Get the free consumer banking fee schedule - Salem Five Direct

Show details

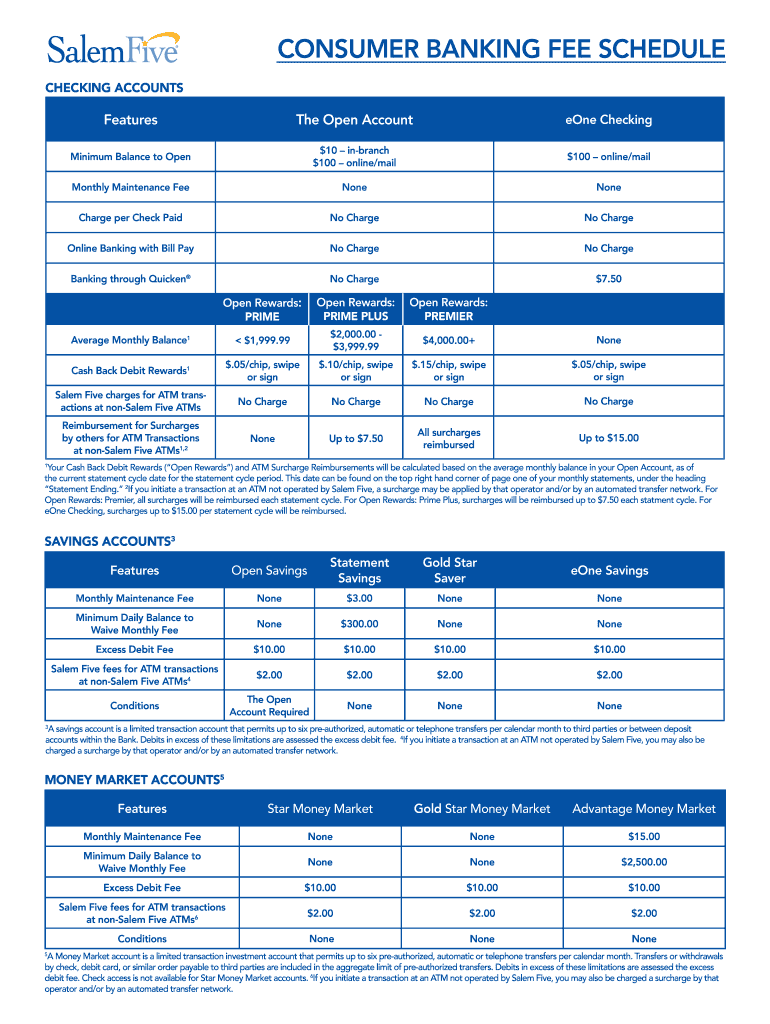

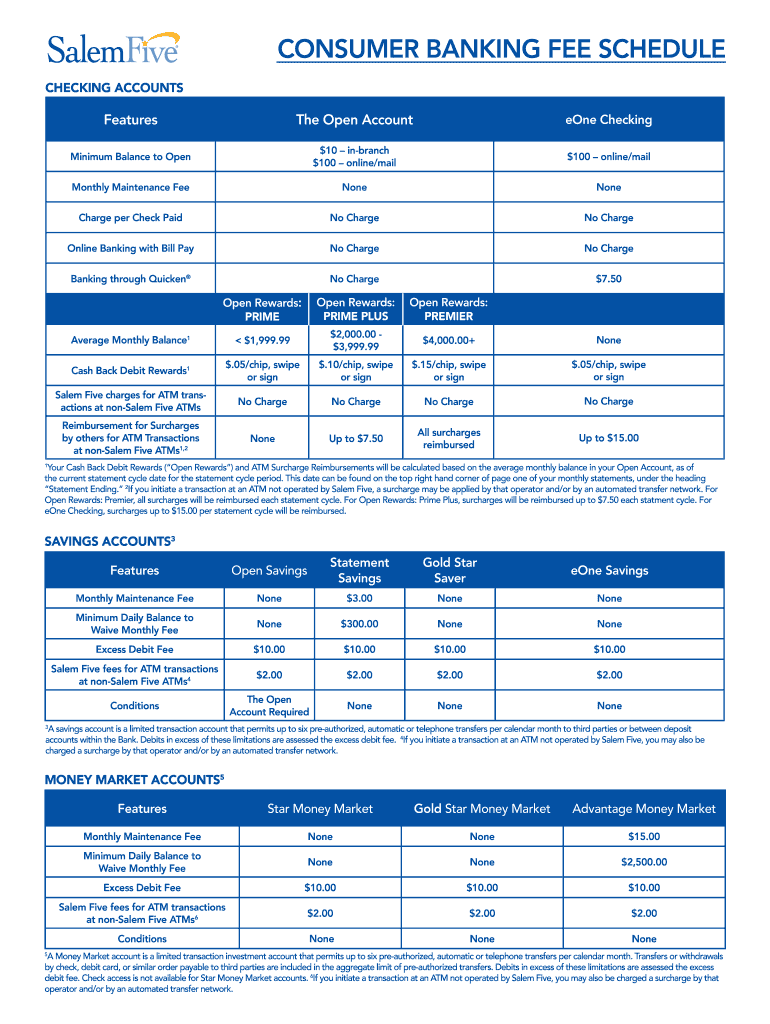

CONSUMER BANKING FEE SCHEDULE CHECKING ACCOUNTSFeaturesThe Open Accounted CheckingMinimum Balance to Open×10 in branch $100 online/mail×100 online/bimonthly Maintenance FeeNoneNoneCharge per Check

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer banking fee schedule

Edit your consumer banking fee schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer banking fee schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer banking fee schedule online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consumer banking fee schedule. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer banking fee schedule

How to fill out consumer banking fee schedule

01

To fill out the consumer banking fee schedule, follow these steps:

02

Gather all the necessary information about the fees associated with the consumer banking services offered by your bank.

03

Create a table or spreadsheet with columns for fee types, descriptions, amounts, and any additional notes.

04

Start listing the fee types in the first column. Examples may include monthly maintenance fee, overdraft fee, ATM withdrawal fee, etc.

05

Provide a brief description for each fee type in the second column. This description should explain when the fee is applicable and under what circumstances.

06

Enter the corresponding fee amounts in the third column. Make sure to include any variables or tiers that may affect the fee calculation.

07

Include any additional notes or terms in the fourth column. This can include information about fee waivers, discounts, or other special conditions.

08

Review the completed fee schedule to ensure accuracy and clarity.

09

Publish or distribute the consumer banking fee schedule to make it easily accessible to customers, either online or through physical copies at bank branches.

10

Regularly update the fee schedule to reflect any changes or amendments to the fee structure.

11

By following these steps, you can effectively fill out a consumer banking fee schedule.

Who needs consumer banking fee schedule?

01

