CT REG-3-MC 2022-2025 free printable template

Show details

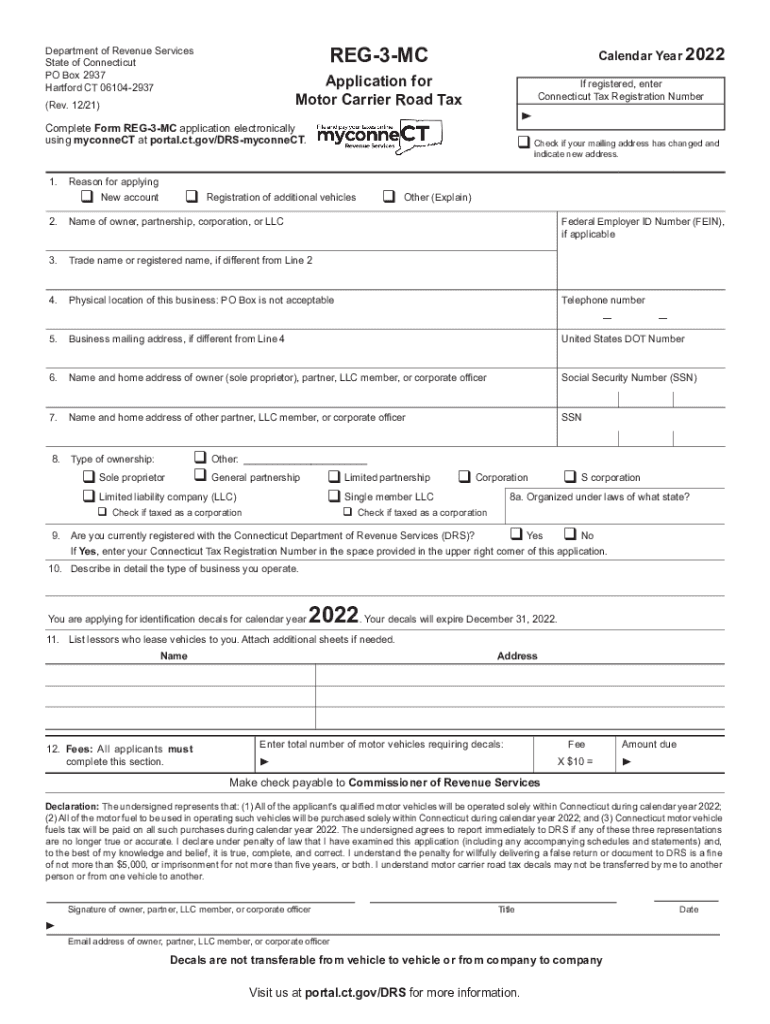

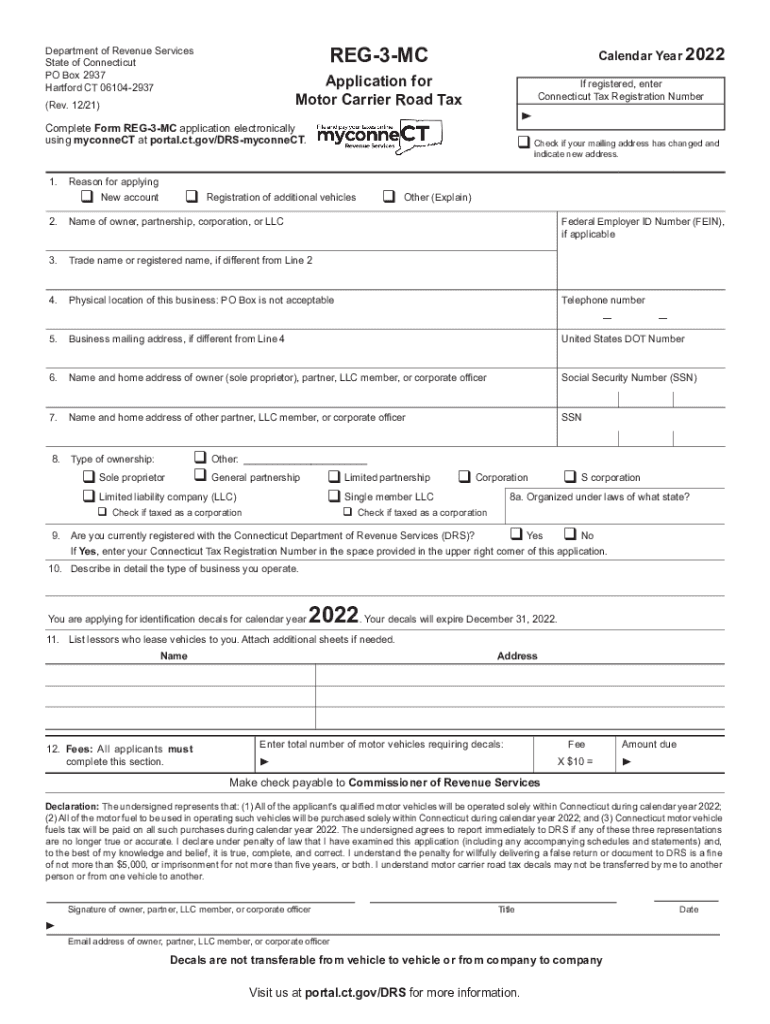

REG3MCDepartment of Revenue Services State of Connecticut PO Box 2937 Hartford CT 061042937Calendar Year 2022Application for Motor Carrier Road Tax(Rev. 12/21)If registered, enter Connecticut Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ifta sticker ct

Edit your ifta sticker ct form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta sticker ct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ifta sticker ct online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ifta sticker ct. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT REG-3-MC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ifta sticker ct

How to fill out CT REG-3-MC

01

Obtain the CT REG-3-MC form from the Connecticut Department of Revenue Services (DRS) website.

02

Fill in the name of the business or entity in the designated section.

03

Provide the physical and mailing addresses of the business.

04

Enter the business's federal Employer Identification Number (EIN) or Social Security Number (SSN).

05

Select the appropriate type of business structure (e.g., corporation, partnership, sole proprietorship).

06

Complete the sections related to ownership, including names and addresses of the owners and responsible parties.

07

Indicate the date the business started or is expected to start operations.

08

Review all filled-out information for accuracy and completeness.

09

Sign and date the form to certify the information provided.

10

Submit the completed CT REG-3-MC form to the Connecticut DRS either by mail or electronically based on provided instructions.

Who needs CT REG-3-MC?

01

Any business entity operating or planning to operate in Connecticut that needs to register for state taxes.

02

Sole proprietors, partnerships, corporations, and LLCs that require a tax registration.

03

Businesses applying for sales tax permits or employee withholding tax registration.

Fill

form

: Try Risk Free

People Also Ask about

Do local trucks need IFTA?

Yes, federal law requires that commercial truck companies abide by IFTA regulations.

Is Connecticut part of IFTA?

The State of Connecticut is a member of the International Fuel Tax Agreement (IFTA).

How much does it cost to get an IFTA in Florida?

