Get the free Charities and giving - Canada.ca - Canada Revenue Agency

Show details

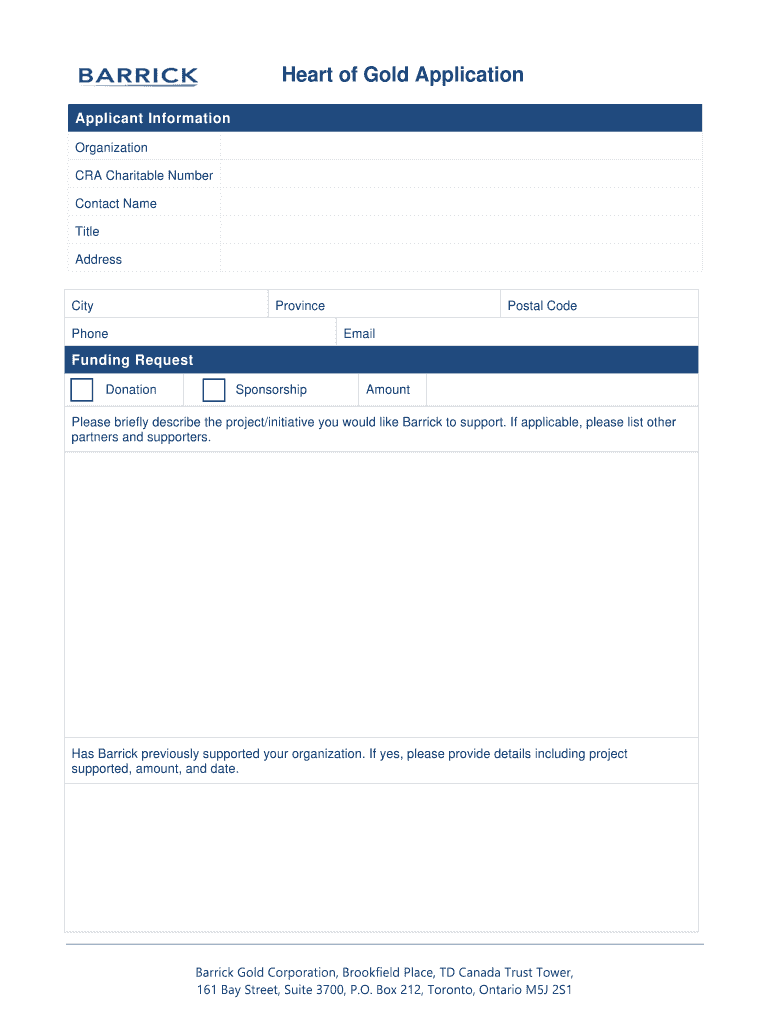

Heart of Gold Application

Applicant Information

Organization

CRA Charitable Number

Contact Name

Title

AddressCityProvincePhonePostal Code

EmailFunding Request

DonationSponsorshipAmountPlease briefly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities and giving

Edit your charities and giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities and giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charities and giving online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charities and giving. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities and giving

How to fill out charities and giving

01

Step 1: Research and select a charity or organization that aligns with your values and causes you are passionate about.

02

Step 2: Read and understand the guidelines provided by the charity for filling out the donation form.

03

Step 3: Gather all the necessary information required for filling out the form, such as your personal details, donation amount, and payment method.

04

Step 4: Start filling out the donation form by entering your personal information accurately.

05

Step 5: Specify the donation amount you wish to contribute and select the preferred payment method.

06

Step 6: Review all the entered information to ensure its accuracy and make any necessary corrections.

07

Step 7: Make the donation by submitting the filled-out form and completing the payment process.

08

Step 8: Once the donation is successfully processed, you may receive a confirmation email or receipt from the charity.

09

Step 9: Keep a record of your donation and consider following up with the charity to learn about the impact of your contribution.

Who needs charities and giving?

01

Charities and giving are beneficial to various individuals and groups, including:

02

- Those facing poverty or socio-economic challenges, who rely on charitable contributions to meet their basic needs.

03

- Vulnerable populations, such as children, elderly, and differently-abled individuals, who require support and assistance.

04

- Non-profit organizations and community initiatives that depend on donations to sustain their operations and fund their programs.

05

- Environmental conservation efforts and wildlife protection organizations that work to preserve the planet for future generations.

06

- Medical research institutions and healthcare organizations in their pursuit of finding cures and providing better healthcare options.

07

- Education-related charities and scholarship funds, which help empower individuals through access to quality education.

08

In summary, charities and giving are needed by those in need, organizations striving to make a positive impact, and the overall betterment of society.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit charities and giving from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your charities and giving into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute charities and giving online?

With pdfFiller, you may easily complete and sign charities and giving online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit charities and giving on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as charities and giving. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is charities and giving?

Charities and giving refer to the act of donating money, goods, or services to charitable organizations or individuals in need.

Who is required to file charities and giving?

Non-profit organizations and individuals who make charitable donations are required to file charities and giving.

How to fill out charities and giving?

Charities and giving can be filled out by providing information on the donations made, including the amount donated, recipient organization, and purpose of the donation.

What is the purpose of charities and giving?

The purpose of charities and giving is to support charitable causes, help those in need, and make a positive impact on society.

What information must be reported on charities and giving?

Information that must be reported on charities and giving includes the amount of donations made, recipient organizations, and any benefits received in return for the donation.

Fill out your charities and giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities And Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.