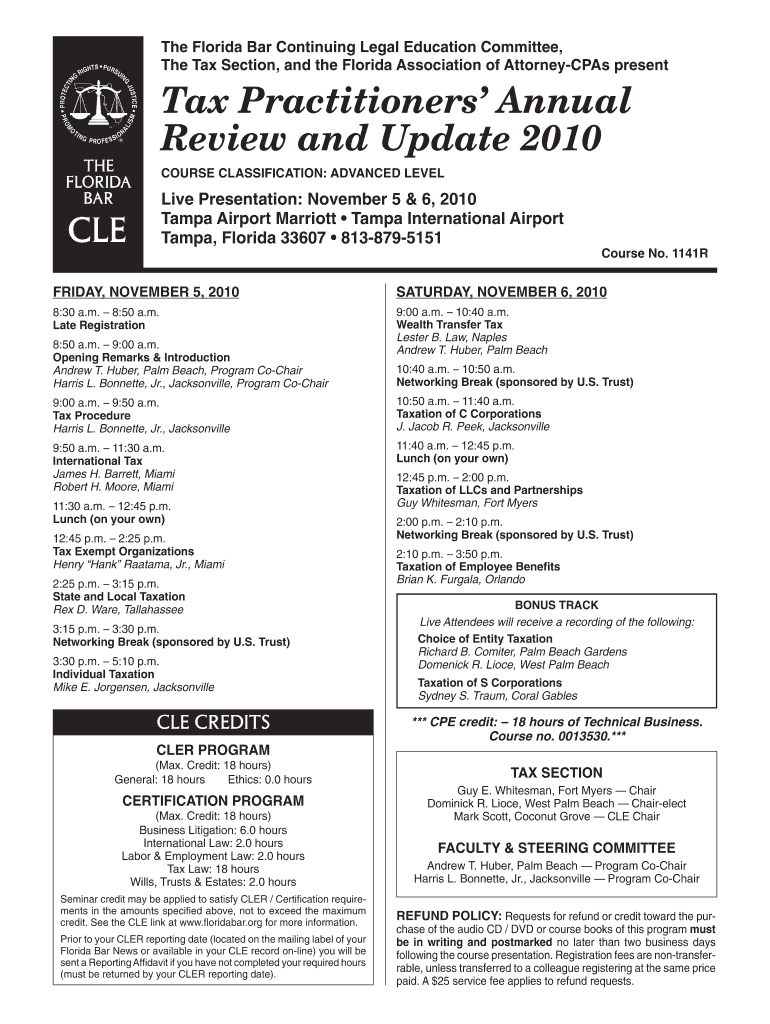

Get the free Tax Practitioners' Annual Review and Update 2010

Show details

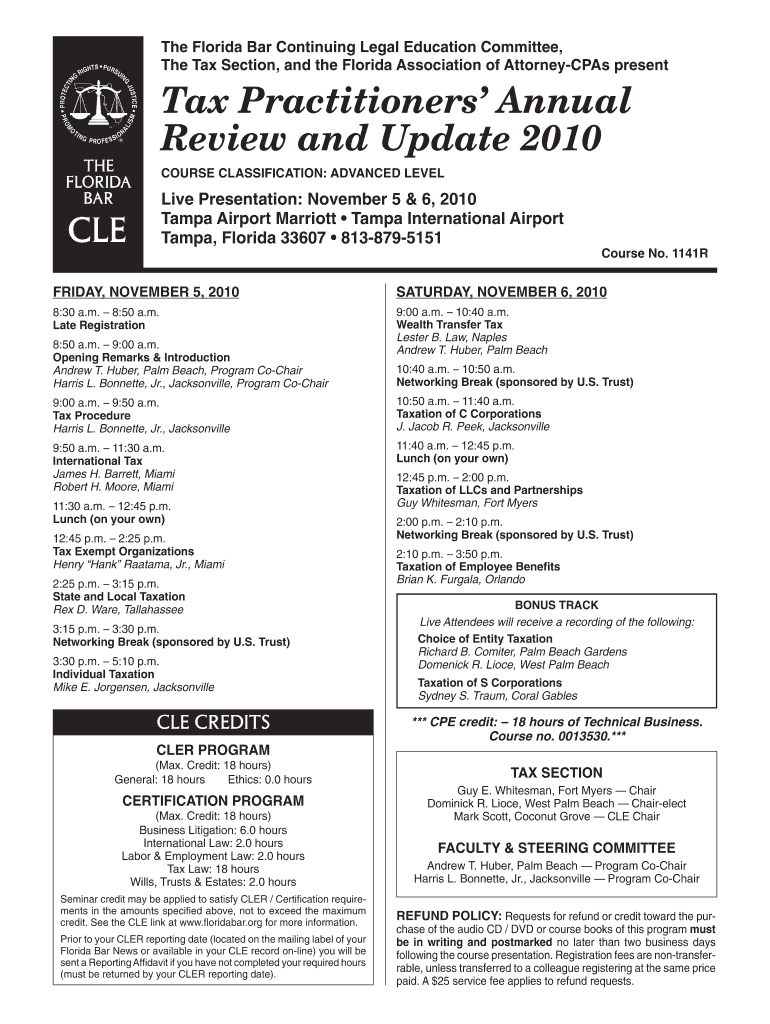

The Florida Bar Continuing Legal Education Committee,

The Tax Section, and the Florida Association of Attorneys present Practitioners Annual

Review and Update 2010

COURSE CLASSIFICATION: ADVANCED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax practitioners annual review

Edit your tax practitioners annual review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax practitioners annual review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax practitioners annual review online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax practitioners annual review. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax practitioners annual review

How to fill out tax practitioners annual review

01

Gather all necessary documents and information, such as income statements, expense receipts, and any relevant tax forms.

02

Review the previous year's tax returns and note any changes or updates that need to be made.

03

Complete the tax practitioners annual review form, ensuring all sections are filled out accurately and completely.

04

Double-check all calculations and ensure all numbers are entered correctly.

05

Attach any supporting documents or schedules as required.

06

Review the completed form and make sure all information is accurate and up-to-date.

07

Sign and date the form, and keep a copy for your records.

08

Submit the completed tax practitioners annual review form to the appropriate tax authority or accounting firm, following their instructions and deadlines.

09

If applicable, make any necessary tax payments or adjustments based on the review findings.

10

Keep a copy of the submitted form and supporting documents for future reference and potential audits.

Who needs tax practitioners annual review?

01

Tax practitioners, such as enrolled agents, certified public accountants (CPAs), and tax attorneys, need to fill out the tax practitioners annual review. This review helps them evaluate their performance, identify areas for improvement, and ensure compliance with tax laws and regulations.

02

