NJ NJ-1040-HW 2021 free printable template

Show details

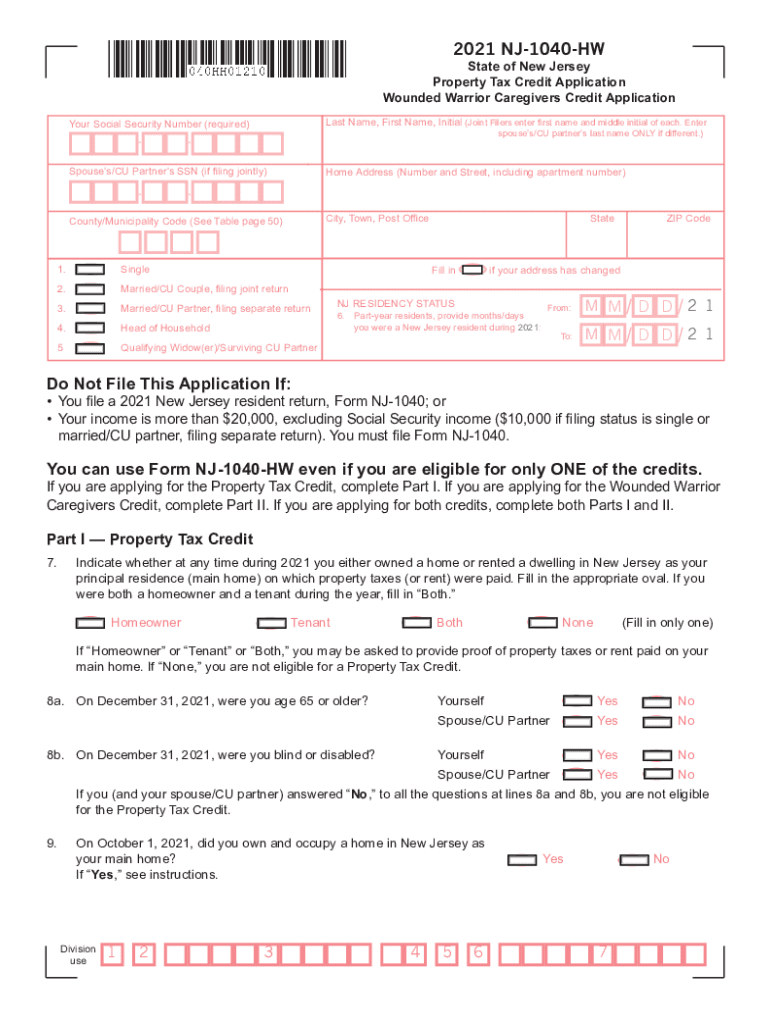

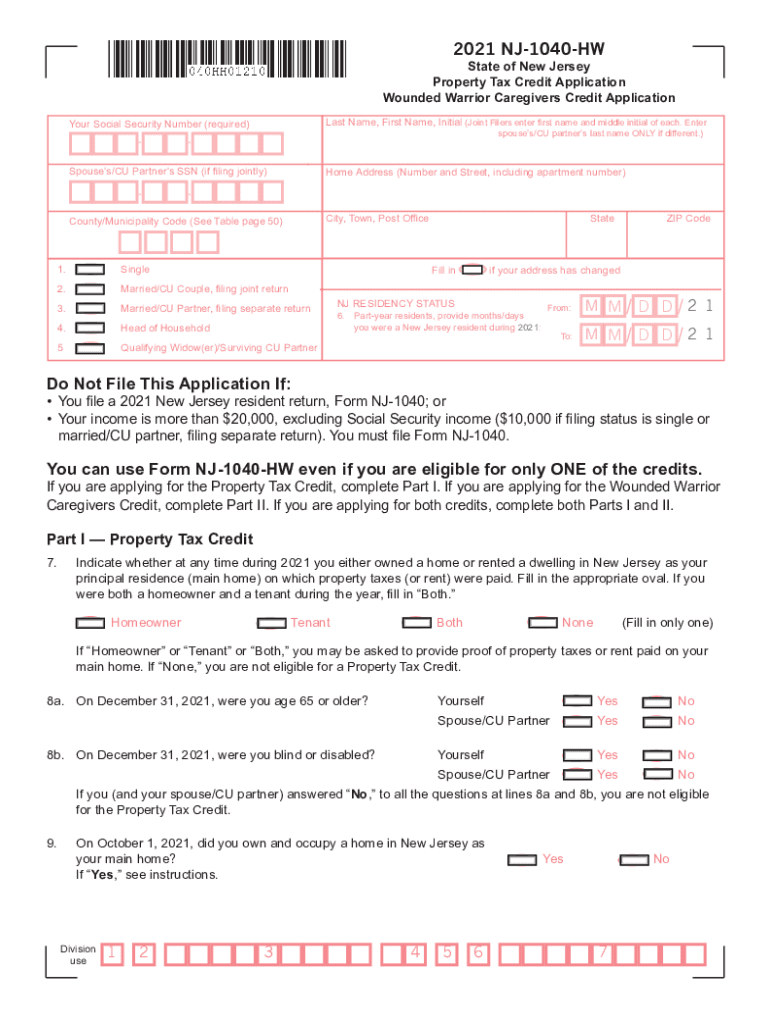

2021 NJ1040HWState of New Jersey

Property Tax Credit Application

Wounded Warrior Caregivers Credit Application

Your Social Security Number (required)