There is no fee for the annual IFTA license. IFTA decals are $4.00 per set (pair).

How do I get my IFTA stickers in CT?

To register for the first time as an International Fuel Tax Agreement (IFTA) licensee in Connecticut, you must register with the Department of Revenue Services (DRS) as a Connecticut business and complete the IFTA/Motor Carrier registration through myconneCT.

Do I need IFTA in Florida?

1. Who Is Required To Register for Florida IFTA? A qualified motor vehicle is a motor vehicle used, designed, or maintained for transportation of persons or property having: Two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms; or.

What is the phone number for the IFTA in CT?

If you have any questions about the application, you may contact the DRS, Registration Unit between 8:00 a.m. and 5:00 p.m., weekdays, at 860-297-4870.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ifta sticker ct online?

pdfFiller has made it simple to fill out and eSign ifta sticker ct. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit ifta sticker ct straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ifta sticker ct.

How do I complete ifta sticker ct on an Android device?

Complete your ifta sticker ct and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CT REG-3-MC?

CT REG-3-MC is a form used in Connecticut for the registration of businesses that operate as a limited liability company (LLC).

Who is required to file CT REG-3-MC?

Businesses that are forming a limited liability company (LLC) or that are doing business in Connecticut are required to file CT REG-3-MC.

How to fill out CT REG-3-MC?

To fill out CT REG-3-MC, businesses need to provide their name, principal office address, and details about the members or managers, among other required information.

What is the purpose of CT REG-3-MC?

The purpose of CT REG-3-MC is to officially register an LLC with the state of Connecticut and ensure compliance with state business regulations.

What information must be reported on CT REG-3-MC?

Information that must be reported on CT REG-3-MC includes the name of the LLC, address, duration, names and addresses of members or managers, and any other required business identification details.

Fill out your ifta sticker ct online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Sticker Ct is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.