Get the free Federal Tax Suits Cases, Dockets and Filings in the US ...

Show details

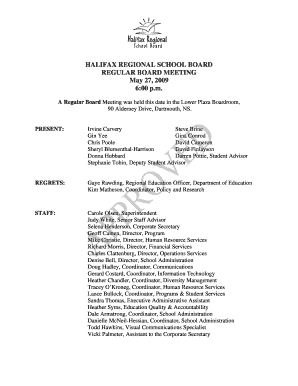

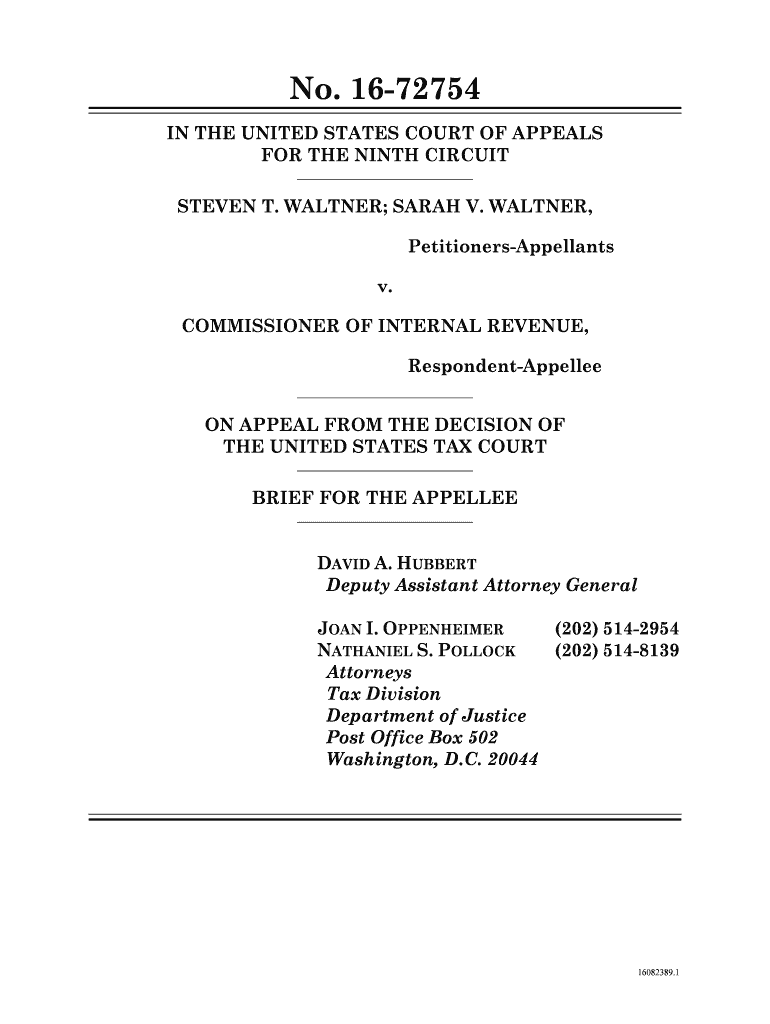

No. 1672754 IN THE UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT STEVEN T. WALTER; SARAH V. WALTER, PetitionersAppellants v. COMMISSIONER OF INTERNAL REVENUE, RespondentAppellee ON APPEAL FROM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal tax suits cases

Edit your federal tax suits cases form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal tax suits cases form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal tax suits cases online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal tax suits cases. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal tax suits cases

How to fill out federal tax suits cases

01

To fill out federal tax suits cases, you need to follow these steps:

02

Gather all relevant financial documents and records related to your tax case.

03

Understand the specific laws and regulations related to federal taxes and suits.

04

Consult with a tax lawyer or legal expert to navigate the complex legal process.

05

Complete the necessary forms and paperwork required for filing a federal tax suit case.

06

Provide accurate and detailed information about your tax situation and the issues you are disputing.

07

Ensure all deadlines for submitting the tax suit case are met.

08

Submit the completed forms and supporting documents to the appropriate federal tax authority or court.

09

Follow up and cooperate with the legal proceedings as required, providing any additional information or evidence when requested.

10

Actively engage with your legal representation to understand the progress and potential outcomes of your federal tax suit case.

11

Comply with any court orders or judgments resulting from the federal tax suit case.

Who needs federal tax suits cases?

01

Federal tax suits cases are typically needed by individuals or businesses who are involved in disputes or disagreements with the federal tax authorities regarding tax matters.

02

Common situations where someone may need federal tax suits cases include:

03

- Challenging tax assessments or audits conducted by the federal tax authorities.

04

- Seeking relief from penalties or interest charges imposed by the federal tax authorities.

05

- Disputing tax liabilities or asserting deductions or credits that have been denied by the federal tax authorities.

06

In such situations, individuals or businesses may rely on federal tax suits cases to protect their rights, challenge incorrect tax assessments, or seek equitable resolutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send federal tax suits cases for eSignature?

When your federal tax suits cases is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my federal tax suits cases in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your federal tax suits cases and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out federal tax suits cases on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your federal tax suits cases by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is federal tax suits cases?

Federal tax suits cases are legal actions brought against individuals or entities for failing to pay federal taxes.

Who is required to file federal tax suits cases?

Individuals or entities who have outstanding federal tax liabilities may be required to file federal tax suits cases.

How to fill out federal tax suits cases?

Federal tax suits cases can be filled out by providing information about the tax liabilities, payments made, and any other relevant details to support the case.

What is the purpose of federal tax suits cases?

The purpose of federal tax suits cases is to enforce compliance with federal tax laws and collect unpaid tax liabilities.

What information must be reported on federal tax suits cases?

Information such as the amount of tax owed, any payments made, details of the taxpayer, and supporting documentation must be reported on federal tax suits cases.

Fill out your federal tax suits cases online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Tax Suits Cases is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.