Consumer banking fee schedules are needed by banks, financial institutions, and their customers.

02

Banks and financial institutions use fee schedules to provide transparency and information about the charges associated with their banking services.

03

Customers, both existing and potential, benefit from having access to a fee schedule as it helps them understand the costs involved in maintaining a bank account or utilizing specific banking services.

04

Having a consumer banking fee schedule ensures that both parties have clear expectations regarding fees and charges, promoting trust and accountability in the banking relationship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete consumer banking fee schedule online?

pdfFiller makes it easy to finish and sign consumer banking fee schedule online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit consumer banking fee schedule on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share consumer banking fee schedule from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit consumer banking fee schedule on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share consumer banking fee schedule on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is consumer banking fee schedule?

Consumer banking fee schedule is a document that outlines the fees charged by a bank for various services provided to consumers.

Who is required to file consumer banking fee schedule?

Banks and financial institutions are required to file consumer banking fee schedule.

How to fill out consumer banking fee schedule?

Consumer banking fee schedule can be filled out electronically or manually using the required format provided by regulatory authorities.

What is the purpose of consumer banking fee schedule?

The purpose of consumer banking fee schedule is to provide transparency to consumers about the fees associated with banking services.

What information must be reported on consumer banking fee schedule?

Consumer banking fee schedule must include details of all fees charged by the bank, including account maintenance fees, overdraft fees, ATM fees, etc.

Fill out your consumer banking fee schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Banking Fee Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.