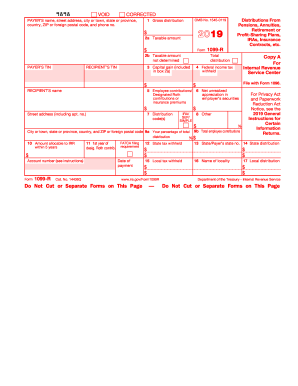

IRS 1040 Schedule R 2019 free printable template

Instructions and Help about IRS 1040 Schedule R

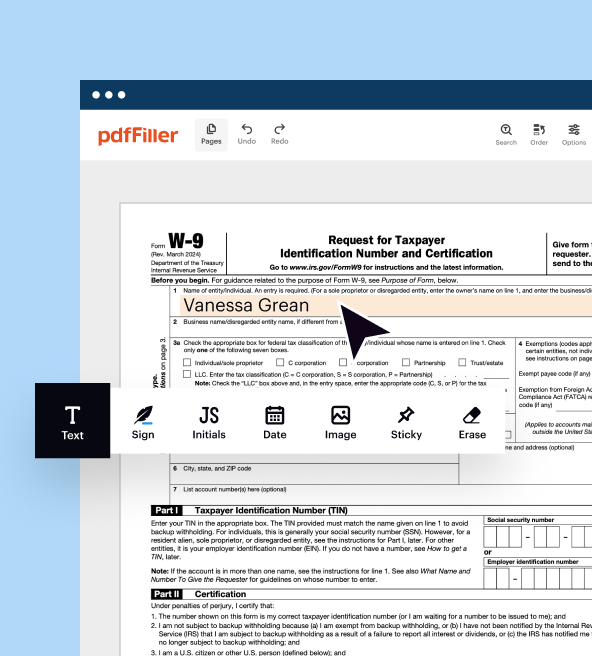

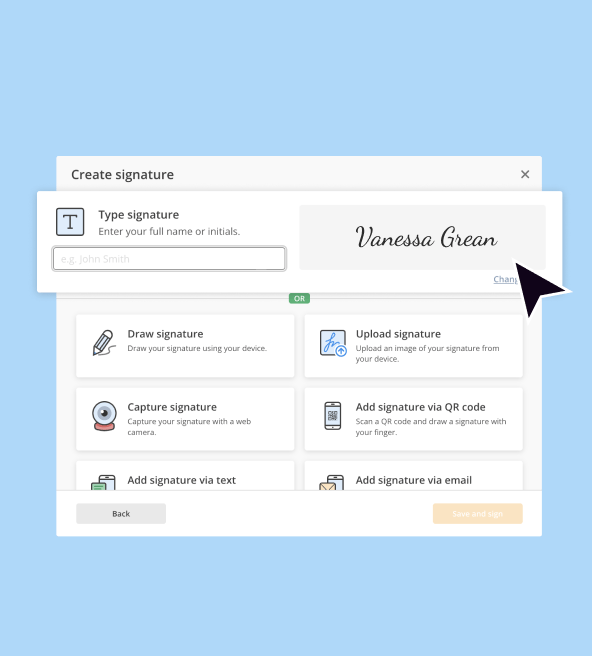

How to edit IRS 1040 Schedule R

How to fill out IRS 1040 Schedule R

About IRS 1040 Schedule R 2019 previous version

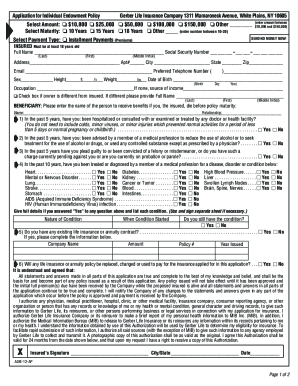

What is IRS 1040 Schedule R?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

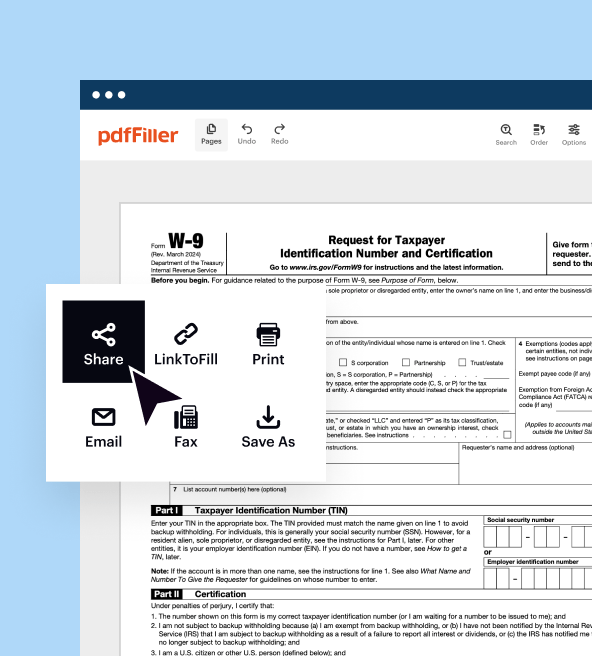

Where do I send the form?

FAQ about IRS 1040 Schedule R

What should I do if I make an error on my schedule 1040 2019?

If you discover a mistake after submitting your schedule 1040 2019, you can file an amended return using Form 1040-X. Be sure to clearly indicate the changes, and attach any necessary documentation to support your amendments. Corrections can help ensure that you receive the appropriate refunds or avoid penalties.

How can I track the status of my schedule 1040 2019 submission?

To check the status of your schedule 1040 2019, you can use the IRS’s 'Where's My Refund?' tool if you e-filed and are expecting a refund. It is important to enter the exact details as required. If you filed by mail, processing times may be longer, and you won't be able to track until it is acknowledged by the IRS.

What technical requirements should I be aware of when e-filing my schedule 1040 2019?

When e-filing your schedule 1040 2019, ensure that your software is compatible with IRS e-file standards. You should also have a reliable internet connection, and it’s recommended to use up-to-date browsers. Make sure to review any specific requirements set by your e-filing software concerning file types and sizes.

Can I file my schedule 1040 2019 on behalf of someone else?

Yes, if you have the proper authorization, you may file schedule 1040 2019 on someone’s behalf. This typically requires a Power of Attorney (POA) document granting you the legal authority to act for the taxpayer. Ensure you have all the pertinent information and signatures required for submission.

What should I do if my schedule 1040 2019 e-file submission is rejected?

In case your schedule 1040 2019 submission is rejected, review the error codes provided by the IRS to understand the reason for rejection. Correct the mistakes indicated and resubmit your return as soon as possible. If you face ongoing issues, consider contacting your e-filing software's support for further assistance.

See what our users say