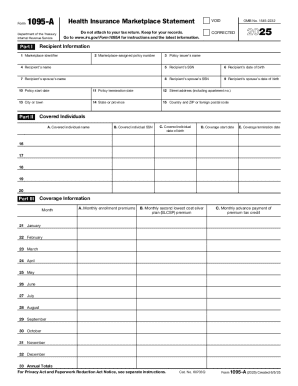

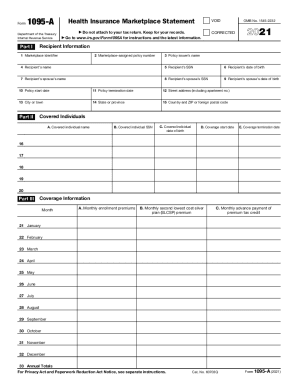

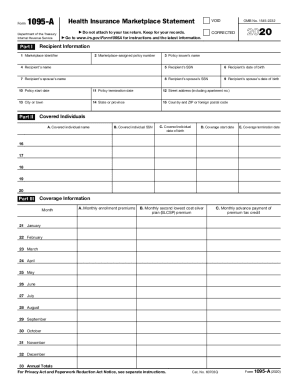

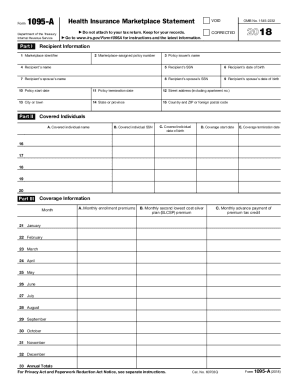

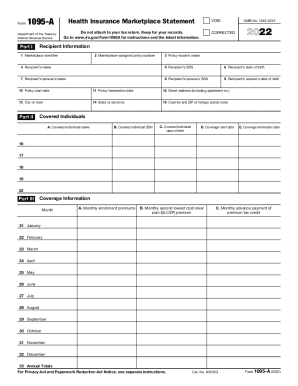

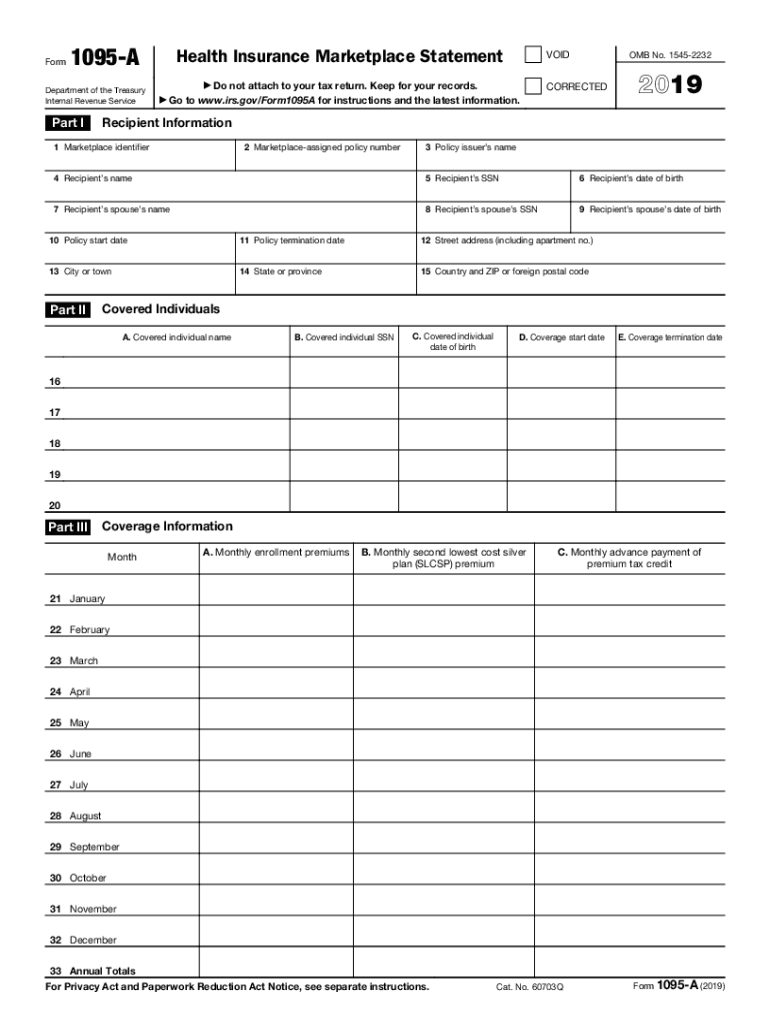

IRS 1095-A 2019 free printable template

FAQ about IRS 1095-A

What should I do if I realize there is a mistake on my submitted IRS 1095-A?

If you find an error on your submitted IRS 1095-A, you should amend it as soon as possible. To do this, you'll need to obtain a new, corrected form and follow the appropriate amendment procedures outlined by the IRS. Make sure to keep a copy of both the original and the corrected forms for your records.

How can I track the status of my IRS 1095-A filing?

To track the status of your filed IRS 1095-A, you can use the IRS online tools or contact their customer service for assistance. Common e-file rejection codes can help you identify any issues, and knowing how to address these can expedite your filing process. Keeping records and confirmations of your submissions is also essential for verification.

Are e-signatures acceptable for filing IRS 1095-A?

Yes, e-signatures are generally accepted for IRS 1095-A filings, provided they meet certain criteria set by the IRS. Make sure that your e-signature system complies with the IRS guidelines to ensure your filing is valid. Proper documentation of consent and signatures is crucial for legal purposes.

What are the common errors to avoid when filing the IRS 1095-A?

Common errors when filing the IRS 1095-A include incorrect taxpayer information, failing to report all required coverage months, and not matching information with IRS records. Double-checking your entries and understanding the reporting requirements can help minimize these mistakes, ensuring accuracy and compliance.

What steps should I take if I receive an audit notice related to my IRS 1095-A?

If you receive an audit notice concerning your IRS 1095-A, promptly gather all necessary documentation and correspondence related to your filing. Respond to the audit request with clear explanations, and consult a tax professional if needed to understand your rights and obligations. Being proactive can help resolve any issues more efficiently.

See what our users say