Get the free credit application - Think Graphtech

Show details

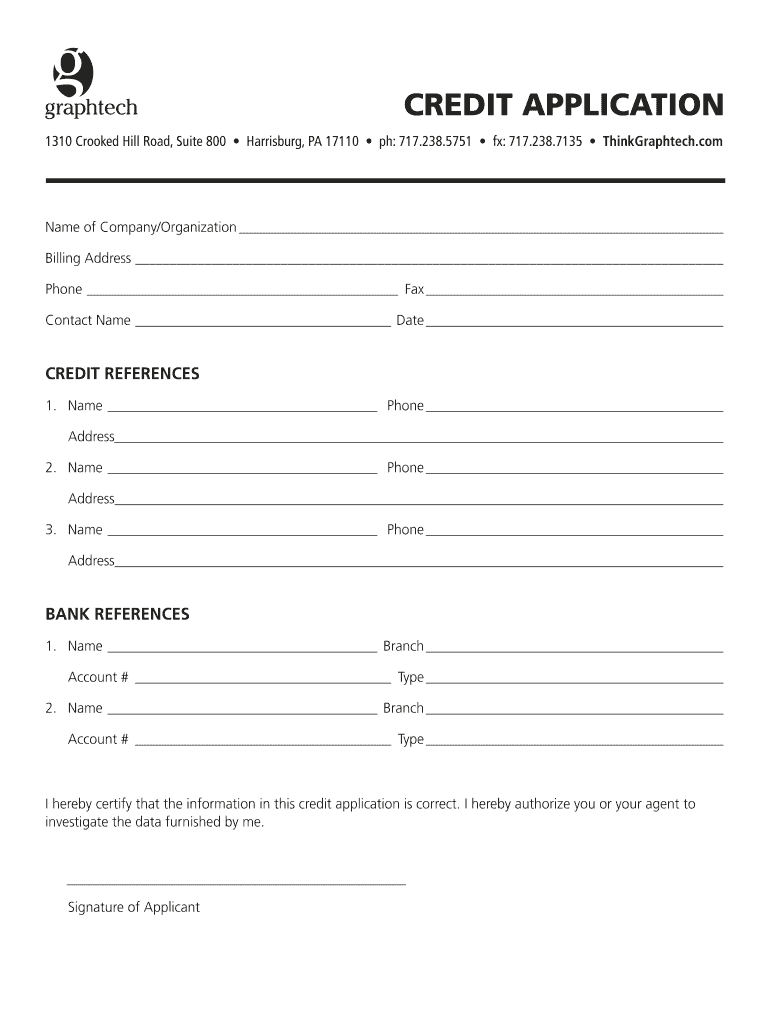

CREDIT APPLICATION 1310 Crooked Hill Road, Suite 800 Harrisburg, PA 17110 pH: 717.238.5751 FX: 717.238.7135 ThinkGraphtech. Compare of Company/Organization Billing Address Phone Fax Contact Name Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application - think

Edit your credit application - think form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application - think form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application - think online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application - think. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application - think

How to fill out credit application - think

01

To fill out a credit application, follow these steps:

02

Start by gathering all the necessary documents, such as identification, proof of income, and bank statements.

03

Carefully read through the instructions and requirements provided by the credit application form or lender.

04

Begin filling out the personal information section, including your name, address, contact details, and social security number.

05

Provide accurate information about your employment history, including current and previous employers.

06

Fill in the details about your financial situation, such as income, expenses, and existing debt obligations.

07

If requested, include information about any co-applicants or co-signers.

08

Review the completed application form thoroughly, ensuring all the provided information is accurate and complete.

09

Sign and date the credit application form wherever required.

10

Make a copy of the completed application for your records.

11

Submit the credit application to the designated recipient, either by mail, online submission, or in-person.

12

Follow up with the lender or financial institution if you do not receive any confirmation or response within a reasonable timeframe.

Who needs credit application - think?

01

A credit application is typically needed by individuals or businesses who require financial assistance or want to apply for credit from a lending institution, such as a bank, credit union, or credit card company.

02

Common situations where a credit application may be necessary include:

03

- Applying for a personal loan to fund a major purchase or cover unexpected expenses.

04

- Requesting a credit card to manage everyday spending and build credit history.

05

- Seeking a mortgage loan to purchase a home or refinance an existing mortgage.

06

- Applying for an auto loan to finance the purchase of a vehicle.

07

- Small businesses or startups seeking a line of credit or business loan to support business operations or expansion plans.

08

- Contractors or freelancers looking for a business line of credit or credit card to manage cash flow and expenses.

09

In general, anyone who wants to access credit or financial services that require an assessment of creditworthiness would need to fill out a credit application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application - think?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the credit application - think. Open it immediately and start altering it with sophisticated capabilities.

How can I edit credit application - think on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing credit application - think.

How can I fill out credit application - think on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your credit application - think, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is credit application - think?

Credit application is a formal request to a lender for the extension of credit. It typically includes personal and financial information to assess a borrower's creditworthiness.

Who is required to file credit application - think?

Individuals or businesses seeking to obtain credit from a lender are required to file a credit application.

How to fill out credit application - think?

To fill out a credit application, one must provide personal information, financial information, employment details, and sometimes references.

What is the purpose of credit application - think?

The purpose of a credit application is for the lender to determine the creditworthiness of the borrower and decide whether to extend credit.

What information must be reported on credit application - think?

Information such as name, address, social security number, income, employment history, and existing debts must be reported on a credit application.

Fill out your credit application - think online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application - Think is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.