Last updated on Feb 20, 2026

KS-ET10 free printable template

Show details

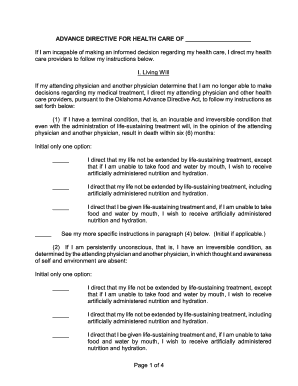

K.S.A. 591507b Affidavit/Estates under $40,000 (12/2017)AFFIDAVIT TRANSFERRING CERTAIN PERSONAL PROPERTY IN ESTATES UNDER $40,000 PURSUANT TO K.S.A. 591507bSTATE OF KANSAS COUNTY OF)) SS:) (name of

We are not affiliated with any brand or entity on this form

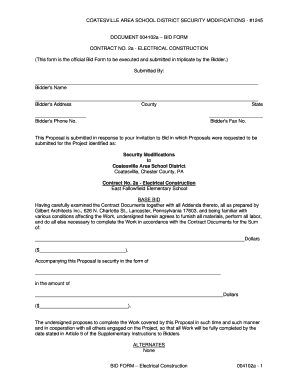

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is KS-ET10

The KS-ET10 is a form used for documenting employment tax information in the Kansas state.

pdfFiller scores top ratings on review platforms

PDFFiller has paid for itself in time and headache.

Just started using it but I think it is a great program!

Great so far...done all I could have wanted and all in one place.

Very helpful, all forms I needed you have

initially some difficulty in lining up words in the correct graphic format Roman etc., but generally good experience but still a lot to learn

it happened so fast i did not realize that i had sent a fax

Who needs KS-ET10?

Explore how professionals across industries use pdfFiller.

Detailed Guide to the KS-ET10 Form on pdfFiller

The KS-ET10 form is a legal document used in Kansas for transferring personal property after a decedent's death. This guide will walk you through each crucial aspect of completing the KS-ET10 form, from understanding its purpose to leveraging pdfFiller’s capabilities for easy submission.

What is the purpose of the KS-ET10 affidavit?

The KS-ET10 affidavit serves to streamline the process of transferring personal property posthumously without the need for full probate proceedings. It allows designated beneficiaries to claim ownership, ensuring the decedent's estate is handled efficiently and in accordance with Kansas law.

-

The KS-ET10 is primarily designed for small estates, allowing heirs to bypass lengthy probate.

-

It should be used when the total value of personal property is below a certain threshold, thereby simplifying the transfer process.

What are the initial requirements for filling out the form?

Before starting the KS-ET10 form, it's vital to ensure you meet all eligibility criteria. This includes being the decedent's designated affiant, and collecting necessary documentation to support the filing.

-

The affiant must be a legal heir or a designated representative of the decedent, confirming their right to file.

-

A death certificate and proof of relationship to the decedent are typically required, ensuring legitimacy.

-

The total value of the estate must not exceed the limits set by Kansas law, currently at $40,000 for an individual.

How to complete the KS-ET10 form step-by-step?

Completing the KS-ET10 form requires precise information about both the affiant and the decedent. Follow these structured steps to fill in the details accurately.

-

Provide the affiant's name, age, and address to establish identity.

-

Include the decedent's date of death and location to contextualize the affidavit.

-

List all beneficiaries with names, ages, relationships, and addresses to identify who receives the property.

-

Clearly describe all personal property and include any insurance policies involved.

-

State that the affiant is legally competent and of age to sign.

How can pdfFiller help with form completion?

pdfFiller offers various interactive tools that make completing the KS-ET10 form effortless. Features such as fillable fields and e-signatures can significantly streamline the process.

-

Easily input information through user-friendly fillable fields designed for data entry.

-

Utilize the e-signature feature to legally sign documents without needing to print or scan.

-

Share the form with others for input or review, keeping your process transparent and collaborative.

What important considerations should you keep in mind?

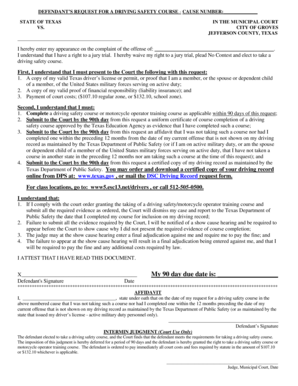

Filing the KS-ET10 form is a legal task that requires careful consideration of compliance and notarization to avoid delays. Familiarizing yourself with these aspects will save you time.

-

Understand the specific laws governing affidavit requirements in Kansas to ensure compliance.

-

Secure notarization of the affidavit to verify identity and enforceability.

-

Be aware of any debts or tax obligations that may affect the estate's transfer process.

What common mistakes should be avoided when filing the KS-ET10?

Mistakes made while completing the KS-ET10 can cause significant delays or even dismissals. Recognizing these common pitfalls will help ensure a smoother application process.

-

Double-check that all required fields are filled in to prevent unnecessary delays.

-

Ensure an accurate assessment of the estate's value to avoid complications.

-

Always attach required documents, such as the death certificate to validate your claims.

What are the next steps after filing?

After submitting the KS-ET10 form, beneficiaries should familiarize themselves with the subsequent processes of transferring personal property. Knowing the right steps will guide a smooth transition.

-

Learn how property is transferred following court acknowledgment of the KS-ET10 affidavit.

-

Maintain open lines of communication with the appropriate county office for any needed clarifications.

-

Ensure that you receive confirmation and pertinent documentation validating the completed transfer.

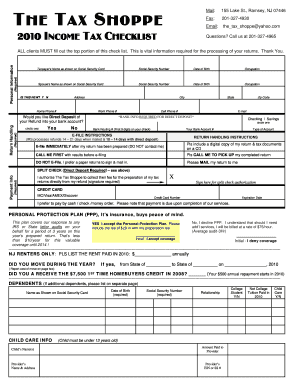

How to fill out the KS-ET10

-

1.Open the KS-ET10 form on pdfFiller.

-

2.Begin by entering your company name and address in the designated fields at the top of the form.

-

3.Next, fill in the employer identification number (EIN) under the relevant section.

-

4.Provide the name and contact information of the payroll administrator responsible for the form.

-

5.In the income information section, enter the total amount of wages subject to employment tax.

-

6.Complete the deductions section with applicable tax amounts and adjustments.

-

7.Sign and date the form at the bottom to validate the information provided.

-

8.Review the completed document for accuracy and ensure all necessary fields are filled.

-

9.Finally, save the form and print it if required for submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.