Last updated on Feb 20, 2026

Get the free fha conventional

Show details

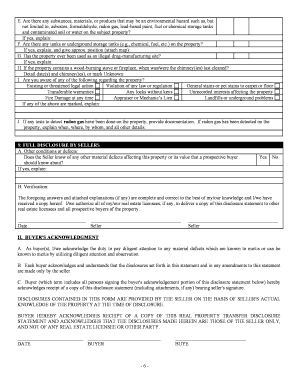

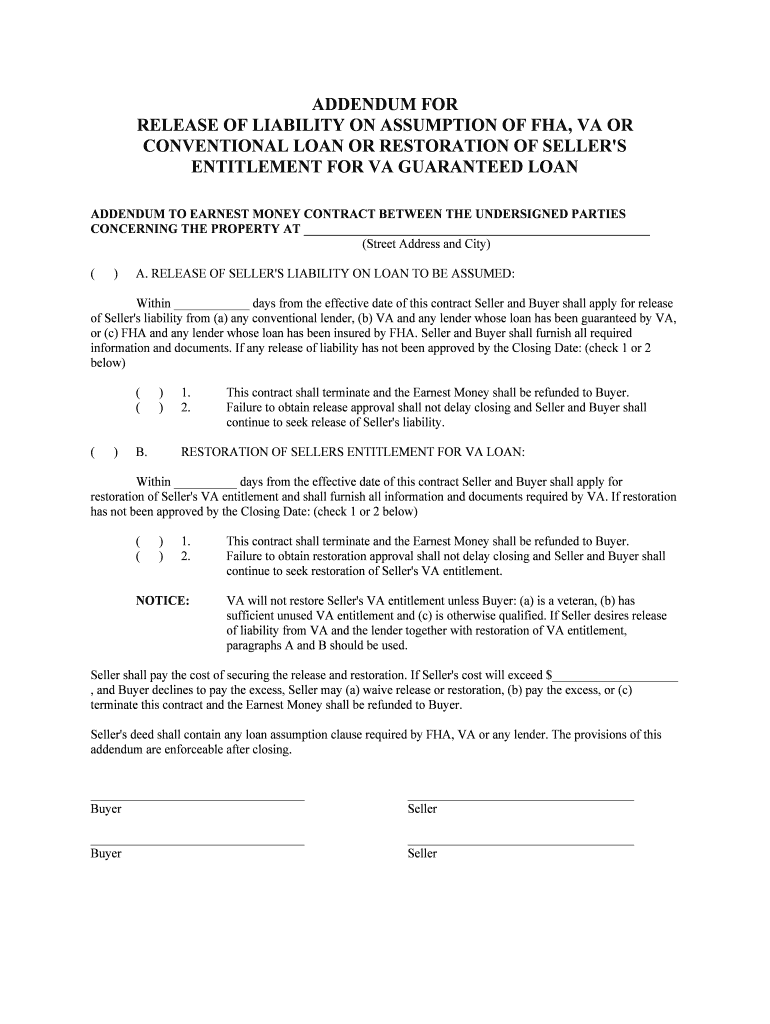

ADDENDUM FOR RELEASE OF LIABILITY ON ASSUMPTION OF FHA, VA OR CONVENTIONAL LOAN OR RESTORATION OF SELLER IS ENTITLEMENT FOR VA GUARANTEED LOAN ADDENDUM TO EARNEST MONEY CONTRACT BETWEEN THE UNDERSIGNED

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

pdfFiller is the best!

Great customer service

Great customer service; they are very friendly and prompt!

Exellent editing.

Exellent editing.. Made editing easier

Easy to use

Easy to use. Does what it is supposed to

Very good application.Developer help me…

Very good application.Developer help me everything when i have ploblems

It's a little expensive but it…

It's a little expensive but it certainly cuts out the bullsh!t. Maybe consider a student discount?

Understanding the FHA Conventional Form

Filling out an FHA conventional form is straightforward when you break it down into manageable steps. This guide will lead you through the complexities of FHA and conventional loans, their associated documents, and the necessary steps to complete the form.

