AK Municipality of Anchorage Room Tax Return (formerly 41-004) 2019 free printable template

Show details

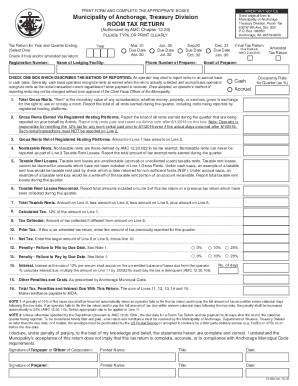

Amount on Line 1 less amount on Line 2. Nontaxable Rents. Nontaxable rents are those defined by AMC 12. 20. 022 to be tax exempt. Nontaxable rents can never be reported as part of Line 3 Taxable Rent Losses. Report the total amount of tax exempt rents earned during the quarter. Taxable Rent Losses. Taxable rent losses are uncollectible accrual or uncollected cash taxable rents. Under accrual basis an example of a taxable rent loss would be a write-off of the taxable rent portion of an account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AK Municipality of Anchorage Room Tax Return

Edit your AK Municipality of Anchorage Room Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AK Municipality of Anchorage Room Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AK Municipality of Anchorage Room Tax Return online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AK Municipality of Anchorage Room Tax Return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Municipality of Anchorage Room Tax Return (formerly 41-004) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AK Municipality of Anchorage Room Tax Return

How to fill out AK Municipality of Anchorage Room Tax Return (formerly

01

Obtain the AK Municipality of Anchorage Room Tax Return form from the official website or local tax office.

02

Fill in your business information, including the name, address, and tax identification number.

03

Enter the reporting period for which you are filing the return.

04

Calculate the total room revenue for the period.

05

Determine the applicable room tax rate and calculate the total tax due.

06

Include any deductions or exemptions if applicable.

07

Provide your contact information for any follow-up inquiries.

08

Review the form for accuracy and completeness.

09

Submit the completed form by the designated due date either online, by mail, or in person.

Who needs AK Municipality of Anchorage Room Tax Return (formerly?

01

Businesses that provide lodging accommodations, such as hotels, motels, and vacation rentals in Anchorage.

02

Individuals or entities that manage rental properties that are subject to the room tax.

03

Anyone who collects room tax from guests on behalf of the Municipality of Anchorage.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior property tax exemption in Alaska?

Under AS 29.45. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a disabled veteran with a service connected disability of 50% or more.

What are property taxes in Anchorage Alaska?

Anchorage Property Taxes The city of Anchorage is home to roughly half of Alaska's total population. It also has one of the highest property taxes in the state. Without claiming any exemptions, homeowners in Anchorage would pay a property tax rate of 1.41%, which is well above the national average.

Do seniors pay property taxes in Alaska?

Alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and disabled veterans (50% or more service connected disability).

What is the residential exemption in Anchorage?

Anchorage Proposition No. 12 was on the ballot as a referral in Anchorage on April 4, 2023. It was approved. A "yes" vote supported increasing real property tax exemption from the current 20% to 40% of the assessed value, up to $75,000.

What is the property tax exemption in Anchorage?

Up to $150,000 of the assessed value may be exempt for; Property owned and occupied as the primary residence and permanent place of abode by a (Senior) resident 65 years of age or older, or A resident at least 60 years old who is the widow or widower of a person who qualified as a Senior.

What is the EIN number for Municipality of Anchorage?

State of Alaska EIN 92-6001185 beneath “For Official State of Alaska Use Only”.

What is the fuel tax in Anchorage Alaska?

The intial effective date for the motor fuel tax was March 1, 2018. The tax on motor fuel began as $0.10 per gallon and is reviewed for adjustment every five years. The tax is to be paid by the dealer or user to the Municipality on the volume of motor fuel sold, transferred, or used and is imposed only once.

What is the sales tax in Anchorage municipality?

The minimum combined 2023 sales tax rate for Anchorage Municipality County, Alaska is 0%. This is the total of state and county sales tax rates. The Alaska state sales tax rate is currently 0%. The Anchorage Municipality County sales tax rate is 0%.

What is the municipality of Anchorage motor fuel tax?

What is the municipal motor fuel tax rate? The tax rate is ten cents ($0.10) per gallon on motor fuel that is purchased, sold, or transferred within the Municipality of Anchorage.

What are the property taxes in Anchorage Alaska?

Anchorage Property Taxes The city of Anchorage is home to roughly half of Alaska's total population. It also has one of the highest property taxes in the state. Without claiming any exemptions, homeowners in Anchorage would pay a property tax rate of 1.41%, which is well above the national average.

What age do you stop paying property taxes in Alaska?

Applicant must be 65 years of age on or before December 31st of the prior year for which the exemption is sought. provide proof of age. factor affecting qualification for the exemption must file each year by March 15th.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AK Municipality of Anchorage Room Tax Return to be eSigned by others?

Once your AK Municipality of Anchorage Room Tax Return is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the AK Municipality of Anchorage Room Tax Return in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your AK Municipality of Anchorage Room Tax Return and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit AK Municipality of Anchorage Room Tax Return on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute AK Municipality of Anchorage Room Tax Return from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is AK Municipality of Anchorage Room Tax Return?

The AK Municipality of Anchorage Room Tax Return is a form that lodging operators must complete to report and remit room taxes collected from guests staying at their facilities within the Municipality of Anchorage.

Who is required to file AK Municipality of Anchorage Room Tax Return?

All lodging operators, including hotels, motels, vacation rentals, and other types of accommodations that collect room taxes from guests in the Municipality of Anchorage, are required to file the AK Municipality of Anchorage Room Tax Return.

How to fill out AK Municipality of Anchorage Room Tax Return?

To fill out the AK Municipality of Anchorage Room Tax Return, operators must provide details such as their business information, total taxable revenue from room rentals, the total room tax collected, and any deductions allowed. The return must be signed and submitted by the due date.

What is the purpose of AK Municipality of Anchorage Room Tax Return?

The purpose of the AK Municipality of Anchorage Room Tax Return is to ensure compliance with local tax regulations by collecting room taxes that fund municipal services and tourism-related programs.

What information must be reported on AK Municipality of Anchorage Room Tax Return?

The information that must be reported on the AK Municipality of Anchorage Room Tax Return includes the operator's name and address, total gross receipts from room rentals, total tax collected, and any exemptions or deductions claimed.

Fill out your AK Municipality of Anchorage Room Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AK Municipality Of Anchorage Room Tax Return is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.