AK Municipality of Anchorage Room Tax Return (formerly 41-004) 2020 free printable template

Show details

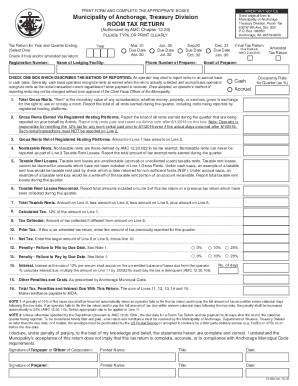

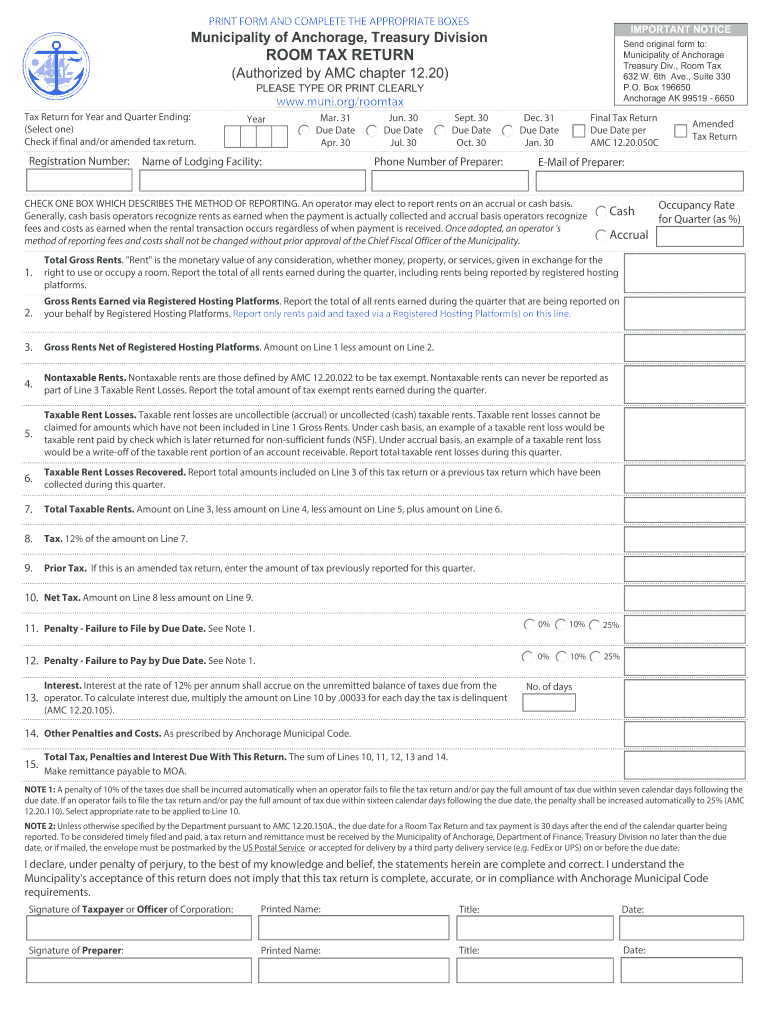

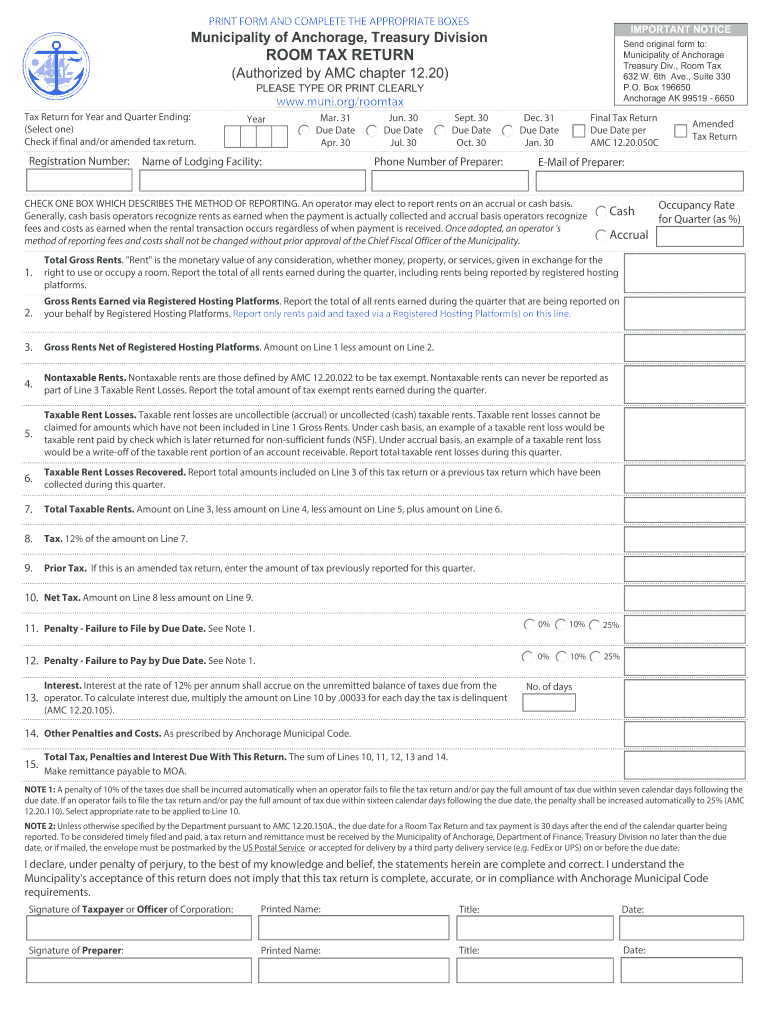

Amount on Line 1 less amount on Line 2. Nontaxable Rents. Nontaxable rents are those defined by AMC 12. 20. 022 to be tax exempt. Nontaxable rents can never be reported as part of Line 3 Taxable Rent Losses. Report the total amount of tax exempt rents earned during the quarter. Taxable Rent Losses. Taxable rent losses are uncollectible accrual or uncollected cash taxable rents. Under accrual basis an example of a taxable rent loss would be a write-off of the taxable rent portion of an account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AK Municipality of Anchorage Room Tax Return

Edit your AK Municipality of Anchorage Room Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AK Municipality of Anchorage Room Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AK Municipality of Anchorage Room Tax Return online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AK Municipality of Anchorage Room Tax Return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Municipality of Anchorage Room Tax Return (formerly 41-004) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AK Municipality of Anchorage Room Tax Return

How to fill out AK Municipality of Anchorage Room Tax Return (formerly

01

Start by downloading the AK Municipality of Anchorage Room Tax Return form from the official website.

02

Fill in your business name and contact information at the top of the form.

03

Indicate the period for which you are filing the tax return.

04

Calculate the total number of taxable rooms rented during the reporting period.

05

Multiply the total taxable rooms by the applicable room tax rate to determine the total room tax due.

06

Include any adjustments or exemptions, if applicable, in the designated section.

07

Complete any additional required information, such as payment details.

08

Review the filled form for accuracy before submission.

09

Submit the form by the deadline along with the payment for the room tax due.

Who needs AK Municipality of Anchorage Room Tax Return (formerly?

01

Any business or individual that rents out rooms or accommodations in Anchorage, Alaska, including hotels, motels, vacation rentals, and bed and breakfasts.

02

Businesses that have a total gross rental income exceeding a specified threshold as defined by the Municipality of Anchorage.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior property tax exemption in Alaska?

Under AS 29.45. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a disabled veteran with a service connected disability of 50% or more.

What are property taxes in Anchorage Alaska?

