CT REG-3-MC 2019 free printable template

Show details

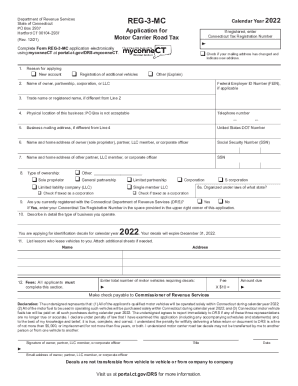

REG3MCDepartment of Revenue Services

State of Connecticut

PO Box 2937

Hartford CT 061042937Calendar Year 2019Application for

Motor Carrier Road Tax(Rev. 12/18)If registered, enter

Connecticut Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT REG-3-MC

Edit your CT REG-3-MC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT REG-3-MC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT REG-3-MC online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT REG-3-MC. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT REG-3-MC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT REG-3-MC

How to fill out CT REG-3-MC

01

Obtain the CT REG-3-MC form from the Connecticut Department of Revenue Services website or office.

02

Provide your business legal name and trade name (if applicable) in the designated fields.

03

Enter your federal Employer Identification Number (EIN) or Social Security Number (if you're a sole proprietor).

04

Fill in the business address and contact information accurately.

05

Indicate the type of business entity (e.g., corporation, LLC, etc.) in the appropriate section.

06

Complete the section related to the reason for filling out the form.

07

Review the information for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form as per the instructions provided, either online or by mail.

Who needs CT REG-3-MC?

01

Any business operating in Connecticut that needs to register for sales and use tax or other tax-related purposes.

02

Businesses that have recently formed and need to obtain a tax registration.

03

Businesses that have changed their structure or ownership and need to update their tax registration.

Fill

form

: Try Risk Free

People Also Ask about

Do local trucks need IFTA?

Yes, federal law requires that commercial truck companies abide by IFTA regulations.

Is Connecticut part of IFTA?

The State of Connecticut is a member of the International Fuel Tax Agreement (IFTA).

How much does it cost to get an IFTA in Florida?

There is no fee for the annual IFTA license. IFTA decals are $4.00 per set (pair).

How do I get my IFTA stickers in CT?

To register for the first time as an International Fuel Tax Agreement (IFTA) licensee in Connecticut, you must register with the Department of Revenue Services (DRS) as a Connecticut business and complete the IFTA/Motor Carrier registration through myconneCT.

Do I need IFTA in Florida?

1. Who Is Required To Register for Florida IFTA? A qualified motor vehicle is a motor vehicle used, designed, or maintained for transportation of persons or property having: Two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms; or.

What is the phone number for the IFTA in CT?

If you have any questions about the application, you may contact the DRS, Registration Unit between 8:00 a.m. and 5:00 p.m., weekdays, at 860-297-4870.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CT REG-3-MC?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CT REG-3-MC in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit CT REG-3-MC online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your CT REG-3-MC and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete CT REG-3-MC on an Android device?

Complete your CT REG-3-MC and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CT REG-3-MC?

CT REG-3-MC is a tax registration form used in Connecticut for businesses that wish to register as a seller, including those that may be required to collect state taxes.

Who is required to file CT REG-3-MC?

Any business entity or organization that intends to engage in selling tangible personal property or taxable services in Connecticut is required to file CT REG-3-MC.

How to fill out CT REG-3-MC?

To fill out CT REG-3-MC, provide accurate business information including the legal name, address, type of ownership, and details about the type of business activity for tax purposes in the designated sections of the form.

What is the purpose of CT REG-3-MC?

The purpose of CT REG-3-MC is to officially register a business for tax purposes with the state of Connecticut, ensuring compliance with state tax laws.

What information must be reported on CT REG-3-MC?

CT REG-3-MC requires reporting information such as the business name, address, federal employer identification number (FEIN), type of business entity, the products or services offered, and the owner's information.

Fill out your CT REG-3-MC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT REG-3-MC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.