How do I stop being a tax resident of Canada?

Dispose of or give up your home in Canada and establish a permanent home in another country; Your spouse or common-law partner or dependants must also leave Canada; Dispose of personal property and break other ties to Canada, including things like your driver's licence, bank accounts, memberships, etc.

How do I inform my CRA of leaving Canada?

If you want the CRA's opinion on your residency status, complete Form NR74, Determination of Residency Status (Entering Canada), or Form NR73, Determination of Residency Status (Leaving Canada), whichever applies.

Who to notify when leaving Canada?

What do I need to do before leaving Canada? List your property at the time of departure from Canada. Notify Canadian payers of your change of tax residence status. Repay your Home Buyers' Plan balance. File a departure tax return. Talk to an international tax expert.

How long does it take to process a t2062a?

How long does it take to get a certificate of compliance from CRA? The CRA will send you an acknowledgement letter within 30 days of receiving your request for a clearance certificate. The CRA's assessment can take up to 120 days, assuming you provide all of the necessary documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada T2062 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing Canada T2062 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit Canada T2062 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada T2062. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete Canada T2062 on an Android device?

Use the pdfFiller Android app to finish your Canada T2062 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Canada T2062?

Canada T2062 is a tax form used by non-residents of Canada to report the disposition of taxable Canadian property.

Who is required to file Canada T2062?

Non-resident individuals or entities who dispose of taxable Canadian property are required to file Canada T2062.

How to fill out Canada T2062?

To fill out Canada T2062, provide details about the taxpayer, description of the property disposed, sale proceeds, and relevant dates, then sign and submit the form to the Canada Revenue Agency.

What is the purpose of Canada T2062?

The purpose of Canada T2062 is to ensure proper reporting and taxation of capital gains arising from the disposition of Canadian property by non-residents.

What information must be reported on Canada T2062?

Information required on Canada T2062 includes the taxpayer's identification details, description of the property, amount received from the disposition, expenses incurred, and details of any prior transactions.

Fill out your Canada T2062 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2062 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.