Additionally, tax firms or organizations may require their tax practitioners to complete the annual review as part of their internal quality control processes.

03

Clients or taxpayers who receive services from tax practitioners may also benefit from the annual review, as it can provide more transparency and confidence in the practitioner's expertise and competence.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax practitioners annual review directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax practitioners annual review and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in tax practitioners annual review?

The editing procedure is simple with pdfFiller. Open your tax practitioners annual review in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out tax practitioners annual review using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax practitioners annual review on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is tax practitioners annual review?

Tax practitioners annual review is a mandatory report that tax professionals must submit to the relevant authorities detailing their activities and compliance with tax regulations.

Who is required to file tax practitioners annual review?

All tax practitioners who provide tax services or advice professionally are required to file tax practitioners annual review.

How to fill out tax practitioners annual review?

Tax practitioners must carefully review the form, provide accurate information about their activities, clients, and compliance with tax laws, and submit the completed form to the appropriate authority.

What is the purpose of tax practitioners annual review?

The purpose of tax practitioners annual review is to ensure that tax professionals are operating ethically and in compliance with tax laws, and to maintain the integrity of the tax system.

What information must be reported on tax practitioners annual review?

Tax practitioners must report details of their clients, services provided, any complaints or disciplinary actions, and their compliance with relevant tax laws and regulations.

Fill out your tax practitioners annual review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Practitioners Annual Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.