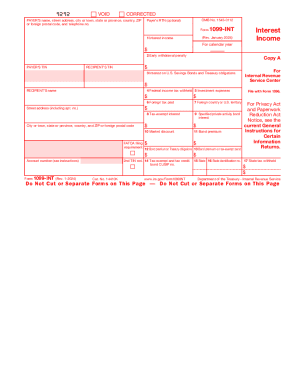

IRS 1099-INT 2020 free printable template

FAQ about IRS 1099-INT

What should I do if I need to correct a mistake on my IRS 1099-INT?

If you discover an error on your IRS 1099-INT after submission, you should file a corrected form as soon as possible. Using the corrected IRS 1099-INT, indicate the changes made and ensure that the original and corrected forms are filed with the IRS. Documentation supporting the changes may also be necessary.

How can I track the status of my IRS 1099-INT submission?

To verify the receipt and processing of your IRS 1099-INT, you can use the IRS's online tracking tool or contact the IRS directly. Be prepared with your details such as the employer identification number (EIN) and submission date to inquire about the status effectively.

Are e-signatures accepted for IRS 1099-INT filings?

Yes, e-signatures are generally accepted for IRS 1099-INT filings, provided that the electronic submission meets IRS standards. It's important to ensure that any e-signature method used is compliant with IRS regulations for electronic signature.

What should I do if my IRS 1099-INT is rejected during e-filing?

If your IRS 1099-INT is rejected upon e-filing, you will receive an error message detailing the reason for the rejection. Review the error codes and make the necessary adjustments before resubmitting the form to the IRS.

See what our users say