NJ NJ-1040-HW 2022 free printable template

Show details

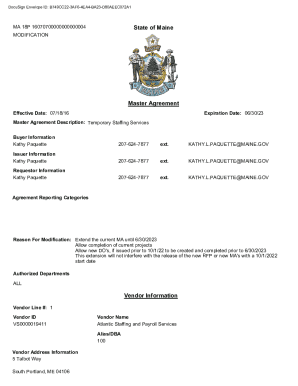

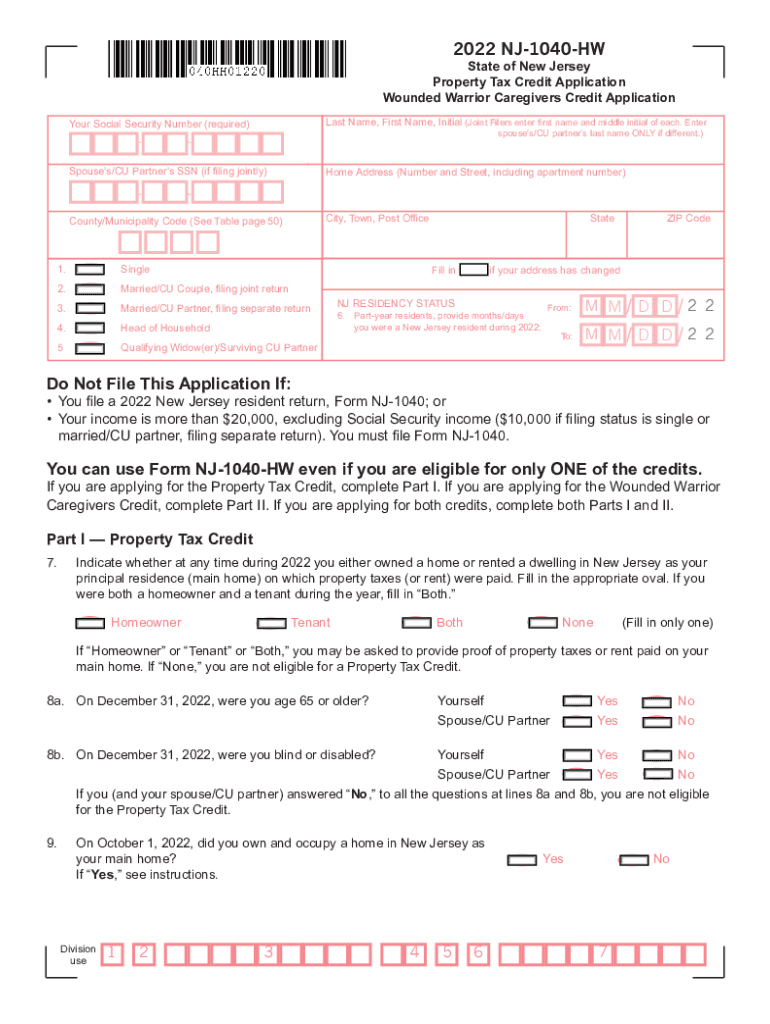

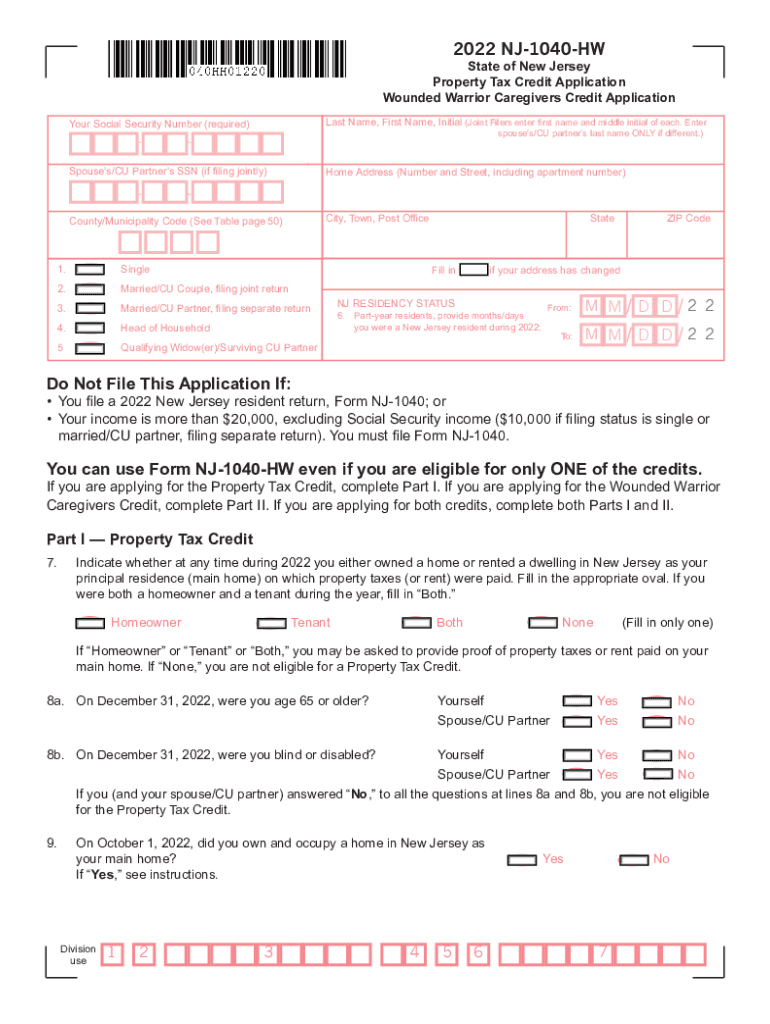

2018 NJ1040HWSTATE OF NEW JERSEY PROPERTY TAX CREDIT APPLICATION WOUNDED WARRIOR CAREGIVERS CREDIT APPLICATIONYour Social Security Number (required) Spouses/CU Partners SSN (if filing jointly) Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ NJ-1040-HW

Edit your NJ NJ-1040-HW form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ NJ-1040-HW form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ NJ-1040-HW online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ NJ-1040-HW. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ NJ-1040-HW Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ NJ-1040-HW

How to fill out NJ NJ-1040-HW

01

Gather all necessary financial documents, including W-2 forms and other income statements.

02

Download the NJ-1040-HW form from the New Jersey Division of Taxation website.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your total income on the appropriate lines of the form.

05

List any allowable deductions or credits in the designated sections.

06

Calculate your tax liability based on the instructions provided.

07

Sign and date the form before submission.

08

Submit the completed NJ-1040-HW form to the New Jersey Division of Taxation by the due date.

Who needs NJ NJ-1040-HW?

01

New Jersey residents who have a tax liability and need to report their income and pay state taxes.

02

Individuals who qualify for specific tax credits or deductions unique to New Jersey tax laws.

03

Taxpayers who are liable for property taxes and wish to claim a property tax deduction.

Fill

form

: Try Risk Free

People Also Ask about

Who gets the NJ tax rebate?

The Middle Class Tax Rebate (MCTR) was a one-year program based on the 2020 New Jersey resident Income Tax return. MCTR checks will continue to be mailed to eligible residents filing a 2020 Income Tax return (NJ-1040) claiming at least one dependent child with a tax balance of $1 or more.

How much do you get for NJ Homestead rebate?

Phil Murphy signed the 2022-2023 budget. It replaces what used to be called the Homestead Rebate Program. New Jersey residents who owned or rented their home as of October 1, 2019, met income requirements and filed state income taxes are eligible. Homeowners with incomes of $150,000 or less will receive $1,500.

How does the NJ Homestead rebate work?

The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills. Most people who qualify for the rebate will get it as a credit on their property tax bills, issued by their local tax collector.

Is 1040 the same as w2?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

How to apply for homestead rebate in NJ?