What are FHA and conventional loans?

FHA loans, backed by the Federal Housing Administration, are designed to assist low-to-moderate-income borrowers in obtaining home financing with more lenient credit requirements. These loans often feature lower down payments, making homeownership more accessible. On the other hand, conventional loans are not insured by the government and typically have stricter credit qualifications but are available with a wider range of loan terms, making them a popular choice.

How do FHA and conventional loans compare?

-

FHA loans have lower credit score requirements, while conventional loans generally require higher scores.

-

FHA loans often come with mortgage insurance premiums, which can make them more costly in the long run compared to conventional options, especially if borrowers have strong credit.

-

FHA loans require as little as 3.5% down, whereas conventional loans can vary between 3% and 20%.

What is the purpose of the ADDENDUM FOR RELEASE OF LIABILITY?

The ADDENDUM FOR RELEASE OF LIABILITY is crucial in property transactions that involve financing assumptions. This document enables buyers to assume the existing loan from the seller, while also limiting the seller's liability post-closing for that debt.

What roles do the Seller and Buyer play?

-

The seller needs to ensure the buyer meets the lender's qualification criteria and complete all required disclosures.

-

The buyer must complete a loan assumption application and meet the requirements to take over the mortgage.

This addendum also serves to protect the seller from future liabilities associated with the loan once it is fully assumed by the buyer.

How is the form broken down?

-

Key elements include the Street Address and City, which must be accurately filled to avoid delays.

-

Both parties have crucial roles in the process: sellers must relay accurate information, while buyers must prepare to assume responsibility.

-

The timelines for applying for liability release and entitlement restoration must be clarified to ensure a smooth transition.

How do you fill out the FHA conventional form?

Completing the FHA conventional form can be made easier with pdfFiller's interactive tools. Start with a step-by-step guide to ensure accuracy. Gather essential documents such as social security numbers, income verification, and other paperwork required for filing.

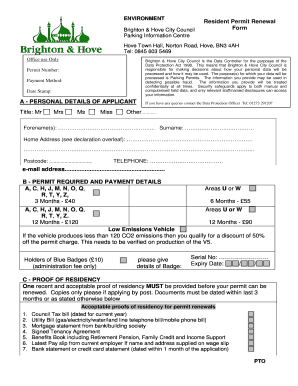

What key documents do you need?

-

Such as a driver’s license or passport to verify the identity of the parties involved.

-

Notices of earnings, tax returns, or W-2 forms to demonstrate financial capability.

-

To ensure that all terms and conditions of the current mortgage are accurately reflected in the new agreement.

pdfFiller also allows users to edit, sign, and manage their documents seamlessly, ensuring an efficient process.

How do addendums impact homeownership goals?

Understanding how the addendum and loan assumptions affect homeownership is vital. While they can facilitate smoother transitions for buyers, they also present unique challenges such as approval delays or additional requirements that need to be met.

What challenges do Buyers and Sellers face?

-

Buyers may face setbacks if their application does not meet lender expectations.

-

Sellers need to provide all necessary documentation to prevent complications.

-

Current real estate trends may complicate negotiations and the overall process.

To navigate these hurdles, consider using resources like pdfFiller to streamline document management.

What is the VA entitlement restoration process?

For veterans, restoration of VA entitlement is essential after the release of liability. The process typically involves the buyer demonstrating eligibility and providing necessary documentation. This transaction must be completed carefully to safeguard the veteran's benefits.

-

The buyer must qualify for a VA loan, ensuring they meet the lender’s criteria.

-

Necessary paperwork includes the original loan statement, a formal request for entitlement restoration, and proof of eligibility.

-

Documents can be submitted through platforms like pdfFiller for quick processing.

What should you consider before signing the addendum?

Before finalizing the addendum, consider the implications of a denied release approval. Delays or issues in the application can affect financial obligations and responsibilities. Being thorough in understanding all aspects of the FHA conventional form ensures informed decisions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.