Get the free Instructions for Charitable Estate Registration - CharitiesNYS ...

Show details

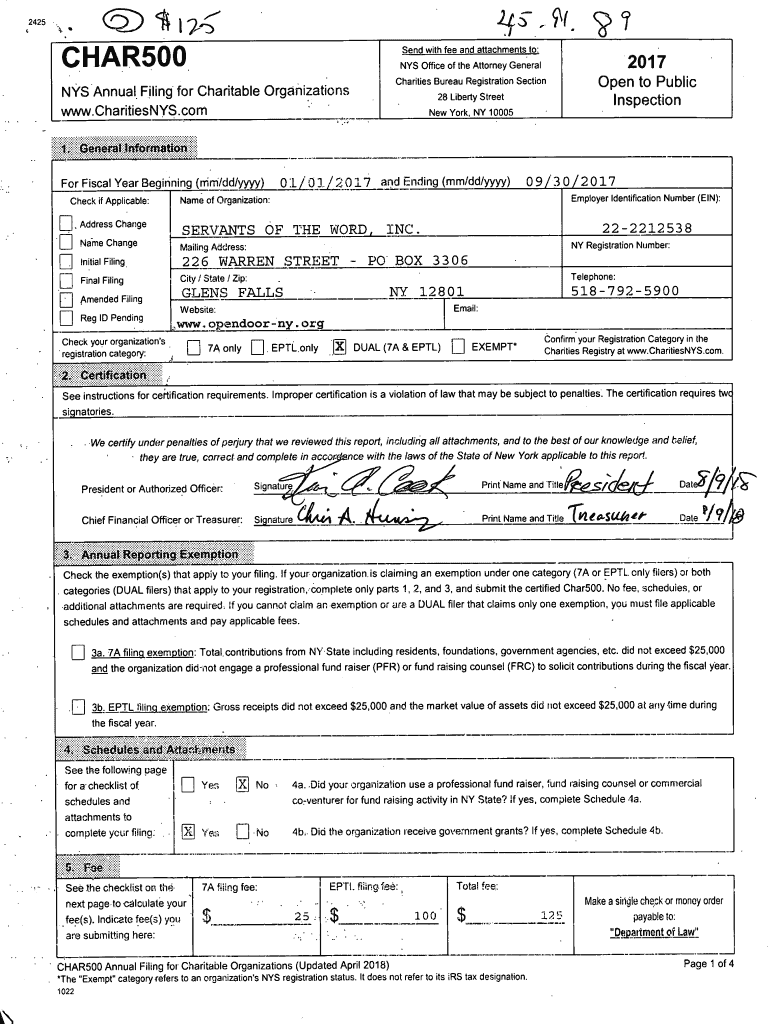

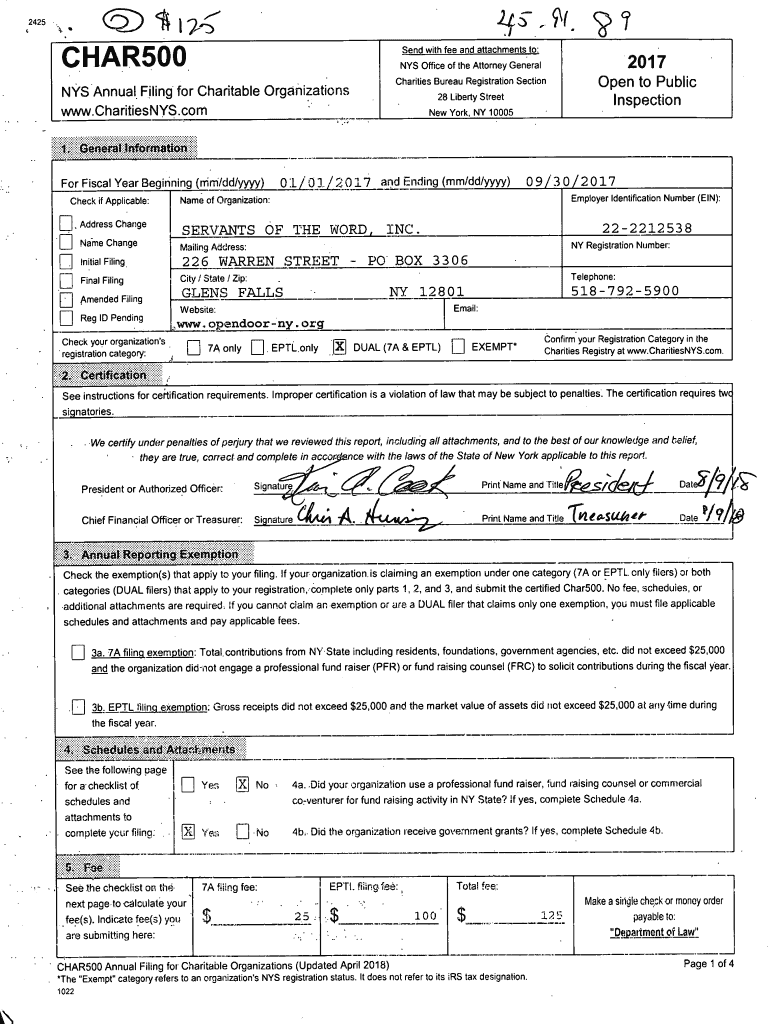

A '2425.IFF 9. 974.CHAR500Sendwitilleeandallachmentato:Open to Public InspectionCharities Bureau Registration Sections Annual Filing for Charitable Organizations www.CharitiesNYS.com 12017NYS Office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for charitable estate

Edit your instructions for charitable estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for charitable estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions for charitable estate online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit instructions for charitable estate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for charitable estate

How to fill out instructions for charitable estate

01

Start by gathering all the necessary documents related to the estate, such as the will, trust documents, and any relevant financial information.

02

Identify the charitable organizations or causes that the estate will be supporting. Research and verify their legitimacy and ensure that they comply with tax laws for charitable deductions.

03

Determine the specific assets or properties that will be donated to the charitable organizations. Appraise their value if necessary.

04

Consult with an experienced attorney or estate planner to ensure that all legal requirements and obligations are met. They can help draft the instructions for the charitable estate and ensure that it aligns with the overall estate plan.

05

Clearly outline the terms and conditions for the charitable donations. Specify whether it will be a one-time donation or a recurring contribution, and any specific areas or programs within the charitable organization that should be prioritized.

06

Provide detailed instructions on how the charitable donations should be transferred or distributed. This may include transferring ownership of properties, liquidating assets, or setting up a trust or foundation to manage the donations.

07

Review and revise the instructions periodically to ensure they are up to date and aligned with any changes in the estate plan or tax laws.

08

Consider involving the charitable organizations in the process to ensure that they are aware of the donation intentions and can provide any necessary guidance or support.