To file an application by phone or check the status of a filed application, call 877-658-2972. If you were neither a homeowner nor a tenant on October 1, you are not eligible for a homestead credit or rebate, even if you owned a home or rented a qualified dwelling for part of the year.

What is the home owners rebate in NJ?

31, 2023 deadline. Qualified homeowners making less than $150,000 in 2021 will receive a tax credit of $1,500, while those making $150,000 to $250,000 will get a tax credit of $1,000. Renters who made $150,000 or less will receive a direct check for $450. The program was a key component of this year's state budget.

Who is required to file NJ-1040?

Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return Head of household Qualifying widow(er)/surviving CU partner$20,000 Dec 15, 2022

What is NJ-1040 tax form?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

How do I get a NJ-1040 form?

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office.

Who qualifies for the NJ Homestead rebate?

$150,000 or less for homeowners age 65 or over or blind or disabled; or. $75,000 or less for homeowners under age 65 and not blind or disabled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NJ NJ-1040-HW online?

pdfFiller has made filling out and eSigning NJ NJ-1040-HW easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the NJ NJ-1040-HW in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your NJ NJ-1040-HW and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out NJ NJ-1040-HW on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your NJ NJ-1040-HW, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is NJ NJ-1040-HW?

NJ NJ-1040-HW is a tax form used by residents of New Jersey to determine their eligibility for the Homestead Benefit program. It is specifically for taxpayers claiming the benefit based on property taxes paid.

Who is required to file NJ NJ-1040-HW?

Residents of New Jersey who own or rent property and are claiming a Homestead Benefit are required to file NJ NJ-1040-HW. Eligibility criteria may include income limits and property tax payments.

How to fill out NJ NJ-1040-HW?

To fill out NJ NJ-1040-HW, taxpayers need to provide personal information, including name, address, and social security number, along with details about property taxes paid and income. It is important to follow the instructions provided on the form carefully.

What is the purpose of NJ NJ-1040-HW?

The purpose of NJ NJ-1040-HW is to allow eligible New Jersey residents to apply for the Homestead Benefit, which provides property tax relief based on income and property taxes paid.

What information must be reported on NJ NJ-1040-HW?

Information that must be reported on NJ NJ-1040-HW includes the taxpayer's personal details, property details, total property taxes paid, and income information to determine eligibility for the Homestead Benefit.

Fill out your NJ NJ-1040-HW online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ NJ-1040-HW is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.