Get the free Tobacco Tax - Cowichan Tribes

Show details

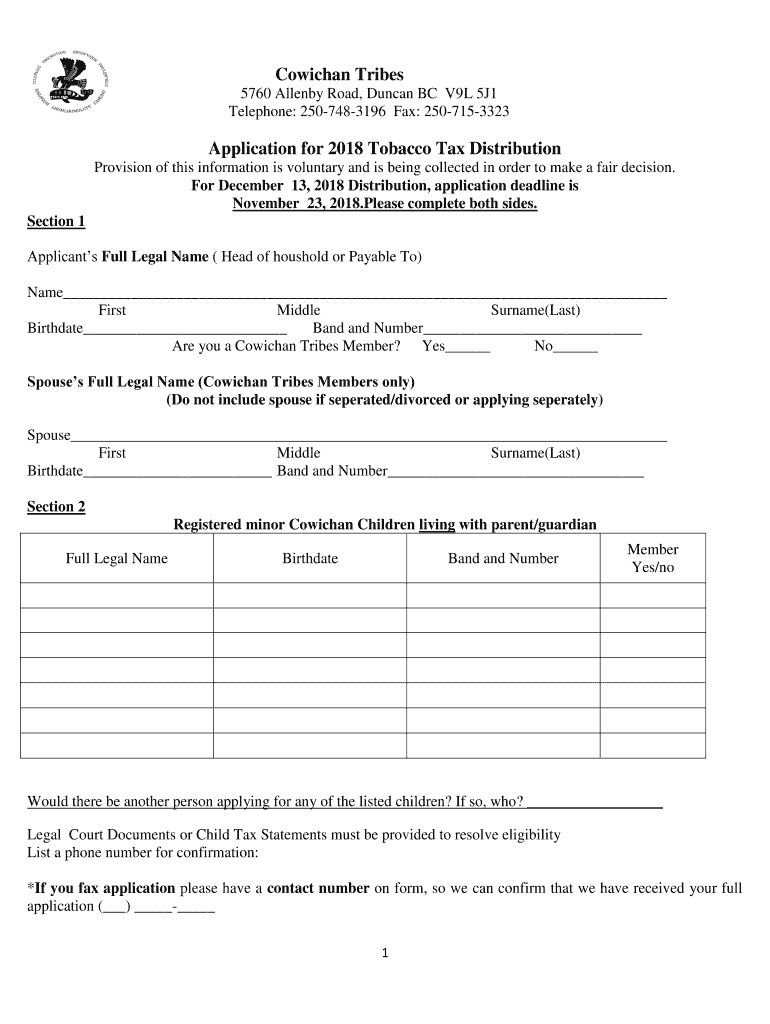

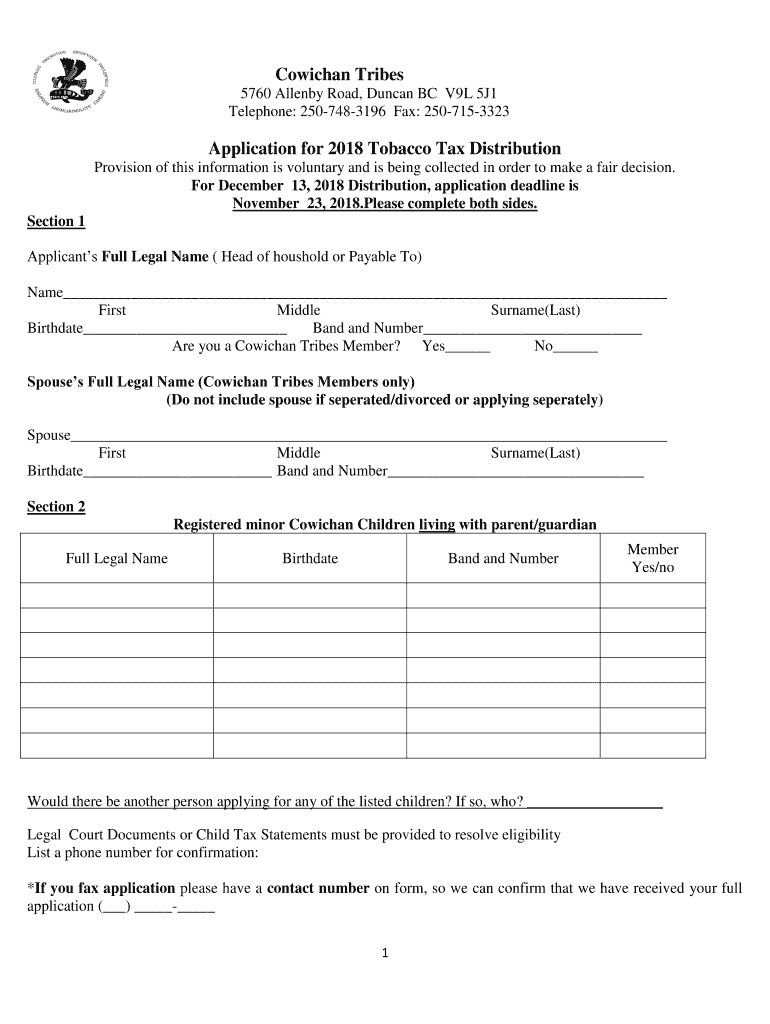

Conical Tribes 5760 Allen by Road, Duncan BC V9L 5J1 Telephone: 2507483196 Fax: 2507153323Application for 2018 Tobacco Tax Distribution Provision of this information is voluntary and is being collected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tobacco tax - cowichan

Edit your tobacco tax - cowichan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tobacco tax - cowichan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tobacco tax - cowichan online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tobacco tax - cowichan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tobacco tax - cowichan

How to fill out tobacco tax - cowichan

01

The first step to fill out the tobacco tax form in Cowichan is to gather all the necessary information and documents, such as the quantity of tobacco products sold, the total sales amount, and the applicable tax rates. This information can usually be obtained from the local tax authority.

02

Next, carefully read through the instructions provided on the tobacco tax form. These instructions will outline the specific details required and any additional documents that may need to be attached.

03

Fill out the form accurately and legibly. Ensure that all required fields are completed and that the information provided is correct. Double-check for any errors or omissions before submitting the form.

04

If required, calculate the total amount of tax owed based on the provided tax rates and the sales amount of tobacco products. Include this tax amount in the appropriate section of the form.

05

Attach any required supporting documents, such as sales invoices or purchase records, as specified in the instructions.

06

Review the completed form and supporting documents to ensure everything is in order. Make copies of the form and documents for your records, if necessary.

07

Submit the completed form and any accompanying documents to the designated tax authority. Follow any specified submission methods or deadlines to avoid penalties or delays in processing.

08

Keep a copy of the submitted form and all related documents for future reference or potential audits.

09

