Get the free Top 10 Best Tax Services near Juneau, AK 99801 - Last ...

Show details

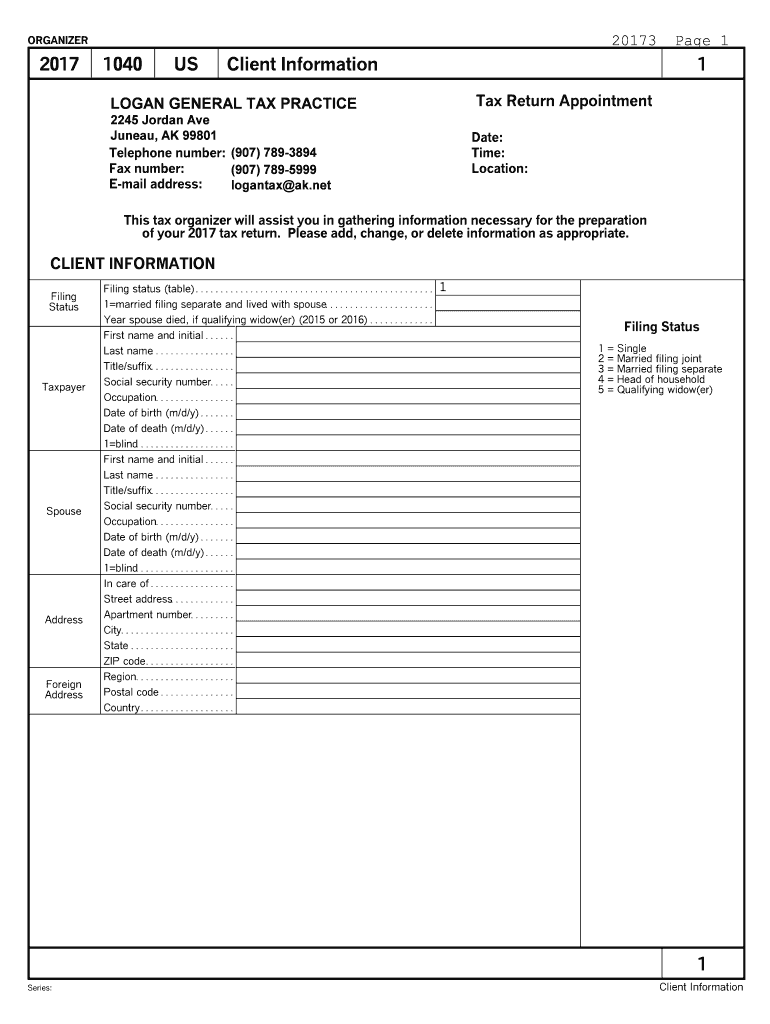

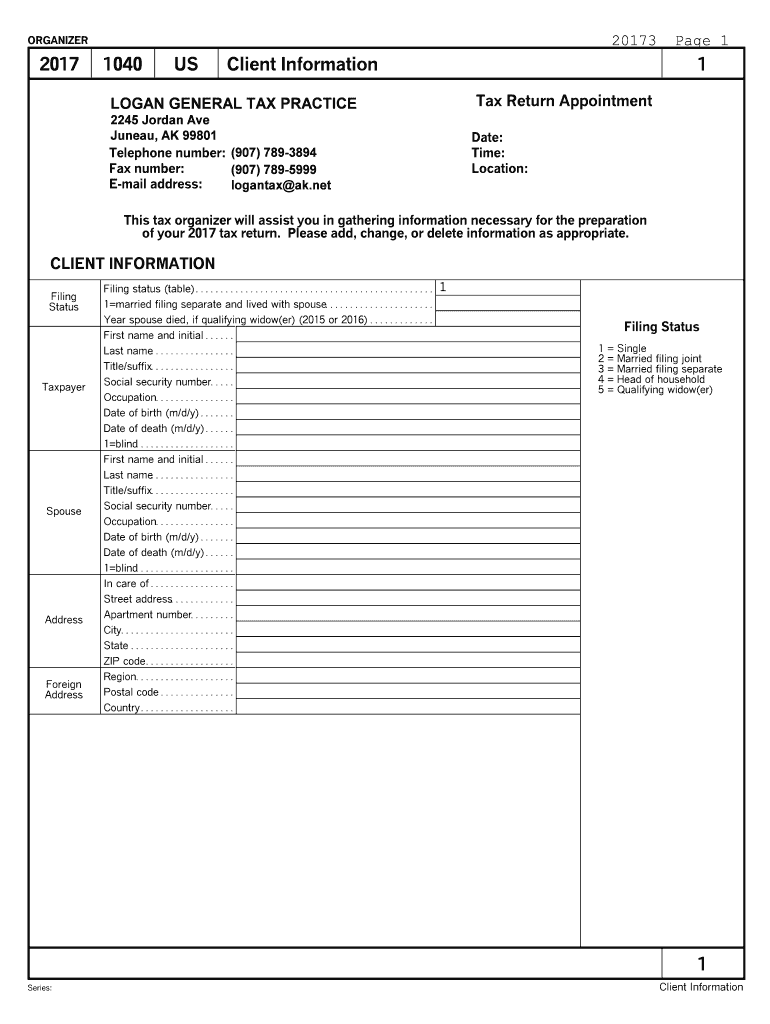

20173ORGANIZER20171040USClient Information Page 11 Tax Return AppointmentLOGAN GENERAL TAX PRACTICE 2245 Jordan Ave Juneau, AK 99801 Telephone number: (907) 7893894 Fax number: (907) 7895999 Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign top 10 best tax

Edit your top 10 best tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your top 10 best tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit top 10 best tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit top 10 best tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out top 10 best tax

How to fill out top 10 best tax

01

Determine the criteria for the top 10 best tax. This could include factors such as simplicity, fairness, efficiency, and economic impact.

02

Research and gather information on different tax systems and policies in various countries or regions.

03

Analyze the collected data and evaluate each tax system based on the predetermined criteria.

04

Rank the tax systems from 1 to 10, with 1 being the best tax according to the chosen criteria.

05

Create a detailed report or list outlining the top 10 best tax, including the reasons for their rankings.

06

Review and update the list periodically to reflect any changes in tax laws or policies.

07

Consider consulting experts or economists to validate the findings and ensure accuracy.

08

Publish the list or report for public knowledge and awareness of the best tax systems.

09

Use the list as a reference or guide for policymakers, governments, or individuals interested in improving their tax systems.

10

Continuously monitor and evaluate tax systems to identify potential candidates for future top 10 best tax rankings.

Who needs top 10 best tax?

01

Researchers studying taxation policies and systems

02

Government officials responsible for tax reforms and improvements

03

Economists advising on tax policy and its impact on the economy

04

Individuals or businesses seeking to understand and compare tax systems across different jurisdictions

05

Academics teaching or researching tax law and policy

06

Tax professionals or consultants looking for insights into best practices for tax systems

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in top 10 best tax without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing top 10 best tax and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out top 10 best tax using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign top 10 best tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete top 10 best tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your top 10 best tax. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is top 10 best tax?

Top 10 best tax is a ranking of the top 10 most advantageous tax strategies.

Who is required to file top 10 best tax?

Anyone looking to optimize their tax savings can benefit from filing a top 10 best tax.

How to fill out top 10 best tax?

To fill out a top 10 best tax form, you must carefully review and select the most beneficial tax strategies for your individual situation.

What is the purpose of top 10 best tax?

The purpose of top 10 best tax is to help individuals and businesses minimize their tax liability.

What information must be reported on top 10 best tax?

On a top 10 best tax form, you typically report your income, deductions, credits, and any other relevant tax information.

Fill out your top 10 best tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Top 10 Best Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.