CA-020-77 free printable template

Show details

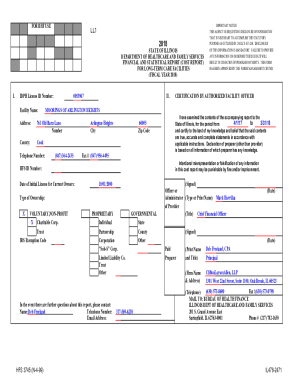

2016 U.S. Legal Forms, Inc. CALIFORNIA GIFT DEED Individual to Individual Control Number: CA02077I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created using Microsoft

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift deed sample form

Edit your gift deeds california form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift deed form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california gift deed sample form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift deed pdf form

How to fill out CA-020-77

01

Start by gathering all necessary information required for CA-020-77, including your personal and contact details.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Fill out the required sections accurately, ensuring that all information is correct.

04

If applicable, provide any supporting documentation or evidence as specified in the instructions.

05

Review the completed form for any errors or missing information.

06

Sign and date the form where required.

Who needs CA-020-77?

01

Individuals who are applying for or renewing a specific type of certification or license.

02

Persons required to report specific events or changes as mandated by their governing body.

Fill

gift deed form california

: Try Risk Free

People Also Ask about california deed pdf

How do I gift a deed to a property in Virginia?

Code, §§ 40-1-9, 39-1-2) – A property's deed must be filed in the County Court Clerk's Office (See List) in the jurisdiction where the real estate is located. Signing (W. Va. Code, § 39-1-2) – All deeds are required to be signed with two (2) witnesses or a Notary Public present.

Can you gift a house in WV?

A deed of gift must be signed by all parties, notarized by a Virginia notary, and witnessed by two or more parties who have no ownership interest in the property. The deed must be submitted to the recorder's office in the county of Virginia where the property exists.

How do I transfer property in WV?

The current owner transferring property must sign a West Virginia deed. The county clerk cannot record an unsigned deed. An agent acting under power of attorney can sign a deed on the owner's behalf if the owner has signed a power-of-attorney agreement giving the agent authority.

How do I transfer a property deed in WV?

Recording fees. The basic filing fee to record a West Virginia deed is $27.00, which includes a $2.00 preservation fee. The clerk charges an extra $1.00 fee for each page beyond five pages. A deed transferring real estate for consideration costs an extra $20.00 fee.

Does WV have a gift tax?

There is no gift tax in West Virginia either. The federal gift tax exemption is $16,000 per recipient per year in 2022, going up to $17,000 in 2023.

What are the terms of a deed of gift?

The Elements of a Deed of Gift The typical deed of gift identifies the donor, describes the materials, transfers legal ownership of the materials to the repository, establishes provisions for use, specifies ownership of intellectual property rights, and indicates disposition of unwanted materials.

What is the difference between a gift deed and a grant deed?

Gift Deed – A gift deed is a special type of grant deed that “gifts” ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

What was the purpose of the deed of gift?

The Deed of Gift is a formal and legal agreement between you, the donor, and Special Collections that transfers ownership of and legal rights to the donated materials.

Why is a deed of gift important?

The deed of gift confirms a legal relationship between the donor and repository that is based on a clearly articulated and common understanding. This relationship ensures that the donated materials, which help illuminate our past and its influence on us, are preserved and made available to future generations.

How does a gift deed work in California?

Gift Deed Definition In California, you can use either a grant deed or a quitclaim deed to gift property into someone else's name. You can simply say on the deed that there's no consideration or that you're transferring title out of affection.

What is the deed transfer tax in Virginia?

In Virginia, transfer taxes are $3.50 per $1,000 of home sale price. This is usually split as $1 per $1,000 for the seller and $2.50 per $1,000 for the buyer. On a $300,000 home, that comes out to $1,050 total — $300 for the seller and $750 for the buyer.

How does a deed of gift work in Virginia?

A deed of gift must be signed by all parties, notarized by a Virginia notary, and witnessed by two or more parties who have no ownership interest in the property. The deed must be submitted to the recorder's office in the county of Virginia where the property exists.

What is required on a gift deed in Texas?

A gift deed must be (1) in writing, (2) signed, (3) describe the property, and (4) delivered. TPC §5.021. Texas further requires the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee.

Do you have to pay taxes on a deed of gift in Virginia?

Deeds of gift are exempt from recordation taxes under Va. Code 58.1-811(D). The deed must state on its face that the transfer is exempt from the tax. Virginia does not levy a state gift tax, but the grantor must pay the Federal Gift Tax.

What is the difference between a grant deed and a gift deed?

Gift Deed – A gift deed is a special type of grant deed that “gifts” ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit gift deed california from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like california deed, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in ca gift deed?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your gift deed template form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit gift deed template form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign gift deed template form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is CA-020-77?

CA-020-77 is a specific tax form used in California for reporting certain financial information to the state.

Who is required to file CA-020-77?

Generally, individuals or businesses that meet certain income or tax thresholds in California are required to file CA-020-77.

How to fill out CA-020-77?

To fill out CA-020-77, you should follow the instructions provided with the form, entering required financial details accurately and completely.

What is the purpose of CA-020-77?

The purpose of CA-020-77 is to report specific income information to California tax authorities, helping to ensure compliance with state tax laws.

What information must be reported on CA-020-77?

Information required on CA-020-77 typically includes income amounts, deductions, and other financial details relevant to tax calculations.

Fill out your gift deed template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Deed Template Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.