KS AE Wealth Management Addendum II Client Profile and Suitability Questionnaire 2019-2025 free printable template

Show details

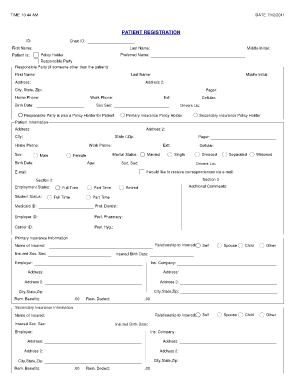

ADDENDUM II CLIENT PROFILE AND SUITABILITY QUESTIONNAIRE Name of Investment Adviser Representative: Section I. This Profile/Suitability Questionnaire applies to the following (Mark all that apply):

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign suitability form

Edit your client suitability form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client suitability assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS AE Wealth Management Addendum II online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS AE Wealth Management Addendum II. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out KS AE Wealth Management Addendum II

How to fill out KS AE Wealth Management Addendum II Client

01

Obtain the KS AE Wealth Management Addendum II Client form from the official website or your financial advisor.

02

Read through the entire document to understand the requirements and terms.

03

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide details about your financial situation, such as income, assets, debts, and investment experience.

05

Complete the sections regarding your investment objectives, risk tolerance, and any specific preferences.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form to your financial advisor or the relevant department.

Who needs KS AE Wealth Management Addendum II Client?

01

Individuals seeking comprehensive wealth management services.

02

Clients who wish to have a structured approach to managing their financial portfolio.

03

Investors looking for tailored investment strategies based on their individual financial goals.

04

People needing to disclose their financial status and investment preferences to their advisors.

Fill

form

: Try Risk Free

People Also Ask about

How do you assess suitability?

The process of assessing suitability is one of comparison, evaluation and trade-off. A thorough understanding of the client's personality, circumstances and goals is evaluated against the possible alternate courses of action — including, or not, a financial product.

What is a good definition of suitability?

Suitability Definition For advice or guidance to be suitable, it must be appropriate for the client and their unique circumstances, including risk profile and financial goals.

What is suitability standard?

The suitability standard requires only that investments be suitable to the investor's circumstances, and may allow a broker to recommend an investment that is more costly and generates a higher commission than a similar low-priced option.

What is a suitability questionnaire?

The instrument uses a questionnaire, which has sixteen groups of eight items (descriptive phrases) in each group. The person answering the questionnaire ranks the items in each group in order, ing to which describes him/her the most.

What is suitability assessment form?

Suitability Assessment or “SA” means an exercise carried out by HLISB to gather necessary information from the prospective Investor(s) on the Investor(s)'s financial capabilities, risk appetite and ability to bear risk in order to form a reasonable basis for the Bank's recommendation.

How do you determine suitability?

What Should a Suitability Assessment Consider? Age. Investment goals. Investment timeframe. Risk tolerance. Financial situation and obligations. Liquidity needs. Current investment portfolio and assets. Investment knowledge, sophistication, and experience.

What is client suitability assessment?

SUITABILITY ASSESSMENT This Client Suitability Assessment (CSA) is being conducted to help the Account Officer determine the client's understanding of the risks related to investing. This assessment will also aid the Account Officer to determine which investment products are suitable to the client's investment profile.

What are the three elements of suitability?

05 Components of Suitability Obligations. Rule 2111 is composed of three main obligations: reasonable-basis suitability, customer-specific suitability, and quantitative suitability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS AE Wealth Management Addendum II for eSignature?

When your KS AE Wealth Management Addendum II is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get KS AE Wealth Management Addendum II?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the KS AE Wealth Management Addendum II in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in KS AE Wealth Management Addendum II without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing KS AE Wealth Management Addendum II and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is KS AE Wealth Management Addendum II Client?

KS AE Wealth Management Addendum II Client is a supplemental document required for clients involved in wealth management services to provide additional information about their financial status and requests.

Who is required to file KS AE Wealth Management Addendum II Client?

Clients who engage with KS AE Wealth Management and are seeking personalized financial advice and services are required to file the KS AE Wealth Management Addendum II Client.

How to fill out KS AE Wealth Management Addendum II Client?

To fill out the KS AE Wealth Management Addendum II Client, clients need to provide relevant personal and financial information as specified in the document, ensuring accuracy and completeness before submission.

What is the purpose of KS AE Wealth Management Addendum II Client?

The purpose of KS AE Wealth Management Addendum II Client is to collect detailed information from clients that aids in tailoring financial management services and ensuring compliance with regulatory requirements.

What information must be reported on KS AE Wealth Management Addendum II Client?

The KS AE Wealth Management Addendum II Client must report information including client identification details, financial assets, liabilities, investment goals, risk tolerance, and any other relevant financial data.

Fill out your KS AE Wealth Management Addendum II online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS AE Wealth Management Addendum II is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.