Who needs instructions for charitable estate?

01

Anyone who wants to leave a charitable legacy through their estate can benefit from instructions for charitable estate.

02

Individuals who have significant assets and want to ensure that a portion of it goes to charitable causes.

03

Estate planners or attorneys who need guidance on how to assist their clients in setting up charitable donations as part of their estate plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my instructions for charitable estate in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your instructions for charitable estate directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out instructions for charitable estate using my mobile device?

Use the pdfFiller mobile app to fill out and sign instructions for charitable estate on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete instructions for charitable estate on an Android device?

Complete your instructions for charitable estate and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is instructions for charitable estate?

Instructions for charitable estate are legal documents outlining how an individual wishes their assets to be distributed to charitable organizations upon their death.

Who is required to file instructions for charitable estate?

Anyone who wishes to leave a portion of their estate to charitable organizations is required to file instructions for charitable estate.

How to fill out instructions for charitable estate?

To fill out instructions for charitable estate, you will need to consult with an estate planning attorney to outline your wishes and ensure the proper legal language is used.

What is the purpose of instructions for charitable estate?

The purpose of instructions for charitable estate is to ensure that a portion of an individual's assets are donated to charitable organizations upon their death.

What information must be reported on instructions for charitable estate?

Information that must be reported on instructions for charitable estate includes the specific assets or percentage of the estate that will be donated, the names of the charitable organizations, and any specific conditions or restrictions.

Fill out your instructions for charitable estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Charitable Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.