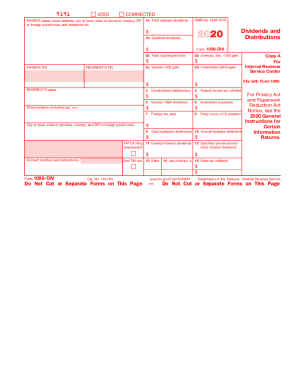

IRS Instruction 1099-DIV 2020 free printable template

Get, Create, Make and Sign 1099 div irs form

Editing 1099 div irs form online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 1099-DIV Form Versions

How to fill out 1099 div irs form

How to fill out IRS Instruction 1099-DIV

Who needs IRS Instruction 1099-DIV?

Instructions and Help about 1099 div irs form

Hello this deal, and today I'm going to be talking about how to fill out these 1099 miscellaneous forms or 1099 mi a/c forms now a lot of times when you've hired a contractor do some work you know you sign a contract you ask them to do certain amount of work they finish it up you pay him off and off you go well at the end of the year you should really be filling out these 1099 forms to tell the IRS how much you paid them and these forms don't really record any taxes you know you're not paying them taxes you're hoping that they'll pay their own taxes you check their credentials their illegal operation they pay their own taxes here you're just reporting what you paid them and that's kind of what I'm focused on today you could fill out a bunch of tax information here as well but just for like hiring contractors you're just reporting what you paid them has nothing to do with taxes they deal with the taxes so the first thing before you can even fill this out is to have your contractor or whoever your piano teacher etc fill out the form w-4 form and this basically they only have to worry about tax deductions or what have you they just what you're after is their name address and their social security number or their tax ID number and so this is what you want to ask them to fill out before they do any work for you and just to kind of tell you what you're up against in general if you pay somebody more than let's say three or six hundred dollars you should really have them fill this out and legally just like for contractors if you fill out the 1099 form you have to fill this out if you pay anybody six hundred dollars or more that's not a gift, so that's kind of where the starting point is so again CAVAM fill out the tent the w-4 form before they start the work after they finish the work record how much you pay them and then at the end of the year you have to fill one of these and let's go over how to fill one of these things out, and it's really simple basically you go to the IRS office, and you ask them for 1099 miscellaneous form, and they give you one of these they'll ask you how many you want if you just want one two or three of these things but if you ask for one they'll give you one with actually two forms on it is coming two forms for a page so don't get confused you only really have to fill out one per person I've had I've known people who've actually thought they had to fill out both of these for one person and that totally screws up everybody's screws of the IRS screws up the taxpayer if you paint one person you fill out one top if you fill out if you pay two people you fill out one for one the bottom for the other the top is not perforated this is what you send the IRS the other copies there's copy one is perforated you can kind of cut across and so you'd be sending one to one person one to the other person, so this is how it works just the top is just your name your address and your telephone number you basically who you are, and then you want...

People Also Ask about

What is the minimum to report 1099-div?

What happens if I don't file 1099-Div?

Do I have to report 1099-div on my tax return?

Do I need both 1099-Div and 1099-B?

What is the difference between 1099-Div and 1099b div?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1099 div irs form in Gmail?

Where do I find 1099 div irs form?

Can I edit 1099 div irs form on an iOS device?

What is IRS Instruction 1099-DIV?

Who is required to file IRS Instruction 1099-DIV?

How to fill out IRS Instruction 1099-DIV?

What is the purpose of IRS Instruction 1099-DIV?

What information must be reported on IRS Instruction 1099-DIV?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.