Anchorage Property Taxes The city of Anchorage is home to roughly half of Alaska's total population. It also has one of the highest property taxes in the state. Without claiming any exemptions, homeowners in Anchorage would pay a property tax rate of 1.41%, which is well above the national average.

Do seniors pay property taxes in Alaska?

Alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and disabled veterans (50% or more service connected disability).

What is the residential exemption in Anchorage?

Anchorage Proposition No. 12 was on the ballot as a referral in Anchorage on April 4, 2023. It was approved. A "yes" vote supported increasing real property tax exemption from the current 20% to 40% of the assessed value, up to $75,000.

What is the property tax exemption in Anchorage?

Up to $150,000 of the assessed value may be exempt for; Property owned and occupied as the primary residence and permanent place of abode by a (Senior) resident 65 years of age or older, or A resident at least 60 years old who is the widow or widower of a person who qualified as a Senior.

What is the EIN number for Municipality of Anchorage?

State of Alaska EIN 92-6001185 beneath “For Official State of Alaska Use Only”.

What is the fuel tax in Anchorage Alaska?

The intial effective date for the motor fuel tax was March 1, 2018. The tax on motor fuel began as $0.10 per gallon and is reviewed for adjustment every five years. The tax is to be paid by the dealer or user to the Municipality on the volume of motor fuel sold, transferred, or used and is imposed only once.

What is the sales tax in Anchorage municipality?

The minimum combined 2023 sales tax rate for Anchorage Municipality County, Alaska is 0%. This is the total of state and county sales tax rates. The Alaska state sales tax rate is currently 0%. The Anchorage Municipality County sales tax rate is 0%.

What is the municipality of Anchorage motor fuel tax?

What is the municipal motor fuel tax rate? The tax rate is ten cents ($0.10) per gallon on motor fuel that is purchased, sold, or transferred within the Municipality of Anchorage.

What are the property taxes in Anchorage Alaska?

Anchorage Property Taxes The city of Anchorage is home to roughly half of Alaska's total population. It also has one of the highest property taxes in the state. Without claiming any exemptions, homeowners in Anchorage would pay a property tax rate of 1.41%, which is well above the national average.

What age do you stop paying property taxes in Alaska?

Applicant must be 65 years of age on or before December 31st of the prior year for which the exemption is sought. provide proof of age. factor affecting qualification for the exemption must file each year by March 15th.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AK Municipality of Anchorage Room Tax Return from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AK Municipality of Anchorage Room Tax Return, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit AK Municipality of Anchorage Room Tax Return on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing AK Municipality of Anchorage Room Tax Return.

Can I edit AK Municipality of Anchorage Room Tax Return on an Android device?

You can edit, sign, and distribute AK Municipality of Anchorage Room Tax Return on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is AK Municipality of Anchorage Room Tax Return (formerly)?

The AK Municipality of Anchorage Room Tax Return is a form used to report and remit local room taxes on lodging rentals within the Municipality of Anchorage.

Who is required to file AK Municipality of Anchorage Room Tax Return (formerly)?

All businesses that provide lodging accommodations, including hotels, motels, and short-term rental operators, are required to file the AK Municipality of Anchorage Room Tax Return.

How to fill out AK Municipality of Anchorage Room Tax Return (formerly)?

To fill out the AK Municipality of Anchorage Room Tax Return, you must provide details about your lodging business, including total rental income, taxes collected, and any applicable deductions. The form typically requires basic business information and tax calculation.

What is the purpose of AK Municipality of Anchorage Room Tax Return (formerly)?

The purpose of the AK Municipality of Anchorage Room Tax Return is to collect local room taxes that help fund public services and infrastructure in Anchorage, including tourism-related initiatives.

What information must be reported on AK Municipality of Anchorage Room Tax Return (formerly)?

The information that must be reported includes total gross rental income, total room taxes collected, allowable deductions, and any payments made throughout the reporting period.

Fill out your AK Municipality of Anchorage Room Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AK Municipality Of Anchorage Room Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.