If you have any questions or need additional assistance, contact the local tax authority's customer service for clarification or guidance.

Who needs tobacco tax - cowichan?

01

Various individuals and entities may need to pay tobacco tax in Cowichan. This typically includes:

02

- Retailers or sellers of tobacco products

03

- Wholesalers or distributors of tobacco products

04

- Manufacturers or importers of tobacco products

05

- Individuals or businesses involved in the production or sale of tobacco products within the jurisdiction

06

It is important to consult the specific regulations and guidelines provided by the local tax authority to determine if you fall within the scope of those who need to pay tobacco tax in Cowichan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tobacco tax - cowichan in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tobacco tax - cowichan and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send tobacco tax - cowichan for eSignature?

When your tobacco tax - cowichan is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit tobacco tax - cowichan straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tobacco tax - cowichan.

What is tobacco tax - cowichan?

Tobacco tax in Cowichan is a tax imposed on the sale or distribution of tobacco products in that region.

Who is required to file tobacco tax - cowichan?

Any individual or business involved in the sale or distribution of tobacco products in Cowichan is required to file the tobacco tax.

How to fill out tobacco tax - cowichan?

To fill out the tobacco tax in Cowichan, individuals or businesses must provide information regarding the sale or distribution of tobacco products, including quantities sold and applicable taxes.

What is the purpose of tobacco tax - cowichan?

The purpose of the tobacco tax in Cowichan is to generate revenue for the government and discourage the consumption of tobacco products.

What information must be reported on tobacco tax - cowichan?

Information such as quantities of tobacco products sold, sales revenue, applicable taxes, and other relevant details must be reported on the tobacco tax form in Cowichan.

Fill out your tobacco tax - cowichan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tobacco Tax - Cowichan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.