Spouses/CU Partners SSN (if filing jointly)

Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ NJ-1040-HW

Edit your NJ NJ-1040-HW form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ NJ-1040-HW form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ NJ-1040-HW online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NJ NJ-1040-HW. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ NJ-1040-HW Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ NJ-1040-HW

How to fill out NJ NJ-1040-HW

01

Obtain the NJ-1040-HW form from the New Jersey Division of Taxation website or a local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Report your total income for the year, including wages, interest, and other sources.

04

Calculate your total tax due using the tax tables provided in the instructions.

05

Account for any deductions or credits you are eligible for and subtract them from your total tax due.

06

Enter any payments made or taxes withheld from your income.

07

Calculate any balance due or refund owed based on your total tax due and payments made.

08

Sign and date the form to confirm accuracy and submit it according to the provided instructions.

Who needs NJ NJ-1040-HW?

01

Residents of New Jersey who have earned income and need to file their state income tax return.

02

Individuals who are eligible for property tax reimbursements in New Jersey.

03

Taxpayers who need to report their income and calculate their state tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who gets the NJ tax rebate?

The Middle Class Tax Rebate (MCTR) was a one-year program based on the 2020 New Jersey resident Income Tax return. MCTR checks will continue to be mailed to eligible residents filing a 2020 Income Tax return (NJ-1040) claiming at least one dependent child with a tax balance of $1 or more.

How much do you get for NJ Homestead rebate?

Phil Murphy signed the 2022-2023 budget. It replaces what used to be called the Homestead Rebate Program. New Jersey residents who owned or rented their home as of October 1, 2019, met income requirements and filed state income taxes are eligible. Homeowners with incomes of $150,000 or less will receive $1,500.

How does the NJ Homestead rebate work?

The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills. Most people who qualify for the rebate will get it as a credit on their property tax bills, issued by their local tax collector.

Is 1040 the same as w2?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

How to apply for homestead rebate in NJ?

To file an application by phone or check the status of a filed application, call 877-658-2972. If you were neither a homeowner nor a tenant on October 1, you are not eligible for a homestead credit or rebate, even if you owned a home or rented a qualified dwelling for part of the year.

What is the home owners rebate in NJ?

31, 2023 deadline. Qualified homeowners making less than $150,000 in 2021 will receive a tax credit of $1,500, while those making $150,000 to $250,000 will get a tax credit of $1,000. Renters who made $150,000 or less will receive a direct check for $450. The program was a key component of this year's state budget.

Who is required to file NJ-1040?

Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return Head of household Qualifying widow(er)/surviving CU partner$20,000 Dec 15, 2022

What is NJ-1040 tax form?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

How do I get a NJ-1040 form?

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office.

Who qualifies for the NJ Homestead rebate?

$150,000 or less for homeowners age 65 or over or blind or disabled; or. $75,000 or less for homeowners under age 65 and not blind or disabled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ NJ-1040-HW for eSignature?

Once you are ready to share your NJ NJ-1040-HW, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in NJ NJ-1040-HW without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit NJ NJ-1040-HW and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out NJ NJ-1040-HW using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NJ NJ-1040-HW and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NJ NJ-1040-HW?

NJ NJ-1040-HW is a tax form used by residents of New Jersey to report their income and calculate their state tax liability for the year.

Who is required to file NJ NJ-1040-HW?

Residents of New Jersey with taxable income above the state threshold are required to file NJ NJ-1040-HW, as well as certain non-residents earning income in the state.

How to fill out NJ NJ-1040-HW?

To fill out NJ NJ-1040-HW, taxpayers must provide personal information, report income from various sources, claim deductions and credits, and calculate their tax liability following the instructions on the form.

What is the purpose of NJ NJ-1040-HW?

The purpose of NJ NJ-1040-HW is to ensure that residents accurately report their taxable income and pay the appropriate amount of state income tax.

What information must be reported on NJ NJ-1040-HW?

Information that must be reported on NJ NJ-1040-HW includes personal identification details, income from wages, interest, dividends, pensions, and any deductions or credits applicable to the taxpayer.

Fill out your NJ NJ-1040-HW online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ NJ-1040-HW is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.